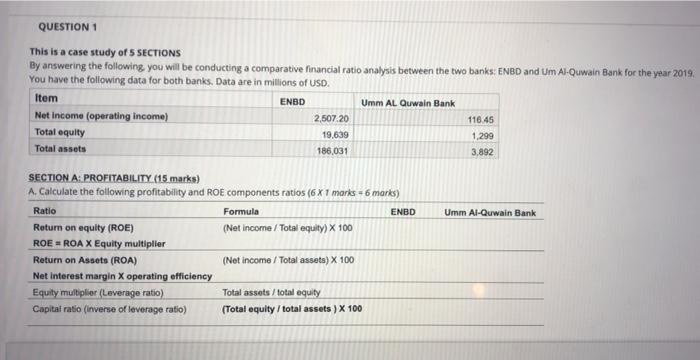

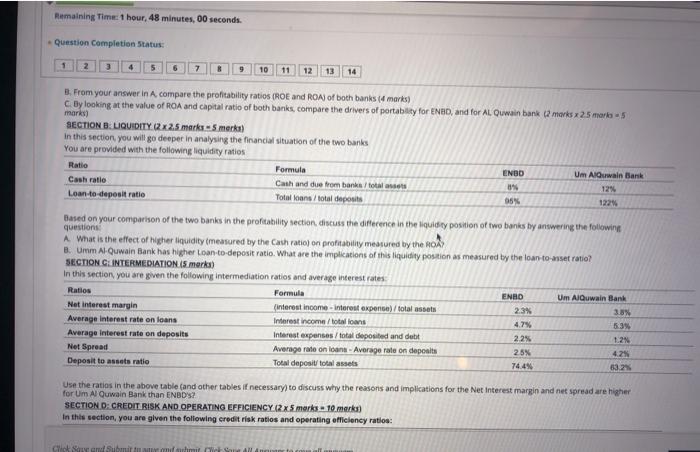

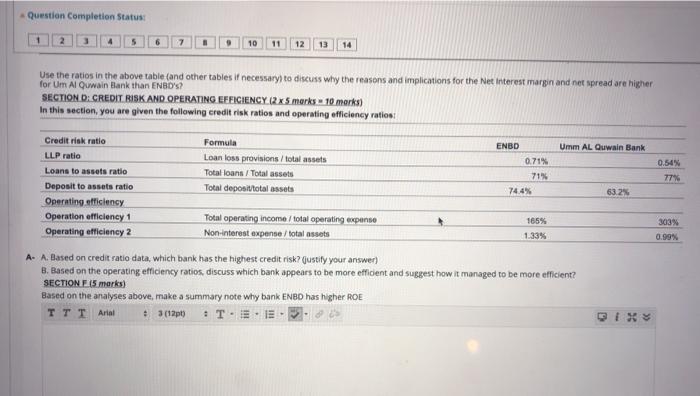

QUESTION 1 This is a case study of 5 SECTIONS By answering the following you will be conducting a comparative financial ratio analysis between the two banks:ENBD and Um Al-Quwain Bank for the year 2019 You have the following data for both banks. Data are in millions of USD. Item ENBD Umm Al Quwain Bank Net Income (operating income) 2,507.20 118.45 Total equity 19,639 1,299 Total assets 186,031 3,892 SECTION A: PROFITABILITY (15 marks) A. Calculate the following profitability and ROE components ratios (6 x 1 marks = 6 marks) Ratio Formula ENBD Umm Al-Quwain Bank Return on equity (ROE) (Net income / Total equity) x 100 ROE-ROA X Equity multiplier Return on Assets (ROA) (Net income / Total assets) X 100 Net interest margin X operating efficiency Equity multiplier (Leverage ratio) Total assets/total equity Capital ratio (inverse of leverage ratio) (Total equity / total assets ) X 100 Remaining Time: 1 hour, 48 minutes, 00 seconds. Question Completion Status: 1 2 3 9 10 11 12 13 14 B. From your answer in A compare the profitability ratios (ROE and ROA) of both banks (4 marks) c. By looking at the value of ROA and capital ratio of both banks, compare the drivers of portability for NBD, and for Al Quwain bank marks 25 mories 5 marks) SECTION B LIQUIDITY (2 x 2.5 marka 5 merka) In this section, you will go deeper in analysing the financial situation of the two banks You are provided with the following liquidity ratios Ratio Formula ENOD Um AlQuwain Bank Cash ratie Cash and due from banka / total assets 8 12% Loan to deposit ratio Total loans / total deposits 05% 122 Based on your comparison of the two banks in the profitability section, discuss the difference in the liquidity position of two banks by answering the following questions A What is the effect of higher liquidity measured by the Cash ratio) on profitability measured by the ROA B. Umm Al Quwain Bank has higher Loan to deposit ratio. What are the implications of this liquidity position as measured by the loan to-asset ratio? SECTION GINTERMEDIATION (5 merka) In this section, you are given the following intermediation ratios and average interest rates Ratios Formula ENHO Um Al Quwain Bank Net interest margin interest income - Interest expense) /total assets 2.3% 3.8% Average Interest rate on loans Interestin.com/total loans 4.7% 5.3% Average Interest rate on deposits Interest expenses/total deposited and debit 2.2% 12 Net Spread Average rate on loans - Average rate on deposits 2.5% 4.25 Deposit to assets ratio Total deposit/total assets 74.4% 63.2% Use the ratios in the above table (and other tables if necessary to discuss why the reasons and implications for the Net Interest margin and net spread are higher for Um Al Quwain Bank than END? SECTION DE CREDIT RISK AND OPERATING EFFICIENCY. 22 x 5 marks-10.marks) In this section, you are given the following credit risk ratios and operating efficiency ration: Click Submit Chic Question completion Status: 10 12 13 14 Use the ratios in the above table and other tables if necessary to discuss why the reasons and implications for the Net interest margin and net spread are higher for Um Al Quwain Bank than EBD'S? SECTION D: CREDIT BISK AND OPERATING EFFICIENCY (2x5marks 10 marks) In this section, you are given the following credit risk ratios and operating officiency ration: 0.54% 77% 303% Credit risk ratio Formula ENBD Umm Al Quwain Bank LLP ratio Loan los provisions / total assets 0.71% Loans to assets ratio Total loans / Total assets 71% Deposit to assets ratio Total deposit total assets 74.4% 63.2% Operating efficiency Operation officiency 1 Total operating income / total operating expense 165% Operating efficiency 2 Non-interest expense / total assets 1.33% A- A. Based on credit ratio data, which bank has the highest credit risk? (Justify your answer) B. Based on the operating efficiency ratios, discuss which bank appears to be more efficient and suggest how it managed to be more efficient? SECTIONE 15 marks) Based on the analyses above, make a summary note why bank ENBD has higher ROE TTT Arint #3012): T. BE%% QUESTION 1 This is a case study of 5 SECTIONS By answering the following you will be conducting a comparative financial ratio analysis between the two banks:ENBD and Um Al-Quwain Bank for the year 2019 You have the following data for both banks. Data are in millions of USD. Item ENBD Umm Al Quwain Bank Net Income (operating income) 2,507.20 118.45 Total equity 19,639 1,299 Total assets 186,031 3,892 SECTION A: PROFITABILITY (15 marks) A. Calculate the following profitability and ROE components ratios (6 x 1 marks = 6 marks) Ratio Formula ENBD Umm Al-Quwain Bank Return on equity (ROE) (Net income / Total equity) x 100 ROE-ROA X Equity multiplier Return on Assets (ROA) (Net income / Total assets) X 100 Net interest margin X operating efficiency Equity multiplier (Leverage ratio) Total assets/total equity Capital ratio (inverse of leverage ratio) (Total equity / total assets ) X 100 Remaining Time: 1 hour, 48 minutes, 00 seconds. Question Completion Status: 1 2 3 9 10 11 12 13 14 B. From your answer in A compare the profitability ratios (ROE and ROA) of both banks (4 marks) c. By looking at the value of ROA and capital ratio of both banks, compare the drivers of portability for NBD, and for Al Quwain bank marks 25 mories 5 marks) SECTION B LIQUIDITY (2 x 2.5 marka 5 merka) In this section, you will go deeper in analysing the financial situation of the two banks You are provided with the following liquidity ratios Ratio Formula ENOD Um AlQuwain Bank Cash ratie Cash and due from banka / total assets 8 12% Loan to deposit ratio Total loans / total deposits 05% 122 Based on your comparison of the two banks in the profitability section, discuss the difference in the liquidity position of two banks by answering the following questions A What is the effect of higher liquidity measured by the Cash ratio) on profitability measured by the ROA B. Umm Al Quwain Bank has higher Loan to deposit ratio. What are the implications of this liquidity position as measured by the loan to-asset ratio? SECTION GINTERMEDIATION (5 merka) In this section, you are given the following intermediation ratios and average interest rates Ratios Formula ENHO Um Al Quwain Bank Net interest margin interest income - Interest expense) /total assets 2.3% 3.8% Average Interest rate on loans Interestin.com/total loans 4.7% 5.3% Average Interest rate on deposits Interest expenses/total deposited and debit 2.2% 12 Net Spread Average rate on loans - Average rate on deposits 2.5% 4.25 Deposit to assets ratio Total deposit/total assets 74.4% 63.2% Use the ratios in the above table (and other tables if necessary to discuss why the reasons and implications for the Net Interest margin and net spread are higher for Um Al Quwain Bank than END? SECTION DE CREDIT RISK AND OPERATING EFFICIENCY. 22 x 5 marks-10.marks) In this section, you are given the following credit risk ratios and operating efficiency ration: Click Submit Chic Question completion Status: 10 12 13 14 Use the ratios in the above table and other tables if necessary to discuss why the reasons and implications for the Net interest margin and net spread are higher for Um Al Quwain Bank than EBD'S? SECTION D: CREDIT BISK AND OPERATING EFFICIENCY (2x5marks 10 marks) In this section, you are given the following credit risk ratios and operating officiency ration: 0.54% 77% 303% Credit risk ratio Formula ENBD Umm Al Quwain Bank LLP ratio Loan los provisions / total assets 0.71% Loans to assets ratio Total loans / Total assets 71% Deposit to assets ratio Total deposit total assets 74.4% 63.2% Operating efficiency Operation officiency 1 Total operating income / total operating expense 165% Operating efficiency 2 Non-interest expense / total assets 1.33% A- A. Based on credit ratio data, which bank has the highest credit risk? (Justify your answer) B. Based on the operating efficiency ratios, discuss which bank appears to be more efficient and suggest how it managed to be more efficient? SECTIONE 15 marks) Based on the analyses above, make a summary note why bank ENBD has higher ROE TTT Arint #3012): T. BE%%