Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 We want to implement a spreadsheet to solve for the European call value using the PDE method discussed in class. Consider a

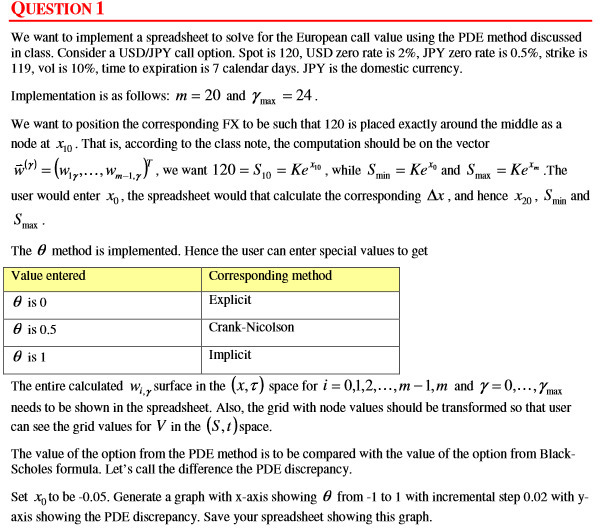

QUESTION 1 We want to implement a spreadsheet to solve for the European call value using the PDE method discussed in class. Consider a USD/JPY call option. Spot is 120, USD zero rate is 2%, JPY zero rate is 0.5%, strike is 119, vol is 10%, time to expiration is 7 calendar days. JPY is the domestic currency. Implementation is as follows: m = 20 and max = 24. We want to position the corresponding FX to be such that 120 is placed exactly around the middle as a node at xo. That is, according to the class note, the computation should be on the vector ()(WW), we want 120 = S10 = Ke, while Smin = Ke* and Smax = Ke** .The user would enter Xo, the spreadsheet would that calculate the corresponding Ax, and hence x20, Smin and Smax The method is implemented. Hence the user can enter special values to get Value entered is 0 is 0.5 Corresponding method Explicit O is 1 Crank-Nicolson Implicit The entire calculated w, surface in the (x,t) space for i = 0,1,2,..., m-1,m and y=0,..., max needs to be shown in the spreadsheet. Also, the grid with node values should be transformed so that user can see the grid values for V in the (S,1) space. The value of the option from the PDE method is to be compared with the value of the option from Black- Scholes formula. Let's call the difference the PDE discrepancy. Set x, to be -0.05. Generate a graph with x-axis showing from -1 to 1 with incremental step 0.02 with y- axis showing the PDE discrepancy. Save your spreadsheet showing this graph.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the steps to implement the European call option valuation usin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started