Question

Question 1 We live in a perfect Modigliani Miller World without frictions. Vencidario Inc. has a mixed capital structure, with both equity and debt. We

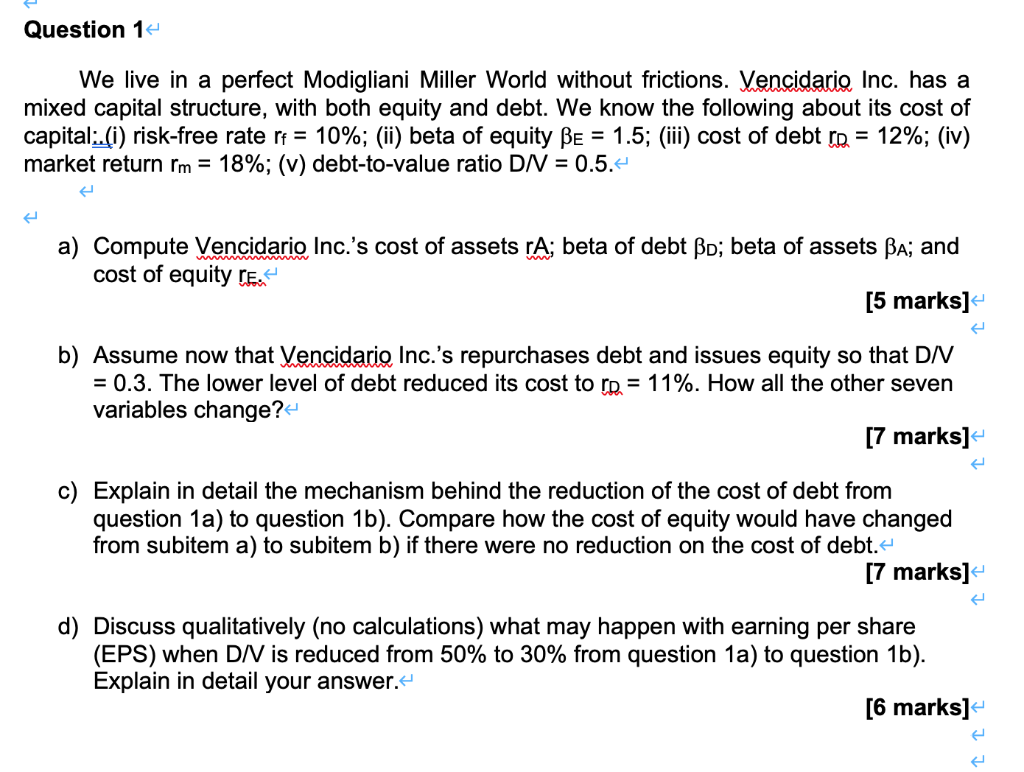

Question 1 We live in a perfect Modigliani Miller World without frictions. Vencidario Inc. has a mixed capital structure, with both equity and debt. We know the following about its cost of capital:.(i) risk-free rate rf = 10%; (ii) beta of equity E = 1.5; (iii) cost of debt rD = 12%; (iv) market return rm = 18%; (v) debt-to-value ratio D/V = 0.5. a) Compute Vencidario Inc.s cost of assets rA; beta of debt D; beta of assets A; and cost of equity rE. [5 marks] b) Assume now that Vencidario Inc.s repurchases debt and issues equity so that D/V = 0.3. The lower level of debt reduced its cost to rD = 11%. How all the other seven variables change? [7 marks] c) Explain in detail the mechanism behind the reduction of the cost of debt from question 1a) to question 1b). Compare how the cost of equity would have changed from subitem a) to subitem b) if there were no reduction on the cost of debt. [7 marks] d) Discuss qualitatively (no calculations) what may happen with earning per share (EPS) when D/V is reduced from 50% to 30% from question 1a) to question 1b). Explain in detail your answer.

Question 1 We live in a perfect Modigliani Miller World without frictions. Vencidario Inc. has a mixed capital structure, with both equity and debt. We know the following about its cost of capital:.(i) risk-free rate rf = 10%; (ii) beta of equity E = 1.5; (iii) cost of debt rD = 12%; (iv) market return rm = 18%; (v) debt-to-value ratio D/V = 0.5. a) Compute Vencidario Inc.s cost of assets rA; beta of debt D; beta of assets A; and cost of equity rE. [5 marks] b) Assume now that Vencidario Inc.s repurchases debt and issues equity so that D/V = 0.3. The lower level of debt reduced its cost to rD = 11%. How all the other seven variables change? [7 marks] c) Explain in detail the mechanism behind the reduction of the cost of debt from question 1a) to question 1b). Compare how the cost of equity would have changed from subitem a) to subitem b) if there were no reduction on the cost of debt. [7 marks] d) Discuss qualitatively (no calculations) what may happen with earning per share (EPS) when D/V is reduced from 50% to 30% from question 1a) to question 1b). Explain in detail your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started