Question

Question 1 Which of the following is true? If the market is semi-strong from efficient then the market is weak form efficient If the market

Question 1

Which of the following is true?

|

| If the market is semi-strong from efficient then the market is weak form efficient |

|

| If the market is strong form efficient then the market is not weak form efficient |

|

| If the market is weak form efficient then the market is strong from efficient |

|

| If the market is semi-strong from efficient then the market is strong form efficient |

Question 2

If someone manage a fund worth $1,000,000 what is the maximum they would pay to earn an excess return of 0.3%?

|

| $0 |

|

| $300 |

|

| $333,333.33 |

|

| $3,000 |

Question 3

Which of the following is true?

|

| Technical analysis is the only way to earn excess returns when the market is strong form efficient |

|

| Security selection increases in importance as markets become more efficient |

|

| It is impossible to earn an excess return if the market is strong form efficient except by luck |

|

| Fundamental analysis is the only way to earn excess returns when the market is strong form efficient |

Question 4

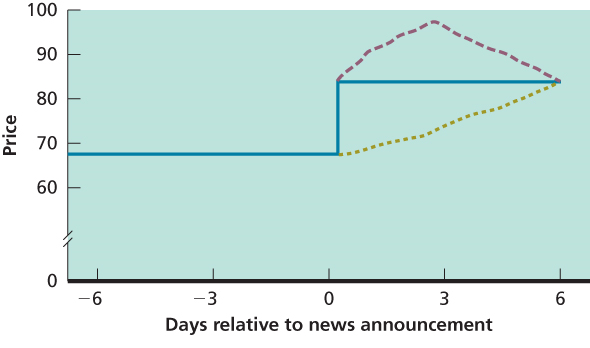

What is the correct description of the blue line in the chart below?

|

| Efficient reaction |

|

| Delayed reaction |

|

| Over reaction |

|

| Under reaction |

Question 5

Can a company corporate insider trade stock in the company they work for?

|

| Yes, they can conduct illegal insider trading |

|

| No, that would be informed trading |

|

| No, that would be insider trading |

|

| Yes, they can conduct legal insider trading |

Question 6

Which of the following is true?

|

| October is known to produce large positive excess returns for small company stocks |

|

| Tuesday has been noted for producing unusual negative average returns |

|

| Market indexes tend to outperform professional money managers |

|

| Short term stock price movements are easy to predict with accuracy |

Question 7

Which of the following is true?

|

| One of the causes of the 2008 real estate market crash was a move to originate and distribute mortgages |

|

| The stock market corrected upward in a shortly after the stock market crash of 1929 |

|

| The tulip bulb craze began during the roaring 1920s |

|

| The Nikkei index has experience a bull market for the decades after the 1990 crash and trades well above the pre-crash level |

Question 8

Which of the following is true?

|

| Females tend to trade more than males |

|

| People consistently make the same choices regardless of how decisions are framed |

|

| People are more likely to participate in retirement programs when their participation choice is framed as opt out |

|

| When using representative heuristics, people underestimate the probability of rare events |

100 90 80 - 70 60 0 6 3 6 Days relative to news announcement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started