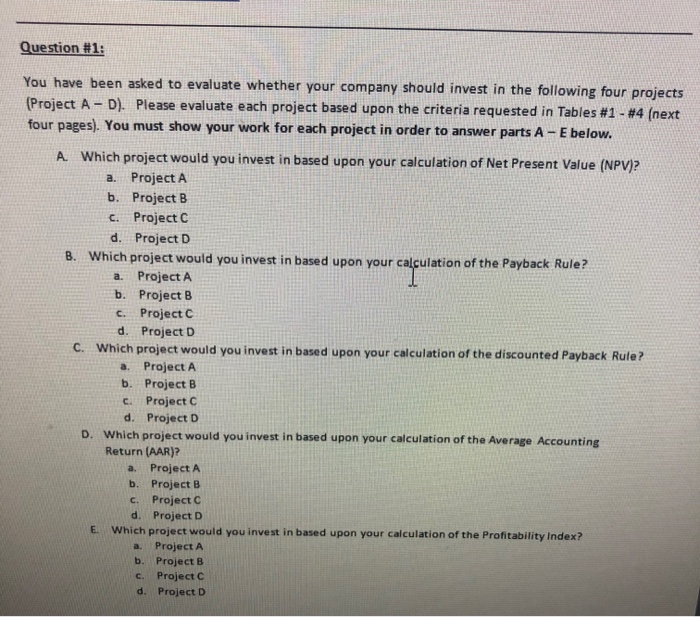

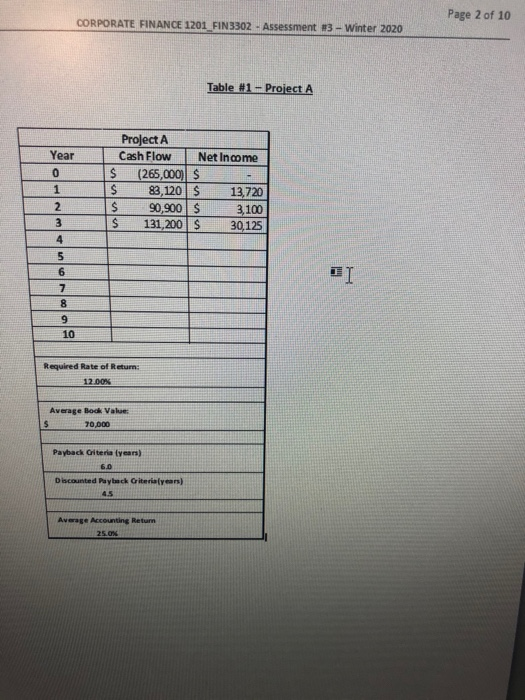

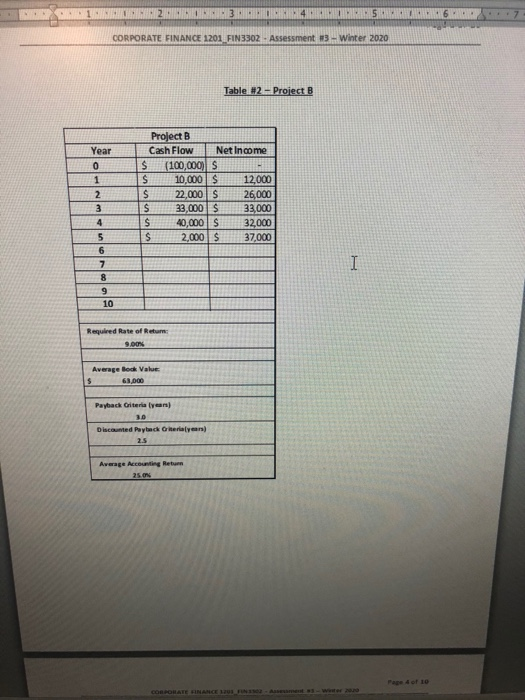

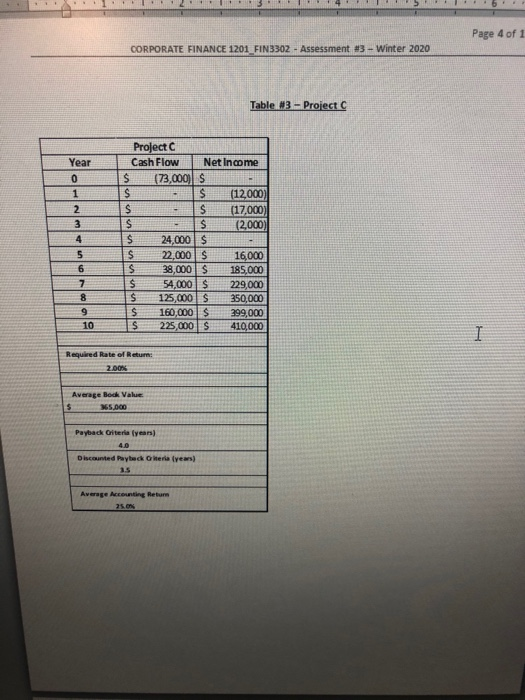

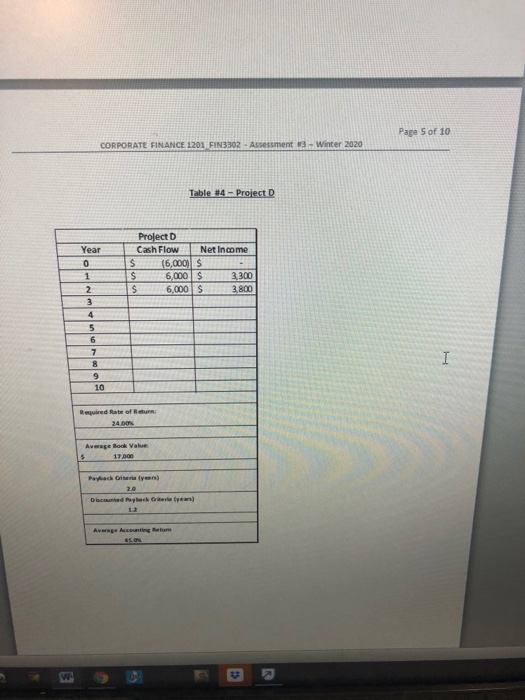

Question #1: You have been asked to evaluate whether your company should invest in the following four projects (Project A-D). Please evaluate each project based upon the criteria requested in Tables #1 - #4 (next four pages). You must show your work for each project in order to answer parts A - E below. A. Which project would you invest in based upon your calculation of Net Present Value (NPV)? a. Project A b. Project B C. Project C d. Project D B. Which project would you invest in based upon your calculation of the Payback Rule? a. Project A b. Project B c. Project C d. Project D C. Which project would you invest in based upon your calculation of the discounted Payback Rule? a. Project A b. Project B c. Project d. Project D D. Which project would you invest in based upon your calculation of the Average Accounting Return (AAR)? a. Project b. Project B c. Project d. Project D E. Which project would you invest in based upon your calculation of the Profitability Index? a. Project A b. Project B c. Project d. Project D Page 2 of 10 CORPORATE FINANCE 1201 FIN 3302 - Assessment #3 - Winter 2020 Table #1 - Project A Year Project A Cash FlowN et Income S (265,000 $- 83, 120 13,720 $ 90,900 $ 3,100 $ 131,200 $ 30,125 S 5 TL 9 10 Required Rate of Retu Average Bed Value 20.000 Payback Criteria (years) Discounted Payback Griterien Average Accounting Return CATEGORIES CA SING CORPORATE FINANCE 1201_FIN3302 - Assessment #3 - Winter 2020 Table #2 - Project B Year Project B Cash Flow Net Income $ (100,000) S S 10,000 $ 12,000 22,000 S 26,000 33,000 $ 33,000 40,000 32,000 2 ,000 $ 37,000 S 7 8 91T 10 Required Rate of Return 90% Average Beck Value $ 63.000 Payback Oriteria yan) Discounted Payback her years) Average Accounting Return Page 4 of 10 Page 4 of 1 CORPORATE FINANCE 1201_FIN3302 - Assessment #3 - Winter 2020 Table #3 - Project Year O S Project C Cash Flow Net Income (73,000 $ S . IS (12.000 $ . $ [17,000 $ - $ (2,000 $ 24,000 $ 22,000 $ 16,000 38,000S 185.000 $ 54,000 $ 229,000 $ 125,000 $ 350,000 S 160,000 $ 299,000 225,000 $ 410,000 S Required Rate of Return Average Bok Value Paybach year Octed by her years) Page 5 of 10 CORPORATE FINANCE 1201 FIN3302 - Assessment #3 - Winter 2020 Table #4 - Project D Year 0 1 2 3 Project D Cash Flow Net Income $ (6,000) S- $ 6,000 $ 3,300 $ 6,000 $ 3,800 15 10 Required Rate of Return Average Book Value Payback Oriteria year) D ylack here