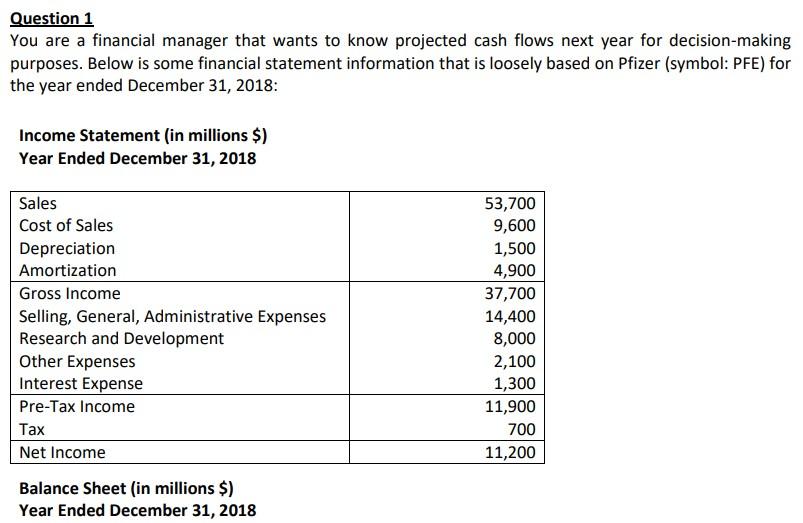

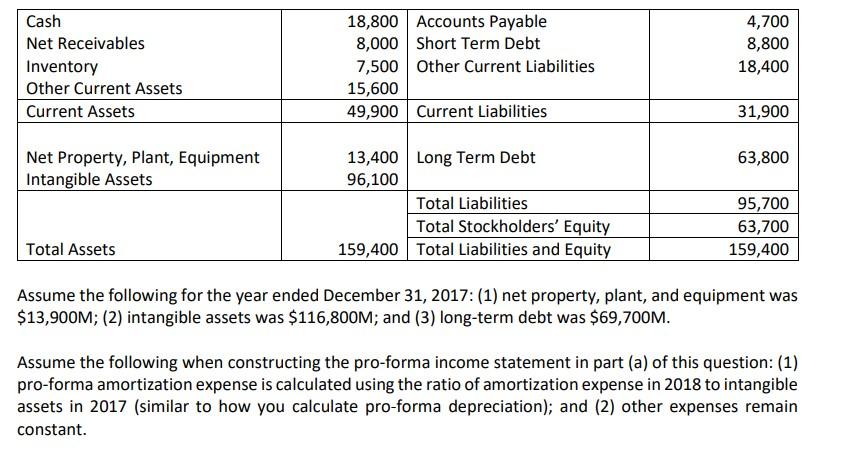

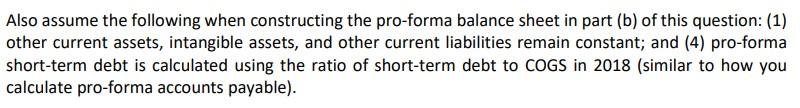

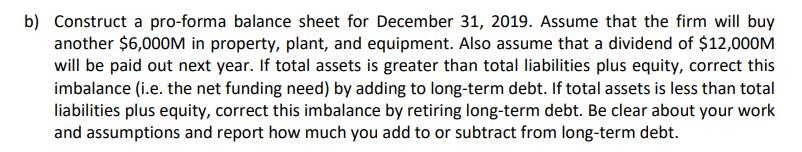

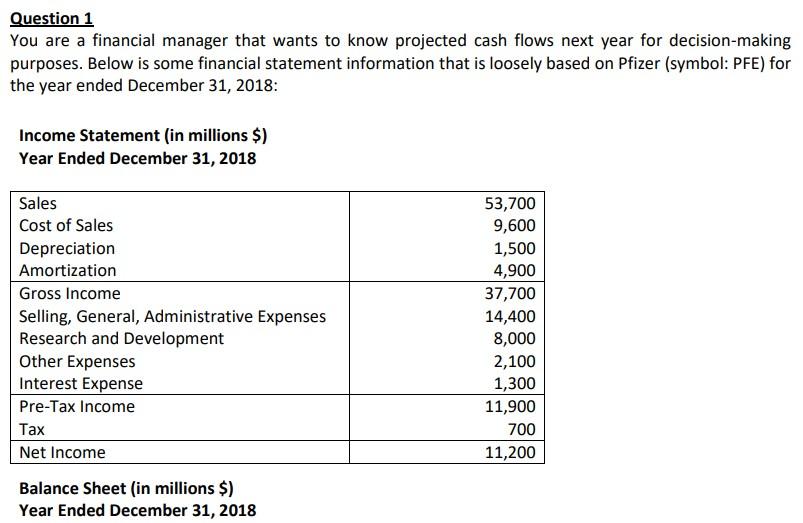

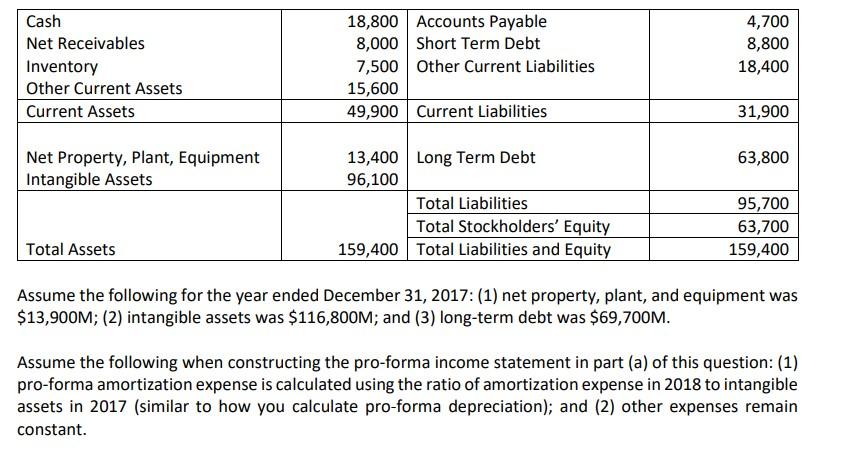

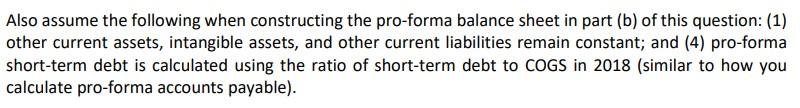

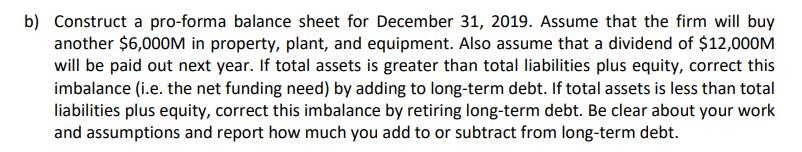

Question 1 You are a financial manager that wants to know projected cash flows next year for decision-making purposes. Below is some financial statement information that is loosely based on Pfizer (symbol: PFE) for the year ended December 31,2018 : Income Statement (in millions \$) Year Ended December 31, 2018 Balance Sheet (in millions \$\$) Year Ended December 31, 2018 Assume the following for the year ended December 31, 2017: (1) net property, plant, and equipment was $13,900M;(2) intangible assets was $116,800M; and (3) long-term debt was $69,700M. Assume the following when constructing the pro-forma income statement in part (a) of this question: (1) pro-forma amortization expense is calculated using the ratio of amortization expense in 2018 to intangible assets in 2017 (similar to how you calculate pro-forma depreciation); and (2) other expenses remain constant. Also assume the following when constructing the pro-forma balance sheet in part (b) of this question: (1) other current assets, intangible assets, and other current liabilities remain constant; and (4) pro-forma short-term debt is calculated using the ratio of short-term debt to COGS in 2018 (similar to how you calculate pro-forma accounts payable). 0) Construct a pro-forma balance sheet for December 31, 2019. Assume that the firm will buy another $6,000M in property, plant, and equipment. Also assume that a dividend of $12,000M will be paid out next year. If total assets is greater than total liabilities plus equity, correct this imbalance (i.e. the net funding need) by adding to long-term debt. If total assets is less than total liabilities plus equity, correct this imbalance by retiring long-term debt. Be clear about your work and assumptions and report how much you add to or subtract from long-term debt. Question 1 You are a financial manager that wants to know projected cash flows next year for decision-making purposes. Below is some financial statement information that is loosely based on Pfizer (symbol: PFE) for the year ended December 31,2018 : Income Statement (in millions \$) Year Ended December 31, 2018 Balance Sheet (in millions \$\$) Year Ended December 31, 2018 Assume the following for the year ended December 31, 2017: (1) net property, plant, and equipment was $13,900M;(2) intangible assets was $116,800M; and (3) long-term debt was $69,700M. Assume the following when constructing the pro-forma income statement in part (a) of this question: (1) pro-forma amortization expense is calculated using the ratio of amortization expense in 2018 to intangible assets in 2017 (similar to how you calculate pro-forma depreciation); and (2) other expenses remain constant. Also assume the following when constructing the pro-forma balance sheet in part (b) of this question: (1) other current assets, intangible assets, and other current liabilities remain constant; and (4) pro-forma short-term debt is calculated using the ratio of short-term debt to COGS in 2018 (similar to how you calculate pro-forma accounts payable). 0) Construct a pro-forma balance sheet for December 31, 2019. Assume that the firm will buy another $6,000M in property, plant, and equipment. Also assume that a dividend of $12,000M will be paid out next year. If total assets is greater than total liabilities plus equity, correct this imbalance (i.e. the net funding need) by adding to long-term debt. If total assets is less than total liabilities plus equity, correct this imbalance by retiring long-term debt. Be clear about your work and assumptions and report how much you add to or subtract from long-term debt