Answered step by step

Verified Expert Solution

Question

1 Approved Answer

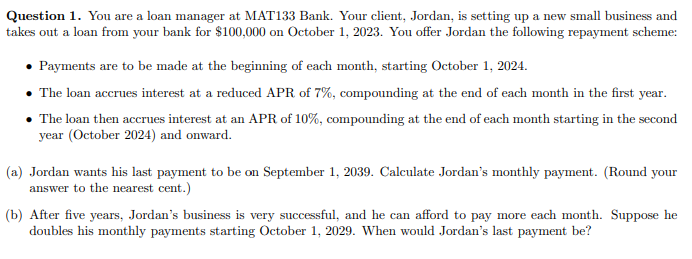

Question 1 . You are a loan manager at Bank. Your client, Jordan, is setting up a new small business and takes out a loan

Question You are a loan manager at Bank. Your client, Jordan, is setting up a new small business and

takes out a loan from your bank for $ on October You offer Jordan the following repayment scheme:

Payments are to be made at the beginning of each month, starting October

The loan accrues interest at a reduced APR of compounding at the end of each month in the first year.

The loan then accrues interest at an APR of compounding at the end of each month starting in the second

year October and onward.

a Jordan wants his last payment to be on September Calculate Jordan's monthly payment. Round your

answer to the nearest cent.

b After five years, Jordan's business is very successful, and he can afford to pay more each month. Suppose he

doubles his monthly payments starting October When would Jordan's last payment be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started