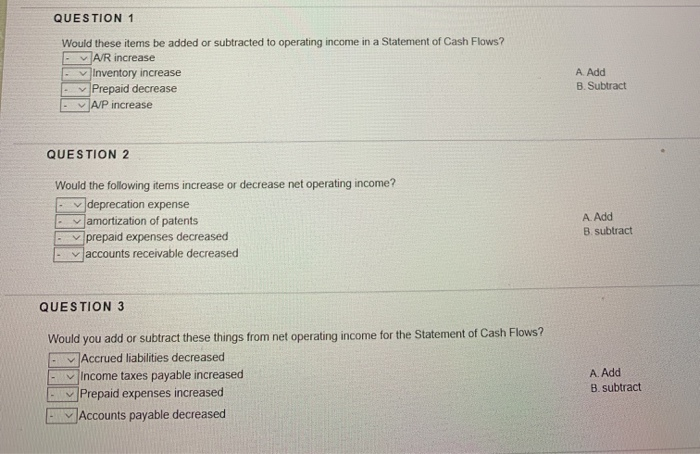

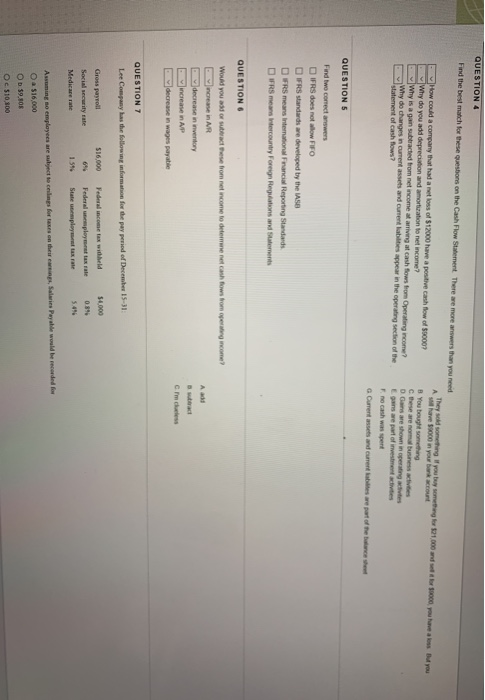

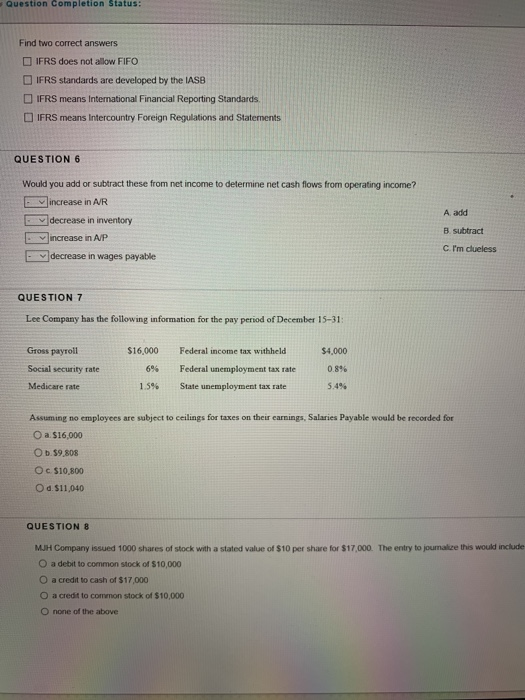

QUESTION 1 Would these items be added or subtracted to operating income in a statement of Cash Flows? - A/R increase Inventory increase - Prepaid decrease - A/P increase A Add B. Subtract QUESTION 2 Would the following items increase or decrease net operating income? - v deprecation expense amortization of patents prepaid expenses decreased - accounts receivable decreased A Add B. subtract QUESTION 3 Would you add or subtract these things from net operating income for the Statement of Cash Flows? Accrued liabilities decreased - Income taxes payable increased - Prepaid expenses increased Accounts payable decreased A. Add B. subtract Find the best match for these questions on the Cash Flow Sant There we more than you need How a company that had a loss of $12000 have a positive Why do you add depreciation and more to come? flow of 000 You bought statement of shows? QUESTIONS FRS does not wowFFO RS standards are developed by the SB FRS means Hemen France Reporting Standards QUESTION NAR E ncrease AP decrease in wages able QUESTION 7 Lee Company has the follow m e for the pay perd of December 15-31 $10.000 Federal income withold 1.000 Meducere O a $16.000 Ob 19.30 $10.00 Question completion Status: Find two correct answers IFRS does not allow FIFO IFRS standards are developed by the IASB IFRS means International Financial Reporting Standards IFRS means Intercountry Foreign Regulations and Statements QUESTION 6 A add Would you add or subtract these from net income to determine net cash flows from operating income? increase in AR decrease in inventory increase in AP decrease in wages payable B. subtract C. I'm clueless QUESTION 7 Lee Company has the following information for the pay period of December 15-31: $4,000 Gross payroll Social security rate Medicare rate $16,000 6% 1.5% Federal income tax withheld Federal unemployment tax rate 0.8% 5.4% State unemployment tax rate Assuming no employees are subject to ceilings for taxes on their earnings, Salaries Payable would be recorded for O a $16,000 O b.59.808 O c $10,800 Od $11,040 QUESTION 8 MJH Company issued 1000 shares of stock with a stated value of $10 per share for $17,000. The entry to joumalize this would include O a debit to common stock of $10,000 O a credit to cash of $17,000 O a credit to common stock of $10,000 O none of the above QUESTION 1 Would these items be added or subtracted to operating income in a statement of Cash Flows? - A/R increase Inventory increase - Prepaid decrease - A/P increase A Add B. Subtract QUESTION 2 Would the following items increase or decrease net operating income? - v deprecation expense amortization of patents prepaid expenses decreased - accounts receivable decreased A Add B. subtract QUESTION 3 Would you add or subtract these things from net operating income for the Statement of Cash Flows? Accrued liabilities decreased - Income taxes payable increased - Prepaid expenses increased Accounts payable decreased A. Add B. subtract Find the best match for these questions on the Cash Flow Sant There we more than you need How a company that had a loss of $12000 have a positive Why do you add depreciation and more to come? flow of 000 You bought statement of shows? QUESTIONS FRS does not wowFFO RS standards are developed by the SB FRS means Hemen France Reporting Standards QUESTION NAR E ncrease AP decrease in wages able QUESTION 7 Lee Company has the follow m e for the pay perd of December 15-31 $10.000 Federal income withold 1.000 Meducere O a $16.000 Ob 19.30 $10.00 Question completion Status: Find two correct answers IFRS does not allow FIFO IFRS standards are developed by the IASB IFRS means International Financial Reporting Standards IFRS means Intercountry Foreign Regulations and Statements QUESTION 6 A add Would you add or subtract these from net income to determine net cash flows from operating income? increase in AR decrease in inventory increase in AP decrease in wages payable B. subtract C. I'm clueless QUESTION 7 Lee Company has the following information for the pay period of December 15-31: $4,000 Gross payroll Social security rate Medicare rate $16,000 6% 1.5% Federal income tax withheld Federal unemployment tax rate 0.8% 5.4% State unemployment tax rate Assuming no employees are subject to ceilings for taxes on their earnings, Salaries Payable would be recorded for O a $16,000 O b.59.808 O c $10,800 Od $11,040 QUESTION 8 MJH Company issued 1000 shares of stock with a stated value of $10 per share for $17,000. The entry to joumalize this would include O a debit to common stock of $10,000 O a credit to cash of $17,000 O a credit to common stock of $10,000 O none of the above