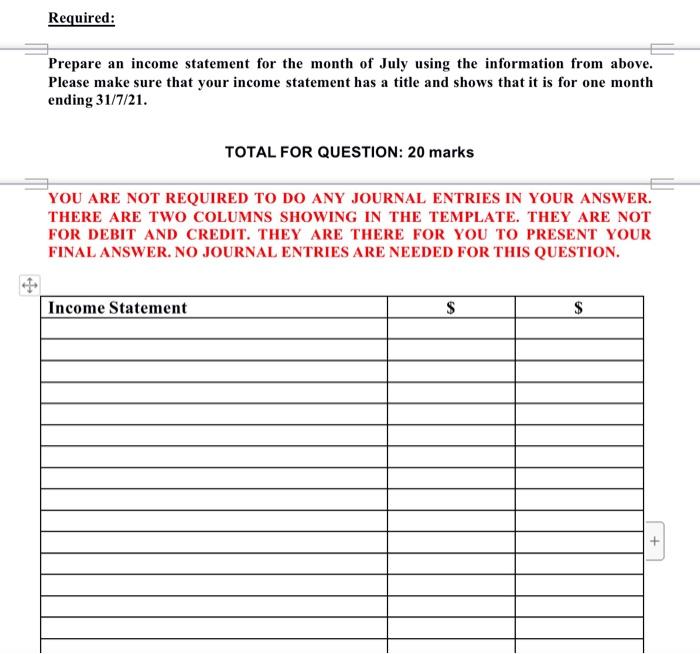

Question 1 You have been presented with the following information for a business for the month ending 318 July 2021. (All of the information is for 2021). 1. The business provided services to customers in July and the customers paid cash as soon as the services were provided. The total amount of cash received from the customers was $12,600 2. The owner of the business paid his personal telephone bill of $320 in July 2021 using his own personal cash account. 3. The business provided services to customers in July totalling $9,200. The customers will pay the $8,600 in August. 4. The business provided services to customers totalling $6,200 in June. The business received $4,100 from the customers in June and $2,100 was received by the business from the customers in July 5. The business paid $3,000 cash in July for 12 months' rent. The rent was for the period 1/7/21 until 30/6/22 6. The business received $3,500 cash from customers in the month of July for services to be performed by the business in August 7. The business used cash to pay the wages for staff who worked for the business in the month of June. The total cash paid for wages was $9,200 and the cash was paid in July. 8. The business paid $1,200 cash for wages to staff that worked for the business in May but the staff had not been paid in May. They were paid in June for the work they did for the business in May. 9. The water expense for the business for the month of July was $600. The $600 was paid using cash by the business in the month of July. 10. The bill for the electricity used by the business for the month of July was $620. The bill will not be paid by the business until August. 11. The telephone bill for the business for June was still owing at the start of July and was paid in July. The telephone bill was $820. 12. The business used cash to pay the wages for the business for the month of July totalling $10,300 Question continues on the next page... 13. Some of the staff in the business have been working in June but at the end of June they have not been paid yet for the work they did for the business in June. The wages owing at the end of June were $900 and these wages will be paid by the business to the staff in July. 14. The business has a long-term loan with the bank of $50,000. The interest owing on the loan for the month of July was $180. The interest owing for the loan has not been paid by the business yet and will be paid on the 4th of August 2021. 15. The business paid $1,200 for 6 months' insurance on the 1of July. The insurance was for the period 1st July - 31 December. 16. Some staff have asked if they can be paid their wages early because they need to pay their personal expenses, so the business has paid the wages in advance. The business has paid the staff $700 cash in advance in July, but the staff will not work for the business until August 2021. 17. The business purchased supplies to be used by the business in July 2021. The business paid $1,200 cash for the supplies. At the end of July, the business checked how much supplies were still not used. At the end of July, $140 of the supplies had not been used and would be used in August. The rest of the supplies had been used in July. 18. The business has $7,500 cash in the bank. The cash has earned interest income of $20 for the month of June. The $20 has been received by the business from the bank on the 4th of July 2021. 19. The business paid $2,000 cash for 5 months advertising in July 2021. The advertising was for the period 19 August - 31" December 20. The total depreciation of the assets used by the business during the month of July was $3.100. 21. The owner of the business paid his personal expenses of $200 in July by taking $200 of cash from the business in July and using it to pay for his personal expenses. 22. General expenses for the business for the month of July were $480 in total and this was paid in July by the business using cash. Required: Prepare an income statement for the month of July using the information from above. Please make sure that your income statement has a title and shows that it is for one month ending 31/7/21. TOTAL FOR QUESTION: 20 marks YOU ARE NOT REQUIRED TO DO ANY JOURNAL ENTRIES IN YOUR ANSWER. THERE ARE TWO COLUMNS SHOWING IN THE TEMPLATE. THEY ARE NOT FOR DEBIT AND CREDIT. THEY ARE THERE FOR YOU TO PRESENT YOUR FINAL ANSWER. NO JOURNAL ENTRIES ARE NEEDED FOR THIS QUESTION. Income Statement $ $