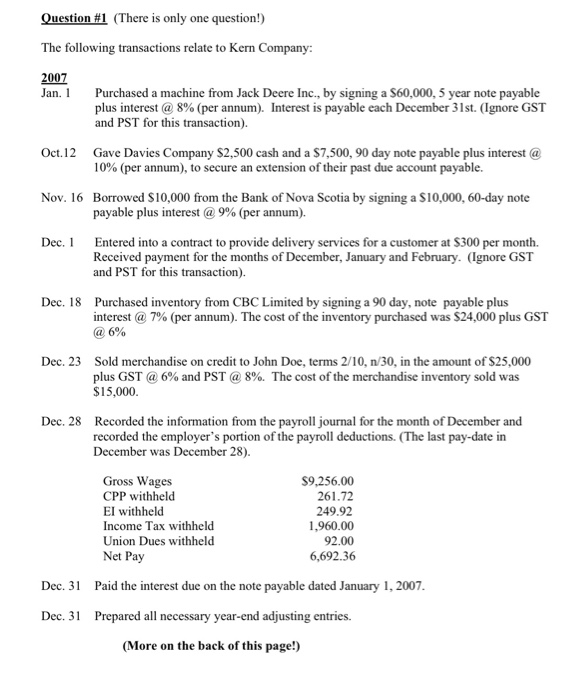

Question #1 (There is only one question!) The following transactions relate to Kern Company: 2007 Jan. 1 Purchased a machine from Jack Deere Inc., by signing a $60,000, 5 year note payable plus interest @ 8% (per annum). Interest is payable each December 31st. (Ignore GST and PST for this transaction). Oct.12 Gave Davies Company $2,500 cash and a $7,500, 90 day note payable plus interest @ 10% (per annum), to secure an extension of their past due account payable. Nov. 16 Borrowed $10,000 from the Bank of Nova Scotia by signing a $10,000, 60-day note payable plus interest @ 9% (per annum). Dec. 1 Entered into a contract to provide delivery services for a customer at $300 per month. Received payment for the months of December, January and February. (Ignore GST and PST for this transaction). Dec. 18 Purchased inventory from CBC Limited by signing a 90 day, note payable plus interest @ 7% (per annum). The cost of the inventory purchased was $24,000 plus GST @ 6% Dec. 23 Sold merchandise on credit to John Doe, terms 2/10, n 30, in the amount of $25,000 plus GST @ 6% and PST @ 8%. The cost of the merchandise inventory sold was $15,000. Dec. 28 Recorded the information from the payroll journal for the month of December and recorded the employer's portion of the payroll deductions. (The last pay-date in December was December 28). Gross Wages CPP withheld El withheld Income Tax withheld Union Dues withheld Net Pay $9,256.00 261.72 249.92 1,960.00 92.00 6,692.36 Dec. 31 Paid the interest due on the note payable dated January 1, 2007. Dec. 31 Prepared all necessary year-end adjusting entries. (More on the back of this page!) Question #1 (There is only one question!) The following transactions relate to Kern Company: 2007 Jan. 1 Purchased a machine from Jack Deere Inc., by signing a $60,000, 5 year note payable plus interest @ 8% (per annum). Interest is payable each December 31st. (Ignore GST and PST for this transaction). Oct.12 Gave Davies Company $2,500 cash and a $7,500, 90 day note payable plus interest @ 10% (per annum), to secure an extension of their past due account payable. Nov. 16 Borrowed $10,000 from the Bank of Nova Scotia by signing a $10,000, 60-day note payable plus interest @ 9% (per annum). Dec. 1 Entered into a contract to provide delivery services for a customer at $300 per month. Received payment for the months of December, January and February. (Ignore GST and PST for this transaction). Dec. 18 Purchased inventory from CBC Limited by signing a 90 day, note payable plus interest @ 7% (per annum). The cost of the inventory purchased was $24,000 plus GST @ 6% Dec. 23 Sold merchandise on credit to John Doe, terms 2/10, n 30, in the amount of $25,000 plus GST @ 6% and PST @ 8%. The cost of the merchandise inventory sold was $15,000. Dec. 28 Recorded the information from the payroll journal for the month of December and recorded the employer's portion of the payroll deductions. (The last pay-date in December was December 28). Gross Wages CPP withheld El withheld Income Tax withheld Union Dues withheld Net Pay $9,256.00 261.72 249.92 1,960.00 92.00 6,692.36 Dec. 31 Paid the interest due on the note payable dated January 1, 2007. Dec. 31 Prepared all necessary year-end adjusting entries. (More on the back of this page!)