Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 You are given the following information regarding four stocks in a portfolio: Number of Shares 120 000 350 000 10 000 150 000

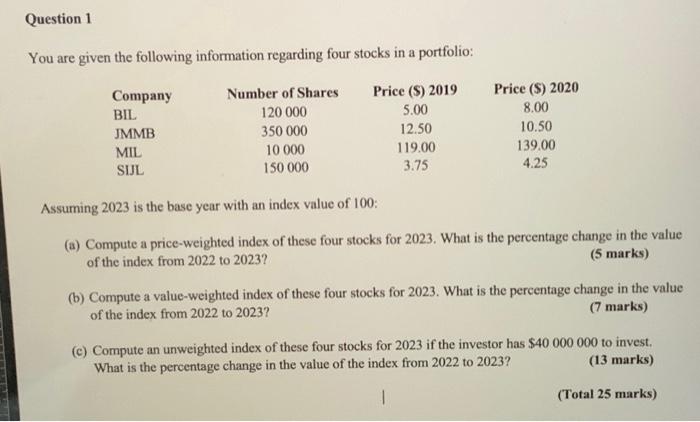

Question 1

You are given the following information regarding four stocks in a portfolio:

Number of Shares 120 000 350 000 10 000 150 000 Company BIL JMMB MIL SIJL Price ($) 2019 5.00 12.50 119.00 3.75 Price ($) 2020 8.00 10.50 139.00 4.25 Assuming 2023 is the base year with an index value of 100: (a) Compute a price-weighted index of these four stocks for 2023. What is the percentage change in the value of the index from 2022 to 2023? (5 marks) (b) Compute a value-weighted index of these four stocks for 2023. What is the percentage change in the value (7 marks) of the index from 2022 to 2023? (c) Compute an unweighted index of these four stocks for 2023 if the investor has $40 000 000 to invest. (13 marks) What is the percentage change in the value of the index from 2022 to 2023? 1 (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started