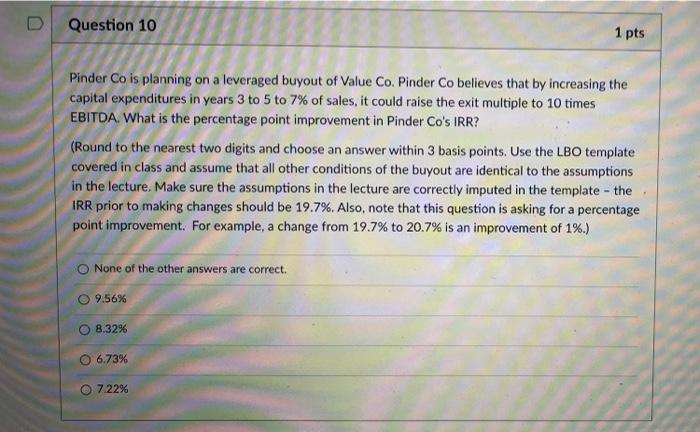

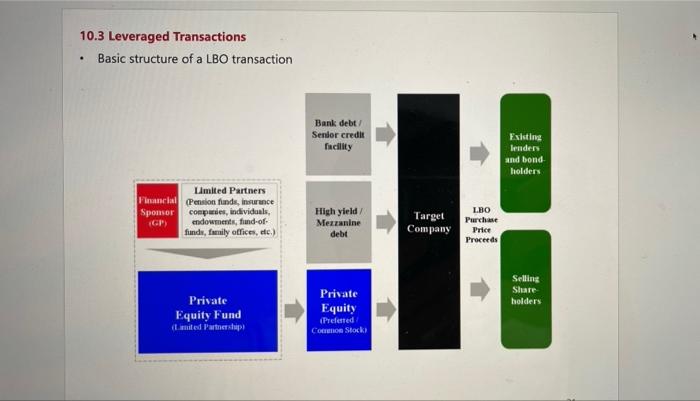

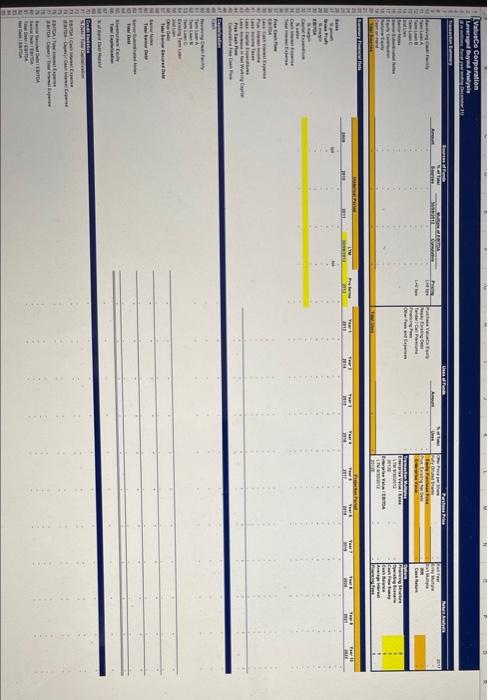

Question 10 1 pts Pinder Co is planning on a leveraged buyout of Value Co. Pinder Co believes that by increasing the capital expenditures in years 3 to 5 to 7% of sales, it could raise the exit multiple to 10 times EBITDA. What is the percentage point improvement in Pinder Co's IRR? (Round to the nearest two digits and choose an answer within 3 basis points. Use the LBO template covered in class and assume that all other conditions of the buyout are identical to the assumptions in the lecture. Make sure the assumptions in the lecture are correctly imputed in the template - the IRR prior to making changes should be 19.7%. Also, note that this question is asking for a percentage point improvement. For example, a change from 19.7% to 20.7% is an improvement of 1%.) None of the other answers are correct. O 9.56% o 8.32% O 6.73% 7.22% 10.3 Leveraged Transactions Basic structure of a LBO transaction . Bank debt Senior credit facility Existing lenders and bond holders Limited Partners Financial Pension funds, insurance Sponsor companies, individuals GP) endowments, find-of- funds, family offices, de.) High yield Mezzanine debt Target Company LBO Purchase Price Proceeds Selling Share holders Private Equity Fund (Lanited Partnership) Private Equity Prelesed Coro Stock ValueCo Corporation y Analysis BE WAT TER L Cash arth 1 WR Ter FA HI B IC . IH Preah En ) w ERSTEN TEORICE Question 10 1 pts Pinder Co is planning on a leveraged buyout of Value Co. Pinder Co believes that by increasing the capital expenditures in years 3 to 5 to 7% of sales, it could raise the exit multiple to 10 times EBITDA. What is the percentage point improvement in Pinder Co's IRR? (Round to the nearest two digits and choose an answer within 3 basis points. Use the LBO template covered in class and assume that all other conditions of the buyout are identical to the assumptions in the lecture. Make sure the assumptions in the lecture are correctly imputed in the template - the IRR prior to making changes should be 19.7%. Also, note that this question is asking for a percentage point improvement. For example, a change from 19.7% to 20.7% is an improvement of 1%.) None of the other answers are correct. O 9.56% o 8.32% O 6.73% 7.22% 10.3 Leveraged Transactions Basic structure of a LBO transaction . Bank debt Senior credit facility Existing lenders and bond holders Limited Partners Financial Pension funds, insurance Sponsor companies, individuals GP) endowments, find-of- funds, family offices, de.) High yield Mezzanine debt Target Company LBO Purchase Price Proceeds Selling Share holders Private Equity Fund (Lanited Partnership) Private Equity Prelesed Coro Stock ValueCo Corporation y Analysis BE WAT TER L Cash arth 1 WR Ter FA HI B IC . IH Preah En ) w ERSTEN TEORICE