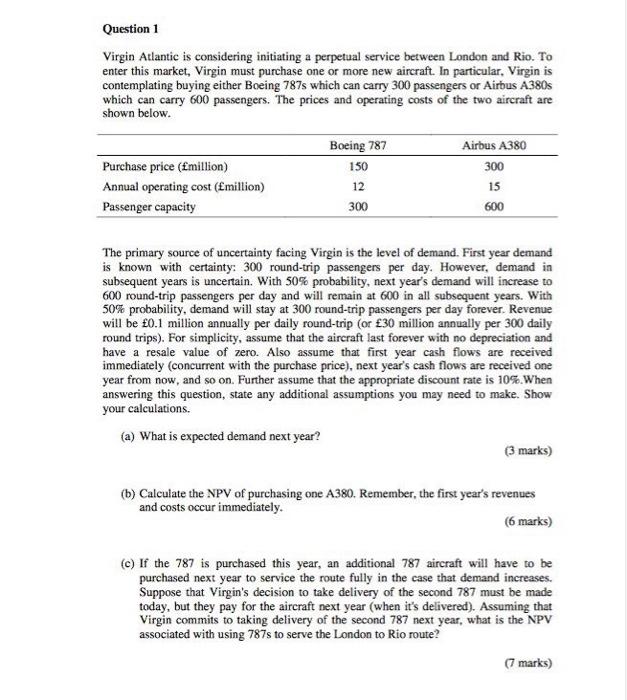

Question 1 Virgin Atlantic is considering initiating a perpetual service between London and Rio. To enter this market, Virgin must purchase one or more new aircraft. In particular, Virgin is contemplating buying either Boeing 787s which can carry 300 passengers or Airbus A380s which can carry 600 passengers. The prices and operating costs of the two aircraft are shown below. Purchase price (Emillion) Annual operating cost (million) Passenger capacity Boeing 787 150 12 300 Airbus A380 300 15 600 The primary source of uncertainty facing Virgin is the level of demand. First year demand is known with certainty: 300 round-trip passengers per day. However, demand in subsequent years is uncertain. With 50% probability, next year's demand will increase to 600 round-trip passengers per day and will remain at 600 in all subsequent years. With 50% probability, demand will stay at 300 round-trip passengers per day forever. Revenue will be 0.1 million annually per daily round-trip (or 30 million annually per 300 daily round trips). For simplicity, assume that the aircraft last forever with no depreciation and have a resale value of zero. Also assume that first year cash flows are received immediately (concurrent with the purchase price), next year's cash flows are received one year from now, and so on. Further assume that the appropriate discount rate is 10%.When answering this question, state any additional assumptions you may need to make. Show your calculations. (a) What is expected demand next year? (3 marks) (b) Calculate the NPV of purchasing one A380. Remember, the first year's revenues and costs occur immediately. (6 marks) (c) If the 787 is purchased this year, an additional 787 aircraft will have to be purchased next year to service the route fully in the case that demand increases. Suppose that Virgin's decision to take delivery of the second 787 must be made today, but they pay for the aircraft next year (when it's delivered). Assuming that Virgin commits to taking delivery of the second 787 next year, what is the NPV associated with using 787s to serve the London to Rio route? (7 marks)