Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 Yorktown Sows Co. was tickled pink they had won a prestigious prize in 2019, granting them the top pick of each year's calfing

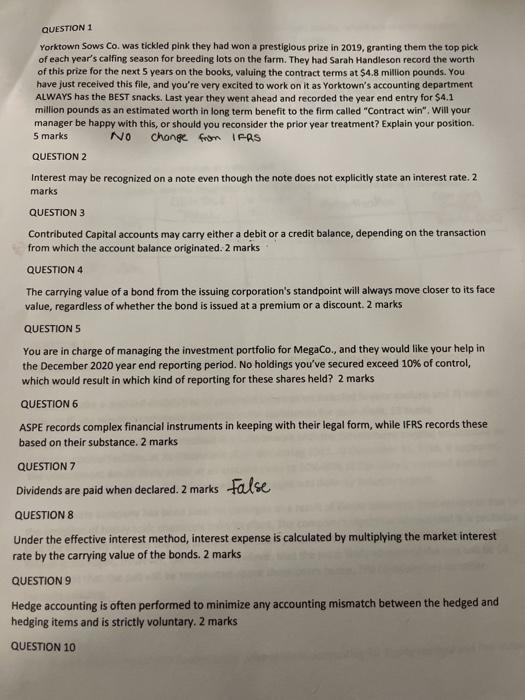

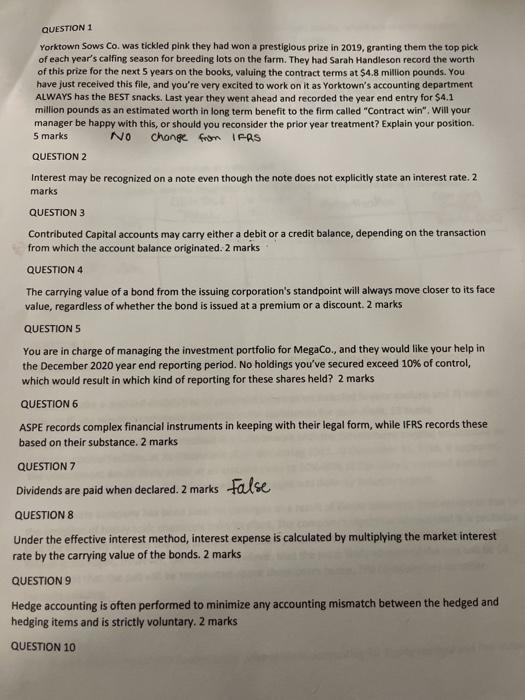

QUESTION 1 Yorktown Sows Co. was tickled pink they had won a prestigious prize in 2019, granting them the top pick of each year's calfing season for breeding lots on the farm. They had Sarah Handleson record the worth of this prize for the next 5 years on the books, valuing the contract terms at $4.8 million pounds. You have just received this file, and you're very excited to work on it as Yorktown's accounting department ALWAYS has the BEST snacks. Last year they went ahead and recorded the year end entry for $4.1 million pounds as an estimated worth in long term benefit to the firm called "Contract win". Will your manager be happy with this, or should you reconsider the prior year treatment? Explain your position. 5 marks NO change from IFRS QUESTION 2 Interest may be recognized on a note even though the note does not explicitly state an interest rate.2 marks QUESTION 3 Contributed Capital accounts may carry either a debit or a credit balance, depending on the transaction from which the account balance originated. 2 marks QUESTION 4 The carrying value of a bond from the issuing corporation's standpoint will always move closer to its face value, regardless of whether the bond is issued at a premium or a discount. 2 marks QUESTIONS You are in charge of managing the investment portfolio for MegaCo., and they would like your help in the December 2020 year end reporting period. No holdings you've secured exceed 10% of control, which would result in which kind of reporting for these shares held? 2 marks QUESTION 6 ASPE records complex financial instruments in keeping with their legal form, while IFRS records these based on their substance. 2 marks QUESTION 7 Dividends are paid when declared. 2 marks False QUESTIONS Under the effective interest method, interest expense is calculated by multiplying the market interest rate by the carrying value of the bonds. 2 marks QUESTIONS Hedge accounting is often performed to minimize any accounting mismatch between the hedged and hedging items and is strictly voluntary. 2 marks QUESTION 10 QUESTION 1 Yorktown Sows Co. was tickled pink they had won a prestigious prize in 2019, granting them the top pick of each year's calfing season for breeding lots on the farm. They had Sarah Handleson record the worth of this prize for the next 5 years on the books, valuing the contract terms at $4.8 million pounds. You have just received this file, and you're very excited to work on it as Yorktown's accounting department ALWAYS has the BEST snacks. Last year they went ahead and recorded the year end entry for $4.1 million pounds as an estimated worth in long term benefit to the firm called "Contract win". Will your manager be happy with this, or should you reconsider the prior year treatment? Explain your position. 5 marks NO change from IFRS QUESTION 2 Interest may be recognized on a note even though the note does not explicitly state an interest rate.2 marks QUESTION 3 Contributed Capital accounts may carry either a debit or a credit balance, depending on the transaction from which the account balance originated. 2 marks QUESTION 4 The carrying value of a bond from the issuing corporation's standpoint will always move closer to its face value, regardless of whether the bond is issued at a premium or a discount. 2 marks QUESTIONS You are in charge of managing the investment portfolio for MegaCo., and they would like your help in the December 2020 year end reporting period. No holdings you've secured exceed 10% of control, which would result in which kind of reporting for these shares held? 2 marks QUESTION 6 ASPE records complex financial instruments in keeping with their legal form, while IFRS records these based on their substance. 2 marks QUESTION 7 Dividends are paid when declared. 2 marks False QUESTIONS Under the effective interest method, interest expense is calculated by multiplying the market interest rate by the carrying value of the bonds. 2 marks QUESTIONS Hedge accounting is often performed to minimize any accounting mismatch between the hedged and hedging items and is strictly voluntary. 2 marks QUESTION 10

QUESTION 1 Yorktown Sows Co. was tickled pink they had won a prestigious prize in 2019, granting them the top pick of each year's calfing season for breeding lots on the farm. They had Sarah Handleson record the worth of this prize for the next 5 years on the books, valuing the contract terms at $4.8 million pounds. You have just received this file, and you're very excited to work on it as Yorktown's accounting department ALWAYS has the BEST snacks. Last year they went ahead and recorded the year end entry for $4.1 million pounds as an estimated worth in long term benefit to the firm called "Contract win". Will your manager be happy with this, or should you reconsider the prior year treatment? Explain your position. 5 marks NO change from IFRS QUESTION 2 Interest may be recognized on a note even though the note does not explicitly state an interest rate.2 marks QUESTION 3 Contributed Capital accounts may carry either a debit or a credit balance, depending on the transaction from which the account balance originated. 2 marks QUESTION 4 The carrying value of a bond from the issuing corporation's standpoint will always move closer to its face value, regardless of whether the bond is issued at a premium or a discount. 2 marks QUESTIONS You are in charge of managing the investment portfolio for MegaCo., and they would like your help in the December 2020 year end reporting period. No holdings you've secured exceed 10% of control, which would result in which kind of reporting for these shares held? 2 marks QUESTION 6 ASPE records complex financial instruments in keeping with their legal form, while IFRS records these based on their substance. 2 marks QUESTION 7 Dividends are paid when declared. 2 marks False QUESTIONS Under the effective interest method, interest expense is calculated by multiplying the market interest rate by the carrying value of the bonds. 2 marks QUESTIONS Hedge accounting is often performed to minimize any accounting mismatch between the hedged and hedging items and is strictly voluntary. 2 marks QUESTION 10 QUESTION 1 Yorktown Sows Co. was tickled pink they had won a prestigious prize in 2019, granting them the top pick of each year's calfing season for breeding lots on the farm. They had Sarah Handleson record the worth of this prize for the next 5 years on the books, valuing the contract terms at $4.8 million pounds. You have just received this file, and you're very excited to work on it as Yorktown's accounting department ALWAYS has the BEST snacks. Last year they went ahead and recorded the year end entry for $4.1 million pounds as an estimated worth in long term benefit to the firm called "Contract win". Will your manager be happy with this, or should you reconsider the prior year treatment? Explain your position. 5 marks NO change from IFRS QUESTION 2 Interest may be recognized on a note even though the note does not explicitly state an interest rate.2 marks QUESTION 3 Contributed Capital accounts may carry either a debit or a credit balance, depending on the transaction from which the account balance originated. 2 marks QUESTION 4 The carrying value of a bond from the issuing corporation's standpoint will always move closer to its face value, regardless of whether the bond is issued at a premium or a discount. 2 marks QUESTIONS You are in charge of managing the investment portfolio for MegaCo., and they would like your help in the December 2020 year end reporting period. No holdings you've secured exceed 10% of control, which would result in which kind of reporting for these shares held? 2 marks QUESTION 6 ASPE records complex financial instruments in keeping with their legal form, while IFRS records these based on their substance. 2 marks QUESTION 7 Dividends are paid when declared. 2 marks False QUESTIONS Under the effective interest method, interest expense is calculated by multiplying the market interest rate by the carrying value of the bonds. 2 marks QUESTIONS Hedge accounting is often performed to minimize any accounting mismatch between the hedged and hedging items and is strictly voluntary. 2 marks QUESTION 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started