Answered step by step

Verified Expert Solution

Question

1 Approved Answer

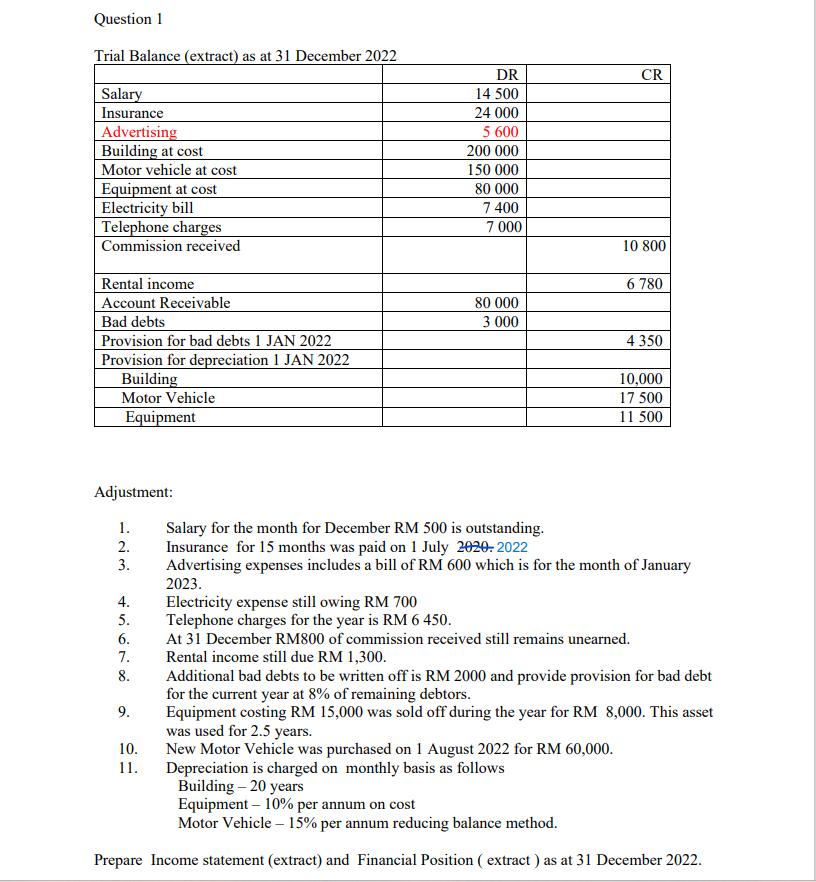

Question 1 Trial Balance (extract) as at 31 December 2022 Salary Insurance Advertising Building at cost Motor vehicle at cost Equipment at cost Electricity

Question 1 Trial Balance (extract) as at 31 December 2022 Salary Insurance Advertising Building at cost Motor vehicle at cost Equipment at cost Electricity bill Telephone charges Commission received Rental income Account Receivable Bad debts Provision for bad debts 1 JAN 2022 Provision for depreciation 1 JAN 2022 Building Motor Vehicle Equipment Adjustment: 1. 2. 3. 4. 5. 6. 7. 8. 9. DR 14 500 24 000 10. 11. 5 600 200 000 150 000 80 000 7 400 7 000 80 000 3.000 CR 10 800 Salary for the month for December RM 500 is outstanding. Insurance for 15 months was paid on 1 July 2020-2022 Advertising expenses includes a bill of RM 600 which is for the month of January 2023. Electricity expense still owing RM 700 Telephone charges for the year is RM 6 450. At 31 December RM800 of commission received still remains unearned. Rental income still due RM 1,300. Additional bad debts to be written off is RM 2000 and provide provision for bad debt for the current year at 8% of remaining debtors. Equipment costing RM 15,000 was sold off during the year for RM 8,000. This asset was used for 2.5 years. New Motor Vehicle was purchased on 1 August 2022 for RM 60,000. Depreciation is charged on monthly basis as follows Building - 20 years Equipment -10% per annum on cost Motor Vehicle -15% per annum reducing balance method. Prepare Income statement (extract) and Financial Position (extract) as at 31 December 2022. 6 780 4 350 10,000 17 500 11 500

Step by Step Solution

★★★★★

3.54 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started