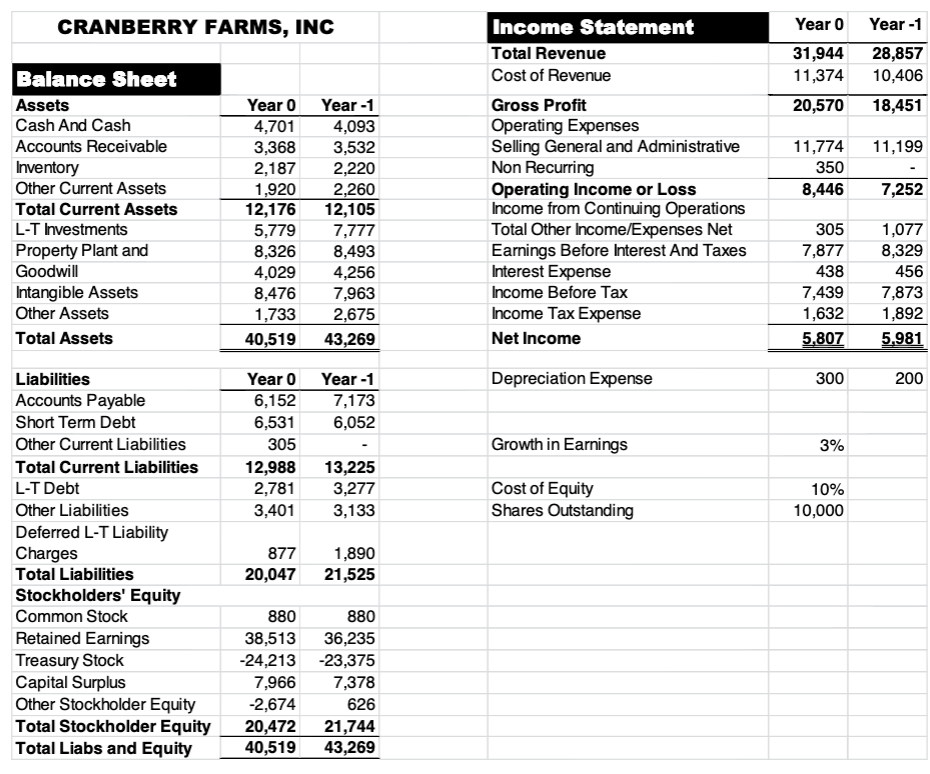

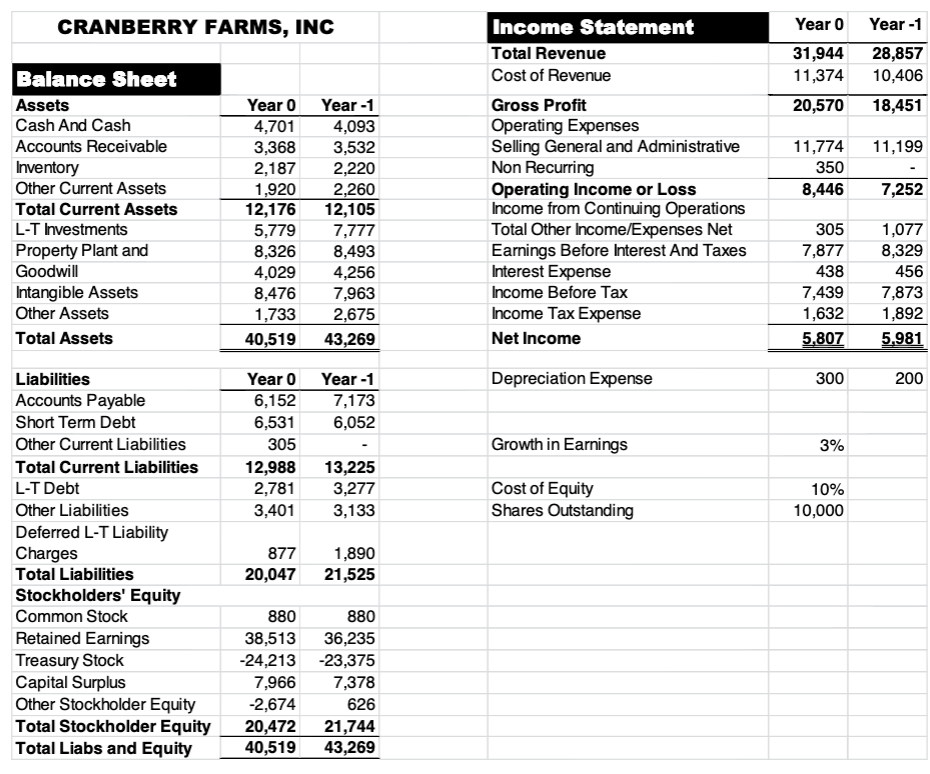

Question 1. Use the Cranberry Inc. financial statements to answer the following questions: 1. Change in Net Working Capital in year 0 is...... 2. Investment in Fixed Capital is in year 0 is..... 4. Net Borrowing in year 0 is.... 6. Assume that FCFE computed in step 5 above is 7,000. Using the FCFE DCF technique what would be the value of the firm? 7. Assume that your answer in step 6 above is 200,000. Based on the FCFE DCF technique at what price should the stock of Cranberry Inc trade? Income Statement Total Revenue Cost of Revenue Year0Year -1 31,94428,857 11,37410,406 20,57018,451 CRANBERRY FARMS, INC Balance Sheet Assets Cash And Cash Accounts Receivable Inventory Other Current Assets Total Current Assets L-T Investments Property Plant and Goodwill Intangible Assets Other Assets Total Assets Year 0 Year-1 4,093 3,3683,532 2,1872,220 ,920 2,260 12,17612,105 5,7797,777 8,326 8,493 4,029 4,256 8,476 7,963 1,733 2,675 40,519 43,269 Gross Profit Operating Expenses Selling General and Administrative Non Recurring Operating Income or Loss Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense Income Before Tax Income Tax Expense Net Income 4,701 1,77411,199 350 8,4467,252 3051,077 7,8778,329 456 7,4397,873 1,892 5,807 5981 438 1,632 Depreciation Expense 300 200 Liabilities Accounts Payable Short Term Debt Other Current Liabilities Total Current Liabilities L-T Debt Other Liabilities Deferred L-T Liability Charges Total Liabilities Stockholders' Equity Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity Total Stockholder Equity Total Liabs and Equity Year 0 Year-1 6,1527,173 6,5316,052 Growth in Earnings 12,98813,225 2,781 3,277 3,4013,133 Cost of Equity Shares Outstanding 10,000 877 1,890 20,04721,525 880 38,513 36,235 24,213-23,375 7,966 7,378 626 21,744 40,519 43,269 880 2,674 20,472 Question 1. Use the Cranberry Inc. financial statements to answer the following questions: 1. Change in Net Working Capital in year 0 is...... 2. Investment in Fixed Capital is in year 0 is..... 4. Net Borrowing in year 0 is.... 6. Assume that FCFE computed in step 5 above is 7,000. Using the FCFE DCF technique what would be the value of the firm? 7. Assume that your answer in step 6 above is 200,000. Based on the FCFE DCF technique at what price should the stock of Cranberry Inc trade? Income Statement Total Revenue Cost of Revenue Year0Year -1 31,94428,857 11,37410,406 20,57018,451 CRANBERRY FARMS, INC Balance Sheet Assets Cash And Cash Accounts Receivable Inventory Other Current Assets Total Current Assets L-T Investments Property Plant and Goodwill Intangible Assets Other Assets Total Assets Year 0 Year-1 4,093 3,3683,532 2,1872,220 ,920 2,260 12,17612,105 5,7797,777 8,326 8,493 4,029 4,256 8,476 7,963 1,733 2,675 40,519 43,269 Gross Profit Operating Expenses Selling General and Administrative Non Recurring Operating Income or Loss Income from Continuing Operations Total Other Income/Expenses Net Earnings Before Interest And Taxes Interest Expense Income Before Tax Income Tax Expense Net Income 4,701 1,77411,199 350 8,4467,252 3051,077 7,8778,329 456 7,4397,873 1,892 5,807 5981 438 1,632 Depreciation Expense 300 200 Liabilities Accounts Payable Short Term Debt Other Current Liabilities Total Current Liabilities L-T Debt Other Liabilities Deferred L-T Liability Charges Total Liabilities Stockholders' Equity Common Stock Retained Earnings Treasury Stock Capital Surplus Other Stockholder Equity Total Stockholder Equity Total Liabs and Equity Year 0 Year-1 6,1527,173 6,5316,052 Growth in Earnings 12,98813,225 2,781 3,277 3,4013,133 Cost of Equity Shares Outstanding 10,000 877 1,890 20,04721,525 880 38,513 36,235 24,213-23,375 7,966 7,378 626 21,744 40,519 43,269 880 2,674 20,472