Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 Your company has approached its bankers for loan facilities to be made available during the coming quarter. The bank has responded by

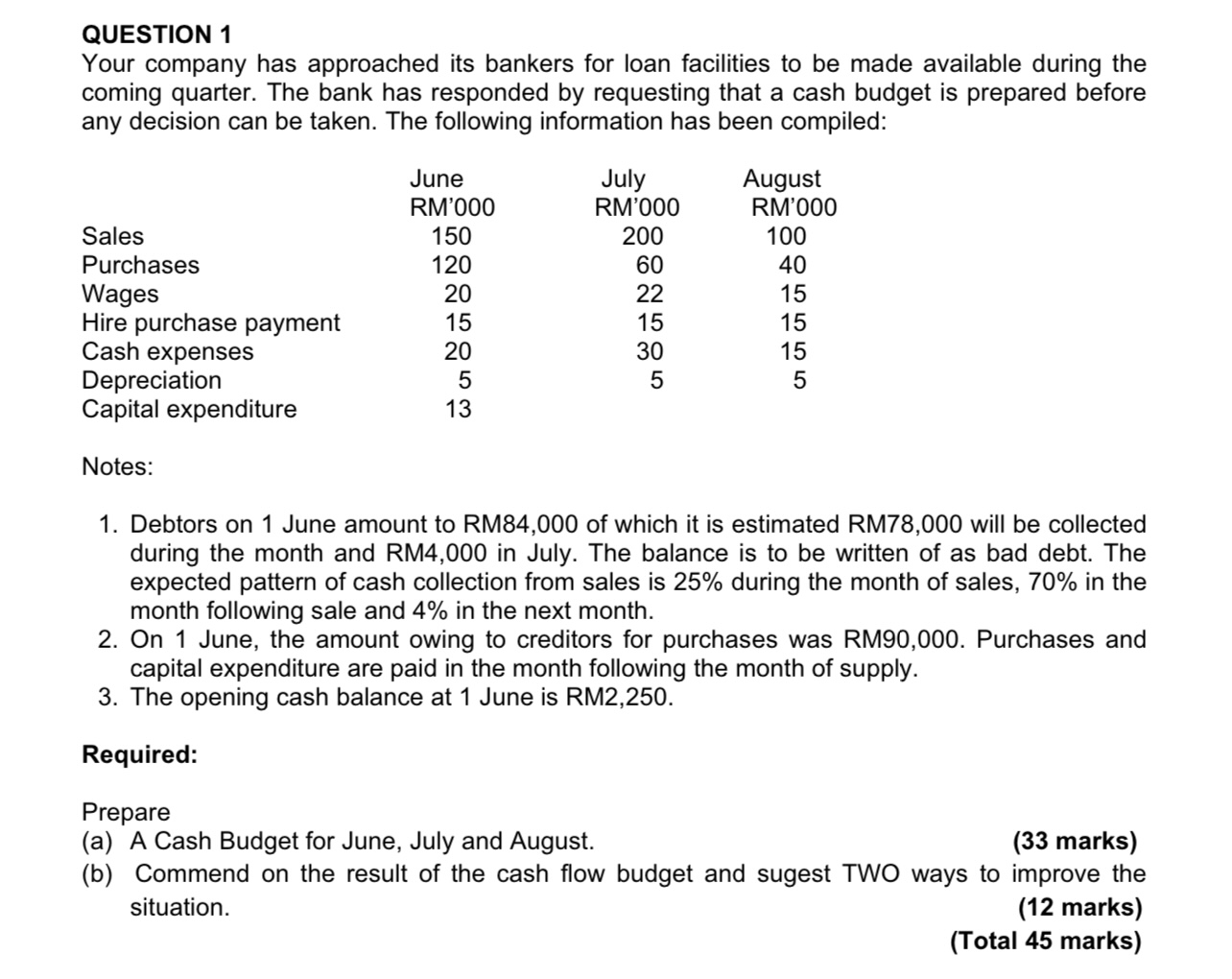

QUESTION 1 Your company has approached its bankers for loan facilities to be made available during the coming quarter. The bank has responded by requesting that a cash budget is prepared before any decision can be taken. The following information has been compiled: Sales Purchases Wages Hire purchase payment Cash expenses Depreciation Capital expenditure Notes: June RM'000 150 120 20 15 20 5 13 July RM'000 200 60 22 15 30 5 August RM'000 100 40 15 15 15 5 1. Debtors on 1 June amount to RM84,000 of which it is estimated RM78,000 will be collected during the month and RM4,000 in July. The balance is to be written of as bad debt. The expected pattern of cash collection from sales is 25% during the month of sales, 70% in the month following sale and 4% in the next month. 2. On 1 June, the amount owing to creditors for purchases was RM90,000. Purchases and capital expenditure are paid in the month following the month of supply. 3. The opening cash balance at 1 June is RM2,250. Required: Prepare (a) A Cash Budget for June, July and August. (33 marks) (b) Commend on the result of the cash flow budget and sugest TWO ways to improve the situation. (12 marks) (Total 45 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Cash Budget for June July and August June July August Opening Cash Balance RM2250 RM RM Receipts Collections from Debtors RM78000 RM4000 RM Sales 25 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started