Answered step by step

Verified Expert Solution

Question

1 Approved Answer

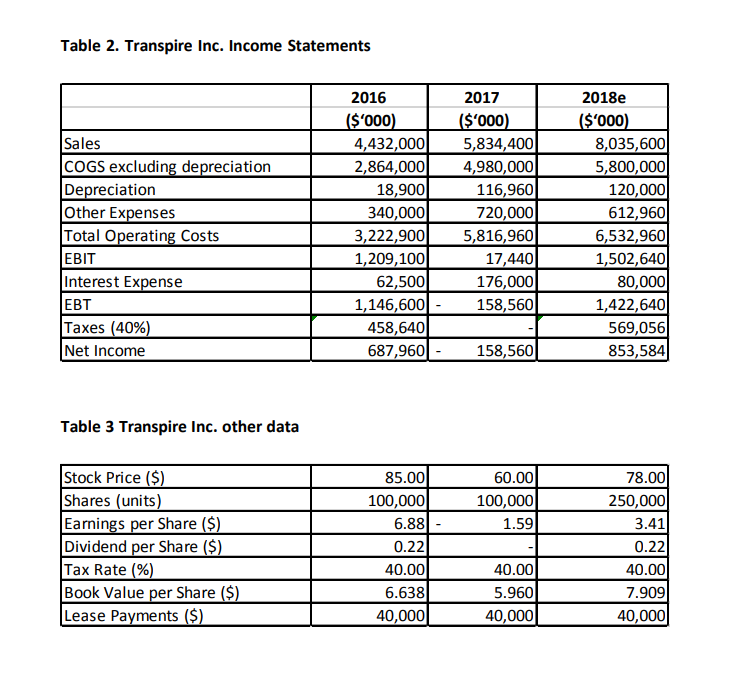

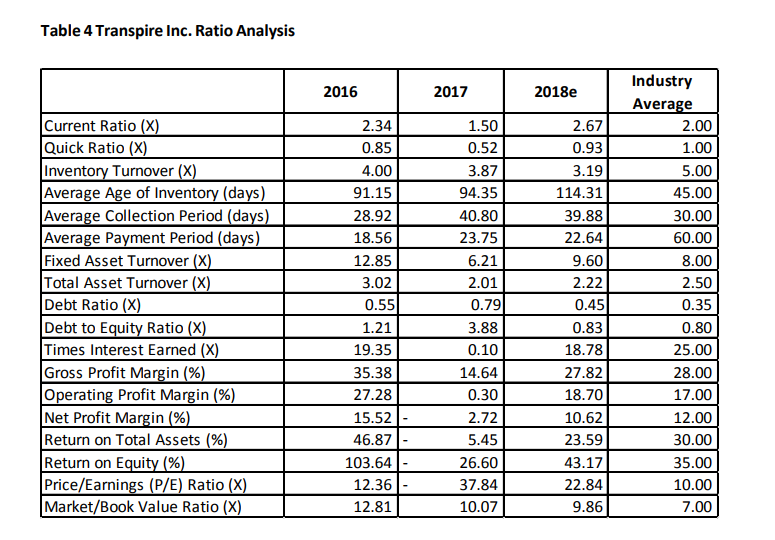

Question 1 . What actions should be taken to improve its liquidity position? Question 2. What actions should be taken to improve its operating and

Question 1 . What actions should be taken to improve its liquidity position? Question 2. What actions should be taken to improve its operating and utilisation of assets position? Question 3. What actions should be taken to improve its financial leverage position? Question 4. What actions should be taken to improve its profitability position?

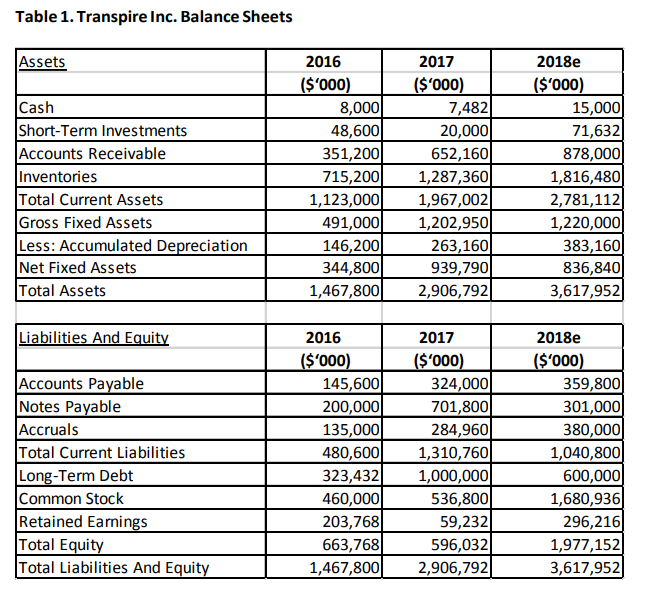

Table 1. Transpire Inc. Balance Sheets 2016 ($'000) 2017 2018e ($'000) (s'000) Cash Short-Term Investments Accounts Receivable Inventories Total Current Assets Gross Fixed Assets Less: Accumulated Depreciation Net Fixed Assets Total Assets 8,000 48,600 351,200 715,200 1,123,000 491,000 146,200 344,800 1,467,800 7,482 20,000 652,160 1,287,360 1,967,00.2 1,202,950 263,160 939,790 2,906,792 15,000 71,632 878,000 1,816,480 2,781,112 1,220,000 383,160 836,840 3,617,952 2016 $'000 2018e S'000 Liabilities And Equit 2017 S'000 Accounts Pavable Notes Pavable Accruals Total Current Liabilities Long-Term Debt Common Stock Retained Earnings Total Equi Total Liabilities And Equit 145,600 200,000 135,000 480,600 323,432 460,000 203,768 663,768 1,467,800 324,000 701,800 284,960 1,310,760 1,000,000 536,800 59,232 596,032 2,906,792 359,800 301,000 380,000 1,040,800 600,000 1,680,936 296,216 1,977,15.2 3,617,952Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started