Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 You advise your parents on investing in financial markets and do some preparation work. Your parents are interested in buying banking stocks

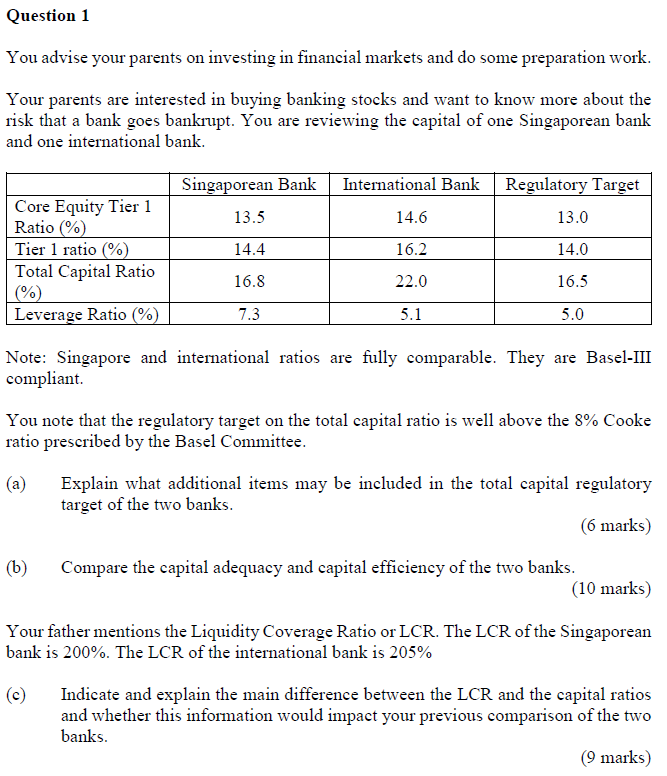

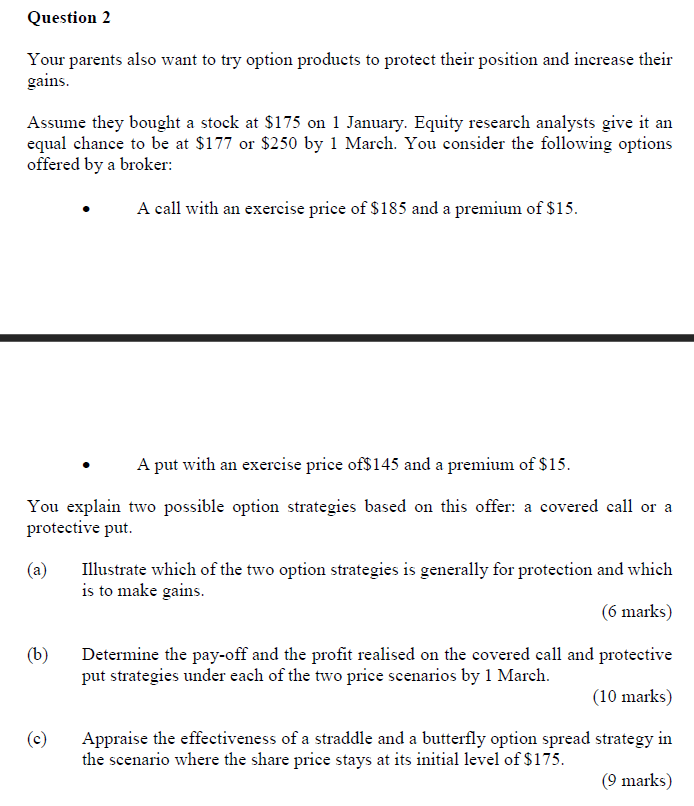

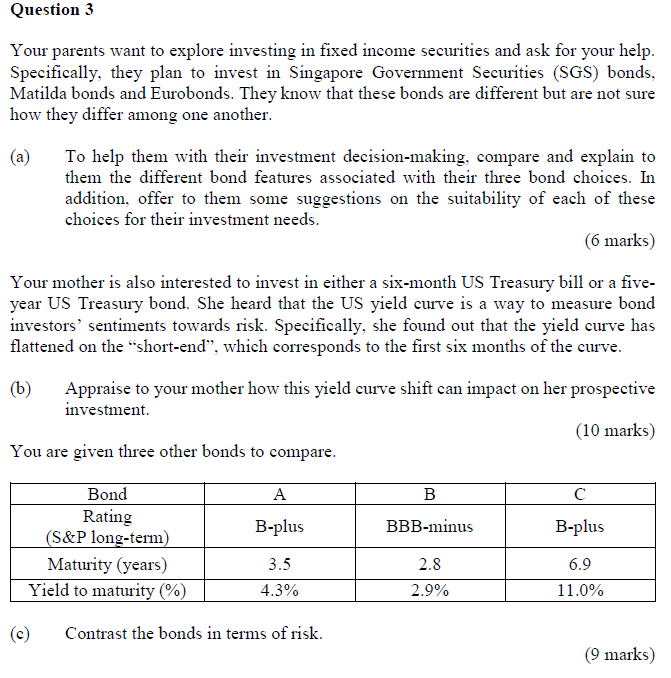

Question 1 You advise your parents on investing in financial markets and do some preparation work. Your parents are interested in buying banking stocks and want to know more about the risk that a bank goes bankrupt. You are reviewing the capital of one Singaporean bank and one international bank. Singaporean Bank International Bank Regulatory Target Core Equity Tier 1 13.5 14.6 13.0 Ratio (%) Tier 1 ratio (%) 14.4 16.2 14.0 Total Capital Ratio 16.8 22.0 16.5 (%) Leverage Ratio (%) 7.3 5.1 5.0 Note: Singapore and international ratios are fully comparable. They are Basel-III compliant. You note that the regulatory target on the total capital ratio is well above the 8% Cooke ratio prescribed by the Basel Committee. (a) Explain what additional items may be included in the total capital regulatory target of the two banks. (6 marks) (b) Compare the capital adequacy and capital efficiency of the two banks. (10 marks) Your father mentions the Liquidity Coverage Ratio or LCR. The LCR of the Singaporean bank is 200%. The LCR of the international bank is 205% (c) Indicate and explain the main difference between the LCR and the capital ratios and whether this information would impact your previous comparison of the two banks. (9 marks) Question 2 Your parents also want to try option products to protect their position and increase their gains. Assume they bought a stock at $175 on 1 January. Equity research analysts give it an equal chance to be at $177 or $250 by 1 March. You consider the following options offered by a broker: A call with an exercise price of $185 and a premium of $15. A put with an exercise price of $145 and a premium of $15. You explain two possible option strategies based on this offer: a covered call or a protective put. (a) (b) (c) Illustrate which of the two option strategies is generally for protection and which is to make gains. (6 marks) Determine the pay-off and the profit realised on the covered call and protective put strategies under each of the two price scenarios by 1 March. (10 marks) Appraise the effectiveness of a straddle and a butterfly option spread strategy in the scenario where the share price stays at its initial level of $175. (9 marks) Question 3 Your parents want to explore investing in fixed income securities and ask for your help. Specifically, they plan to invest in Singapore Government Securities (SGS) bonds, Matilda bonds and Eurobonds. They know that these bonds are different but are not sure how they differ among one another. (a) To help them with their investment decision-making, compare and explain to them the different bond features associated with their three bond choices. In addition, offer to them some suggestions on the suitability of each of these choices for their investment needs. (6 marks) Your mother is also interested to invest in either a six-month US Treasury bill or a five- year US Treasury bond. She heard that the US yield curve is a way to measure bond investors sentiments towards risk. Specifically, she found out that the yield curve has flattened on the "short-end", which corresponds to the first six months of the curve. (b) Appraise to your mother how this yield curve shift can impact on her prospective investment. You are given three other bonds to compare. (10 marks) Bond Rating A B C (S&P long-term) B-plus BBB-minus B-plus Maturity (years) 3.5 2.8 6.9 Yield to maturity (%) 4.3% 2.9% 11.0% (c) Contrast the bonds in terms of risk. (9 marks) Question 4 Finally, your parents ask you about alternative investments and new technologies. Your uncle approached your parents to participate in pre-seed funding of his business, which entails creating a new drone application for his construction business. (a) Explain to your parents by appraising the purpose of this funding and elaborate on the possible funding they might need to make, following this pre-seed funding stage. In addition, suggest to your uncle some typical participants, whom he can also source for such funding. (10 marks) Your parents prefer to invest in a new mobile messaging platform developed by your cousin based on a model of WeChat. They think it has great potential to later compete against incumbent Singaporean banks. (b) Discriminate the risk of your parents' prospective investment. In particular, explain to your parents why the same conditions that allowed WeChat Pay to succeed in China would not be fully met in a market like Singapore. (10 marks) You would like your parents to use robo-advisors proposed by their asset manager. (c) Persuade your parents to accept their asset manager's proposal and examine to them why robo-advisors are useful and suitable for them. (5 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started