Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 What factors affect the yields between two corporate bonds? Question 2 What is a yield curve and what forms can it take? Question

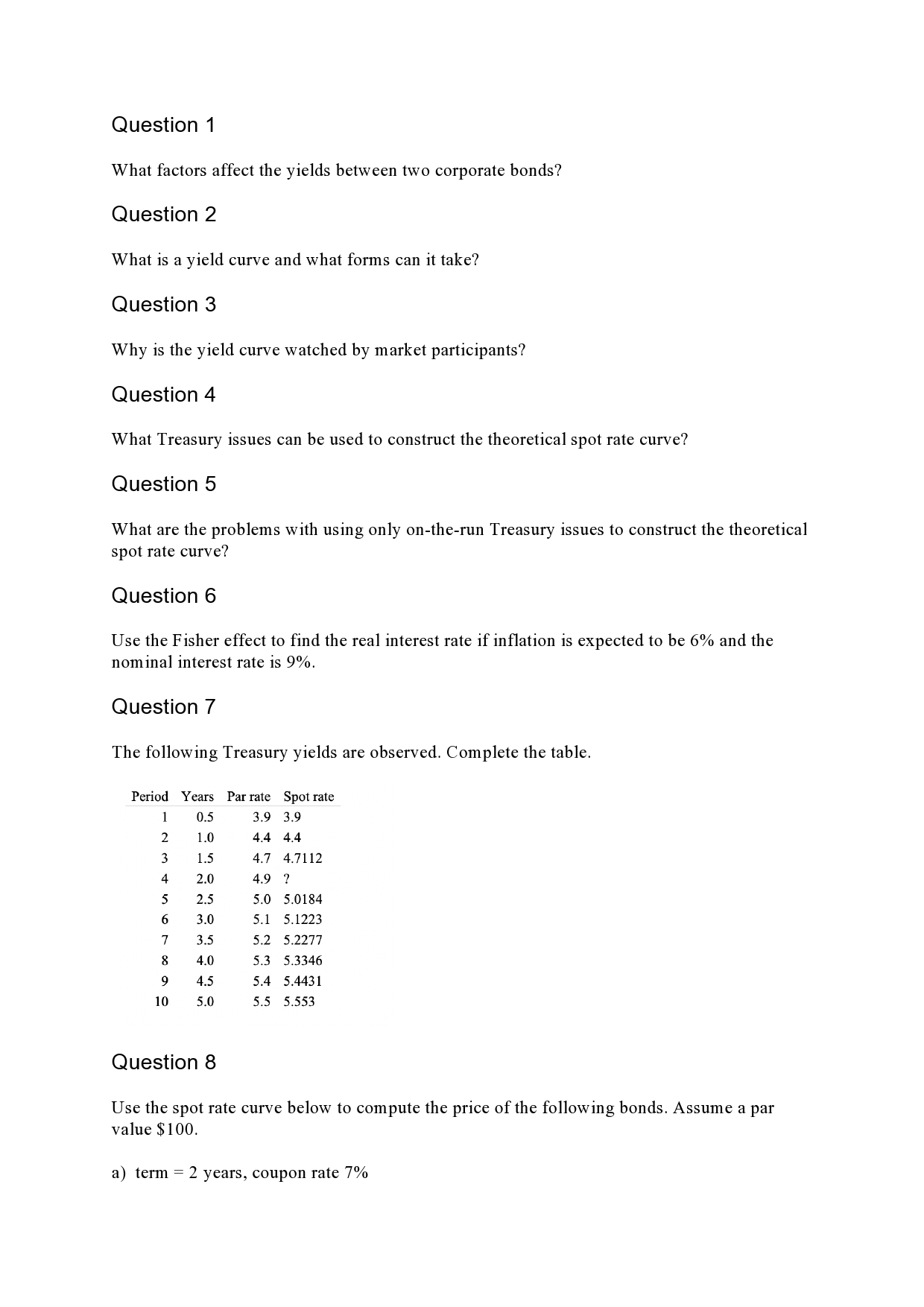

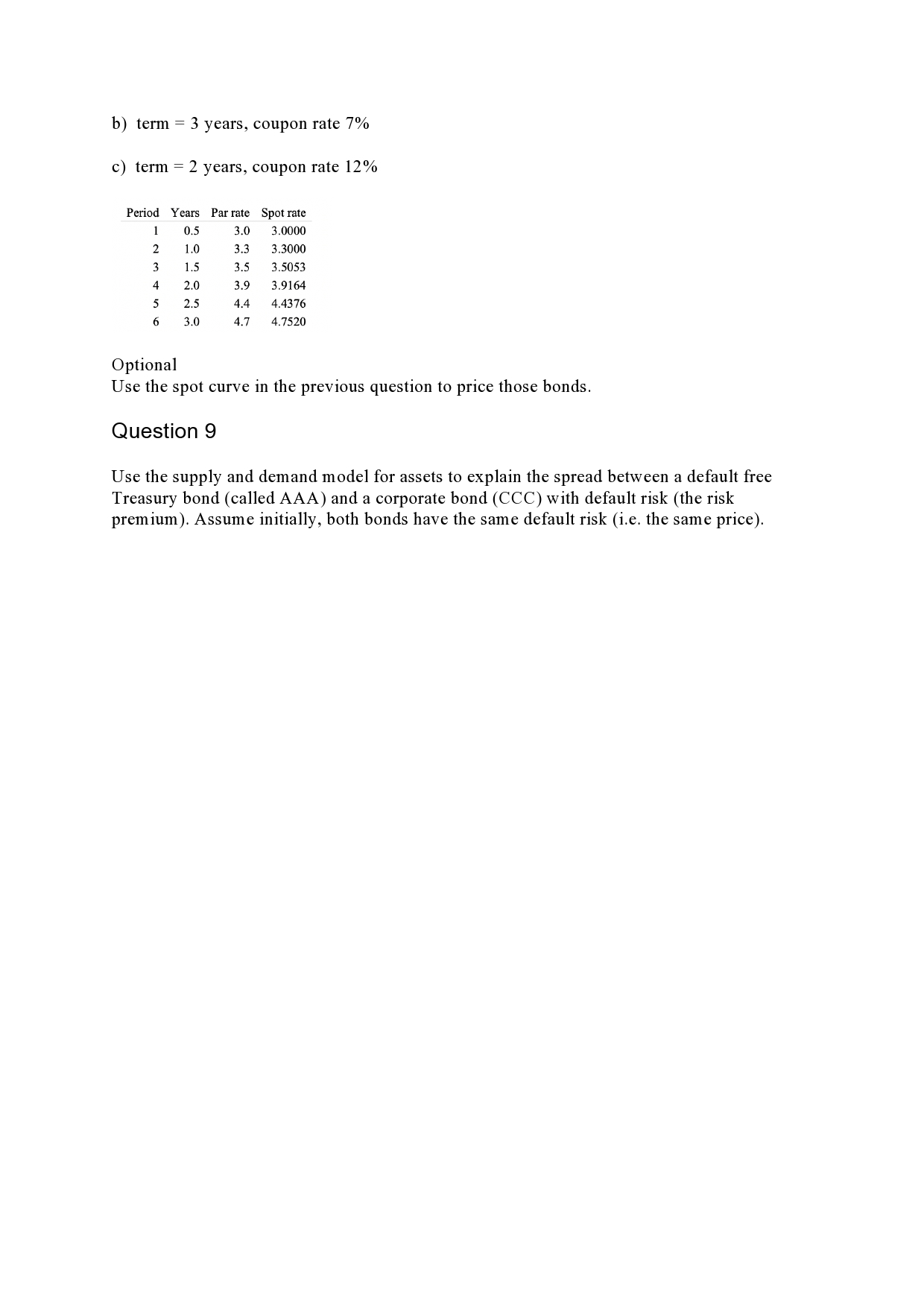

Question 1 What factors affect the yields between two corporate bonds? Question 2 What is a yield curve and what forms can it take? Question 3 Why is the yield curve watched by market participants? Question 4 What Treasury issues can be used to construct the theoretical spot rate curve? Question 5 What are the problems with using only on-the-run Treasury issues to construct the theoretical spot rate curve? Question 6 Use the Fisher effect to find the real interest rate if inflation is expected to be 6% and the nominal interest rate is 9%. Question 7 The following Treasury yields are observed. Complete the table. Question 8 Use the spot rate curve below to compute the price of the following bonds. Assume a par value $100. a) term =2 years, coupon rate 7% b) term =3 years, coupon rate 7% c) term =2 years, coupon rate 12% Optional Use the spot curve in the previous question to price those bonds. Question 9 Use the supply and demand model for assets to explain the spread between a default free Treasury bond (called AAA) and a corporate bond (CCC) with default risk (the risk premium ). Assume initially, both bonds have the same default risk (i.e. the same price)

Question 1 What factors affect the yields between two corporate bonds? Question 2 What is a yield curve and what forms can it take? Question 3 Why is the yield curve watched by market participants? Question 4 What Treasury issues can be used to construct the theoretical spot rate curve? Question 5 What are the problems with using only on-the-run Treasury issues to construct the theoretical spot rate curve? Question 6 Use the Fisher effect to find the real interest rate if inflation is expected to be 6% and the nominal interest rate is 9%. Question 7 The following Treasury yields are observed. Complete the table. Question 8 Use the spot rate curve below to compute the price of the following bonds. Assume a par value $100. a) term =2 years, coupon rate 7% b) term =3 years, coupon rate 7% c) term =2 years, coupon rate 12% Optional Use the spot curve in the previous question to price those bonds. Question 9 Use the supply and demand model for assets to explain the spread between a default free Treasury bond (called AAA) and a corporate bond (CCC) with default risk (the risk premium ). Assume initially, both bonds have the same default risk (i.e. the same price) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started