Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Tom Tulliver has been appointed as sales director of Pembridge Ltd, a company in the building industry as from 1 Sep 2018.

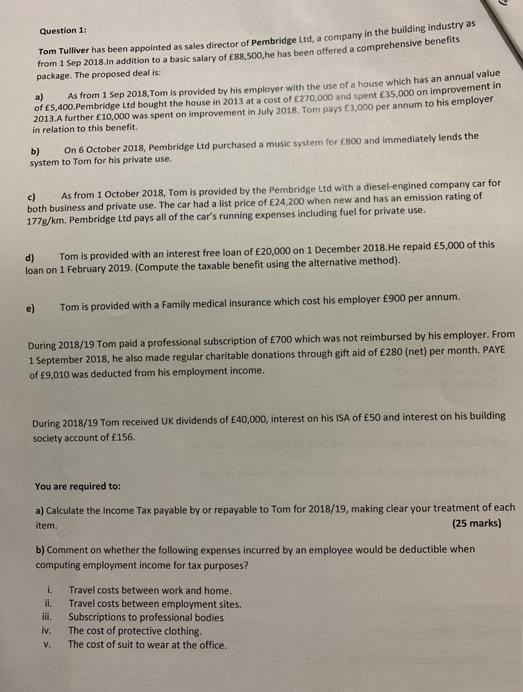

Question 1: Tom Tulliver has been appointed as sales director of Pembridge Ltd, a company in the building industry as from 1 Sep 2018. In addition to a basic salary of 88,500, he has been offered a comprehensive benefits package. The proposed deal is: a) As from 1 Sep 2018, Tom is provided by his employer with the use of a house which has an annual value of 5,400.Pembridge Ltd bought the house in 2013 at a cost of 270,000 and spent 35,000 on improvement in 2013.A further 10,000 was spent on improvement in July 2018. Tom pays 3,000 per annum to his employer in relation to this benefit. b) On 6 October 2018, Pembridge Ltd purchased a music system for 800 and immediately lends the system to Tom for his private use. c) As from 1 October 2018, Tom is provided by the Pembridge Ltd with a diesel-engined company car for both business and private use. The car had a list price of 24,200 when new and has an emission rating of 177g/km. Pembridge Ltd pays all of the car's running expenses including fuel for private use. d) Tom is provided with an interest free loan of 20,000 on 1 December 2018.He repaid 5,000 of this loan on 1 February 2019. (Compute the taxable benefit using the alternative method). e) Tom is provided with a Family medical insurance which cost his employer 900 per annum. During 2018/19 Tom paid a professional subscription of 700 which was not reimbursed by his employer. From 1 September 2018, he also made regular charitable donations through gift aid of 280 (net) per month. PAYE of 9,010 was deducted from his employment income. During 2018/19 Tom received UK dividends of 40,000, interest on his ISA of 50 and interest on his building society account of 156. You are required to: a) Calculate the Income Tax payable by or repayable to Tom for 2018/19, making clear your treatment of each (25 marks) item. b) Comment on whether the following expenses incurred by an employee would be deductible when computing employment income for tax purposes? i. ii. iii. iv. V. Travel costs between work and home. Travel costs between employment sites. Subscriptions to professional bodies The cost of protective clothing. The cost of suit to wear at the office,

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a The income tax payable by Tom for 201819 would be as follows Salary 88500 Taxable benefit from hou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started