Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 [Total 25 marks] Question 1 Part (a) ABC Co. is a small publisher and is considering a project to publish a new

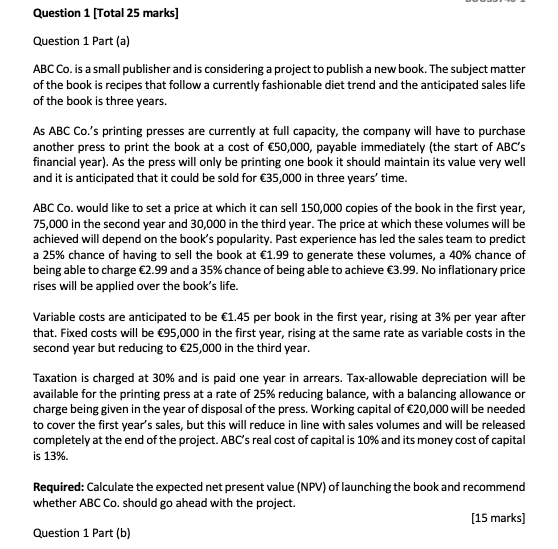

Question 1 [Total 25 marks] Question 1 Part (a) ABC Co. is a small publisher and is considering a project to publish a new book. The subject matter of the book is recipes that follow a currently fashionable diet trend and the anticipated sales life of the book is three years. As ABC Co.'s printing presses are currently at full capacity, the company will have to purchase another press to print the book at a cost of 50,000, payable immediately (the start of ABC's financial year). As the press will only be printing one book it should maintain its value very well and it is anticipated that it could be sold for 35,000 in three years' time. ABC Co. would like to set a price at which it can sell 150,000 copies of the book in the first year, 75,000 in the second year and 30,000 in the third year. The price at which these volumes will be achieved will depend on the book's popularity. Past experience has led the sales team to predict a 25% chance of having to sell the book at 1.99 to generate these volumes, a 40% chance of being able to charge 2.99 and a 35% chance of being able to achieve 3.99. No inflationary price rises will be applied over the book's life. Variable costs are anticipated to be 1.45 per book in the first year, rising at 3% per year after that. Fixed costs will be 95,000 in the first year, rising at the same rate as variable costs in the second year but reducing to 25,000 in the third year. Taxation is charged at 30% and is paid one year in arrears. Tax-allowable depreciation will be available for the printing press at a rate of 25% reducing balance, with a balancing allowance or charge being given in the year of disposal of the press. Working capital of 20,000 will be needed to cover the first year's sales, but this will reduce in line with sales volumes and will be released completely at the end of the project. ABC's real cost of capital is 10% and its money cost of capital is 13%. Required: Calculate the expected net present value (NPV) of launching the book and recommend whether ABC Co. should go ahead with the project. Question 1 Part (b) [15 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Initial investment Printing costs are 50000 Euros and are paid immediately 2Revenue from sales The ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started