Answered step by step

Verified Expert Solution

Question

1 Approved Answer

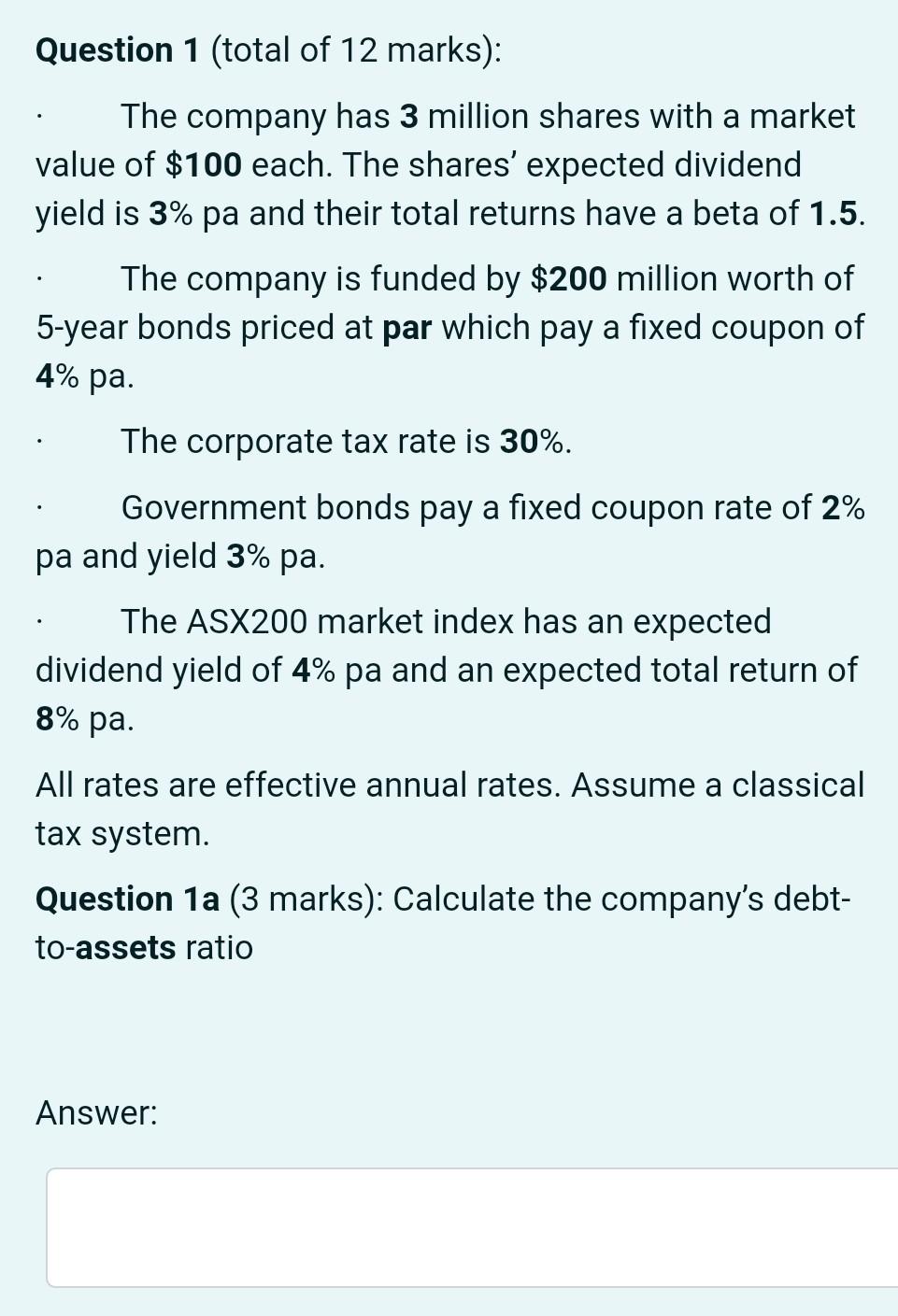

Question 1 (total of 12 marks): The company has 3 million shares with a market value of $100 each. The shares' expected dividend yield is

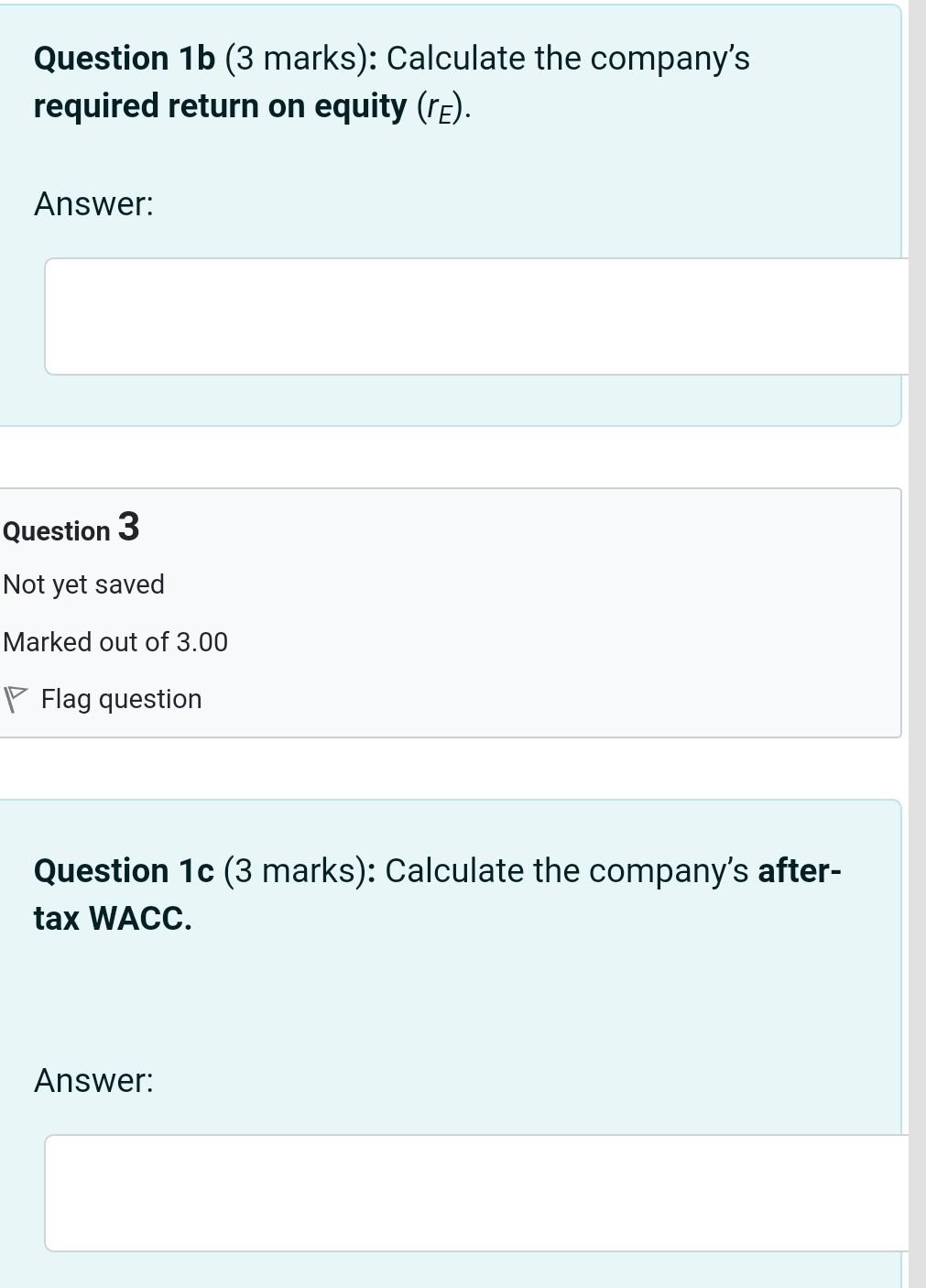

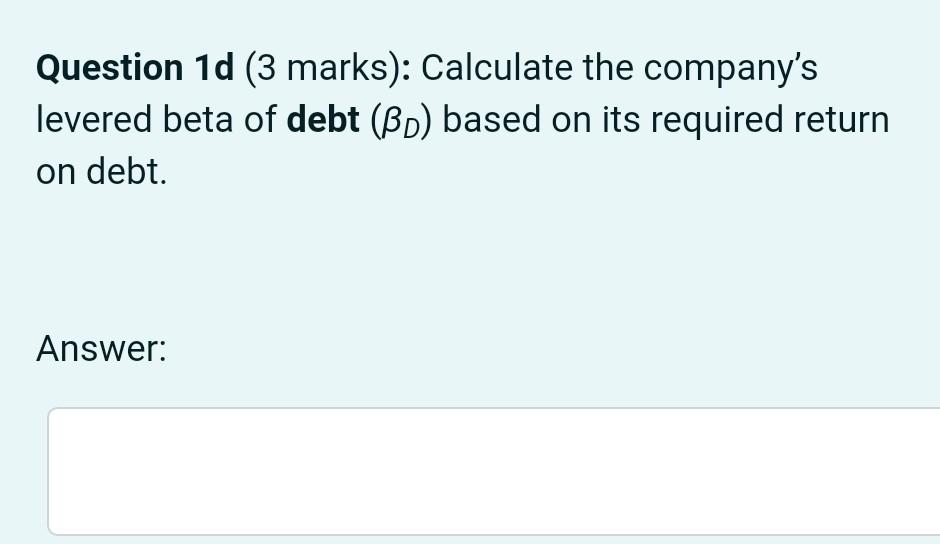

Question 1 (total of 12 marks): The company has 3 million shares with a market value of $100 each. The shares' expected dividend yield is 3% pa and their total returns have a beta of 1.5. The company is funded by $200 million worth of 5-year bonds priced at par which pay a fixed coupon of 4% pa. The corporate tax rate is 30%. Government bonds pay a fixed coupon rate of 2% pa and yield 3% pa. The ASX200 market index has an expected dividend yield of 4% pa and an expected total return of 8% pa. All rates are effective annual rates. Assume a classical tax system. Question 1a (3 marks): Calculate the company's debt- to-assets ratio Answer: Question 1b (3 marks): Calculate the company's required return on equity (re). Answer: Question 3 Not yet saved Marked out of 3.00 P Flag question Question 1c (3 marks): Calculate the company's after- tax WACC. Answer: Question 1d (3 marks): Calculate the company's levered beta of debt (BD) based on its required return on debt

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started