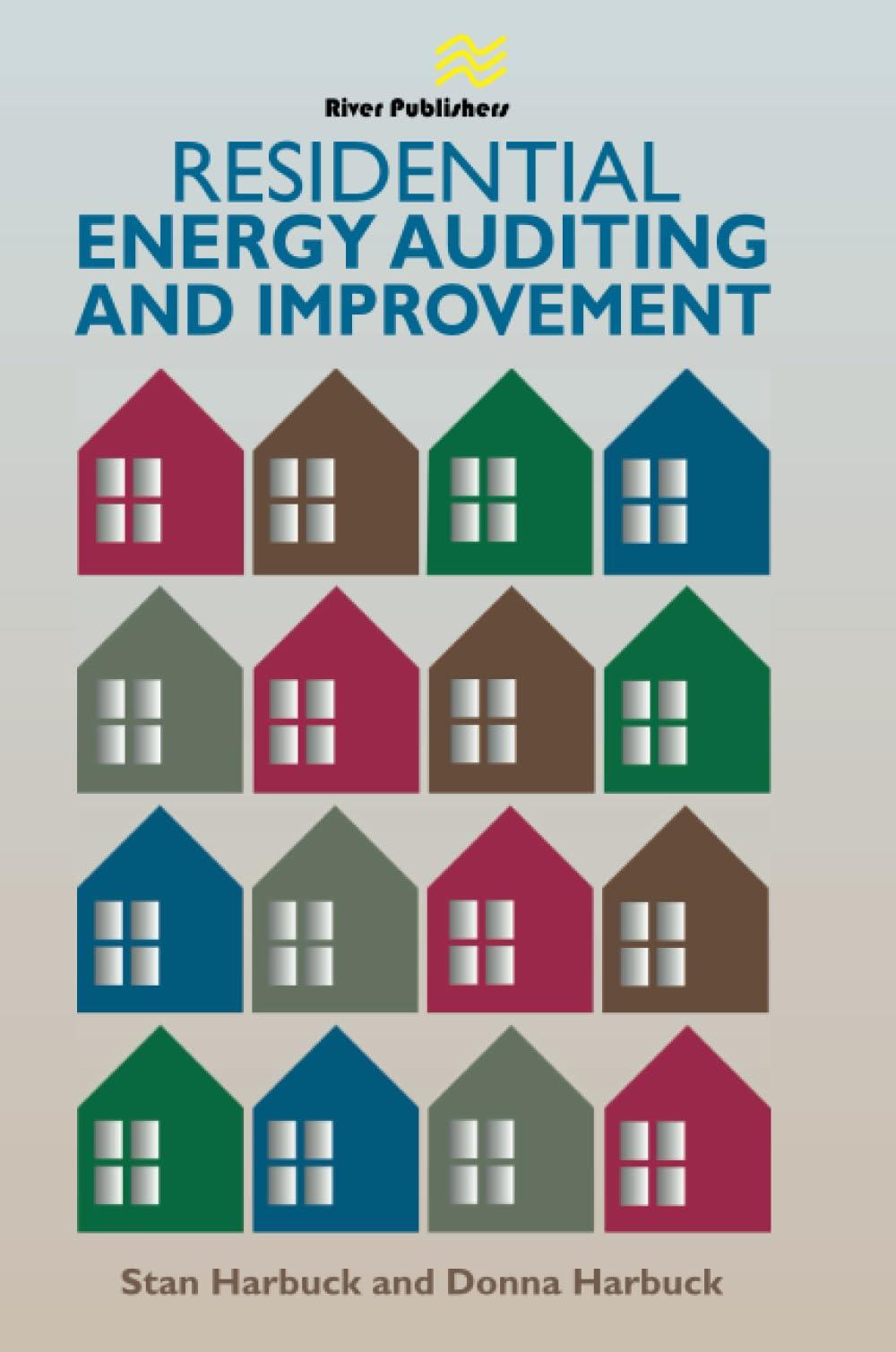

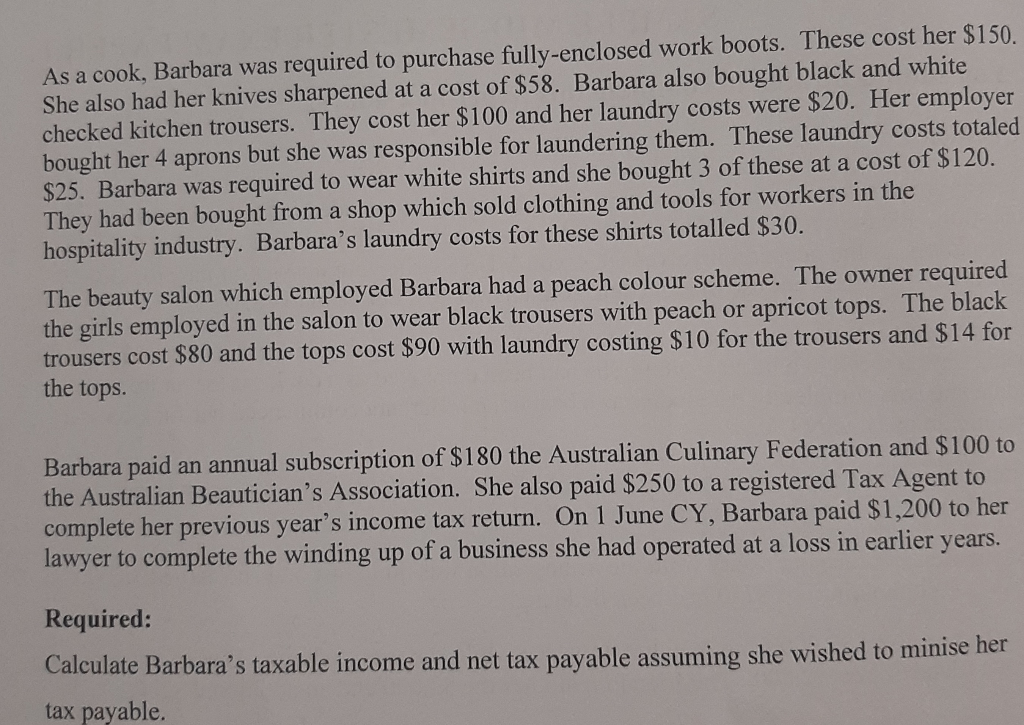

Question 1 You are required to answer the questions which have been included in the body of the question. Please note: you MUST comment on any item which you have excluded from the calculation. If the question involves UCA you MUST write your answer on the provided schedule. If you do not use the schedule your answer will not be marked. Barbara is 28 years old and has 2 part-time jobs. She works 2 days a week as a cook in a caf and 2 days a week in a beauty salon. She had been employed as a cook for the entire year while she was completing her studies as a beautician. Barbara commenced her first job as a beautician in January CY. From her job as a cook she earned a salary of $16,000. PAYG (Withholding) of $1.800 had been deducted. Barbara also received a Tool Allowance of $1,100. As she was a trainee her salary from the beauty salon was quite low and she earned $8,000. PAYG (Withholding) of $750 had been deducted. She had received $2,000 from Youth Allowance while she was studying. During the year she lent a friend of hers $2,000. The friend repaid her the $2,000 and an additional $200. Barbara's father provided her with a loan of $10,000 which she used to buy some additional investments. She received the loan on her birthday, 1 October CY in addition to a birthday present of $1,000 from her parents. Barbara sold 2 parcels of shares during the year. Parcel 1 was bought on 23 April PY and cost $3,600. Brokerage had cost $36 at purchase and $80 when she sold the shares on 20 April CY for $8,000. Parcel 2 was sold on 1 June CY for $4,500. She had bought the shares on 20 May CY at a cost of $5,000. The shares had been bought when the company listed on the Stock Exchange and was sold privately so no brokerage was payable. Barbara also sold a vacant block of land on 1 July CY for $120,000. She had paid $104.000 for it on 1 July 2013. Stamp duty on the purchase was 2,000. During the first half of the year Barbara worked part-time as a cook and attended a private beautician college. Her study expenses were as follows: Fees for 6 months Travel from home to college and return Travel from college to work Books and stationery 4,300 800 220 230 Barbara decided to go back to Technical College and complete her chef qualifications. Her fees for college were $280, stationery cost $45 and travel to the college after working at the beauty salon cost $60. The subsequent travel home after college totalled $50. As a cook, Barbara was required to purchase fully-enclosed work boots. These cost her $150. She also had her knives sharpened at a cost of $58. Barbara also bought black and white checked kitchen trousers. They cost her $100 and her laundry costs were $20. Her employer bought her 4 aprons but she was responsible for laundering them. These laundry costs totaled $25. Barbara was required to wear white shirts and she bought 3 of these at a cost of $120. They had been bought from a shop which sold clothing and tools for workers in the hospitality industry. Barbara's laundry costs for these shirts totalled $30. The beauty salon which employed Barbara had a peach colour scheme. The owner required the girls employed in the salon to wear black trousers with peach or apricot tops. The black trousers cost $80 and the tops cost $90 with laundry costing $10 for the trousers and $14 for the tops. Barbara paid an annual subscription of $180 the Australian Culinary Federation and $100 to the Australian Beautician's Association. She also paid $250 to a registered Tax Agent to complete her previous year's income tax return. On 1 June CY, Bart me tax return. On 1 June CY, Barbara paid $1,200 to her lawyer to complete the winding up of a business she had operated at a loss in earlier years. Required: Calculate Barbara's taxable income and net tax payable assuming she wished to minise her tax payable. Question 1 You are required to answer the questions which have been included in the body of the question. Please note: you MUST comment on any item which you have excluded from the calculation. If the question involves UCA you MUST write your answer on the provided schedule. If you do not use the schedule your answer will not be marked. Barbara is 28 years old and has 2 part-time jobs. She works 2 days a week as a cook in a caf and 2 days a week in a beauty salon. She had been employed as a cook for the entire year while she was completing her studies as a beautician. Barbara commenced her first job as a beautician in January CY. From her job as a cook she earned a salary of $16,000. PAYG (Withholding) of $1.800 had been deducted. Barbara also received a Tool Allowance of $1,100. As she was a trainee her salary from the beauty salon was quite low and she earned $8,000. PAYG (Withholding) of $750 had been deducted. She had received $2,000 from Youth Allowance while she was studying. During the year she lent a friend of hers $2,000. The friend repaid her the $2,000 and an additional $200. Barbara's father provided her with a loan of $10,000 which she used to buy some additional investments. She received the loan on her birthday, 1 October CY in addition to a birthday present of $1,000 from her parents. Barbara sold 2 parcels of shares during the year. Parcel 1 was bought on 23 April PY and cost $3,600. Brokerage had cost $36 at purchase and $80 when she sold the shares on 20 April CY for $8,000. Parcel 2 was sold on 1 June CY for $4,500. She had bought the shares on 20 May CY at a cost of $5,000. The shares had been bought when the company listed on the Stock Exchange and was sold privately so no brokerage was payable. Barbara also sold a vacant block of land on 1 July CY for $120,000. She had paid $104.000 for it on 1 July 2013. Stamp duty on the purchase was 2,000. During the first half of the year Barbara worked part-time as a cook and attended a private beautician college. Her study expenses were as follows: Fees for 6 months Travel from home to college and return Travel from college to work Books and stationery 4,300 800 220 230 Barbara decided to go back to Technical College and complete her chef qualifications. Her fees for college were $280, stationery cost $45 and travel to the college after working at the beauty salon cost $60. The subsequent travel home after college totalled $50. As a cook, Barbara was required to purchase fully-enclosed work boots. These cost her $150. She also had her knives sharpened at a cost of $58. Barbara also bought black and white checked kitchen trousers. They cost her $100 and her laundry costs were $20. Her employer bought her 4 aprons but she was responsible for laundering them. These laundry costs totaled $25. Barbara was required to wear white shirts and she bought 3 of these at a cost of $120. They had been bought from a shop which sold clothing and tools for workers in the hospitality industry. Barbara's laundry costs for these shirts totalled $30. The beauty salon which employed Barbara had a peach colour scheme. The owner required the girls employed in the salon to wear black trousers with peach or apricot tops. The black trousers cost $80 and the tops cost $90 with laundry costing $10 for the trousers and $14 for the tops. Barbara paid an annual subscription of $180 the Australian Culinary Federation and $100 to the Australian Beautician's Association. She also paid $250 to a registered Tax Agent to complete her previous year's income tax return. On 1 June CY, Bart me tax return. On 1 June CY, Barbara paid $1,200 to her lawyer to complete the winding up of a business she had operated at a loss in earlier years. Required: Calculate Barbara's taxable income and net tax payable assuming she wished to minise her tax payable