Answered step by step

Verified Expert Solution

Question

1 Approved Answer

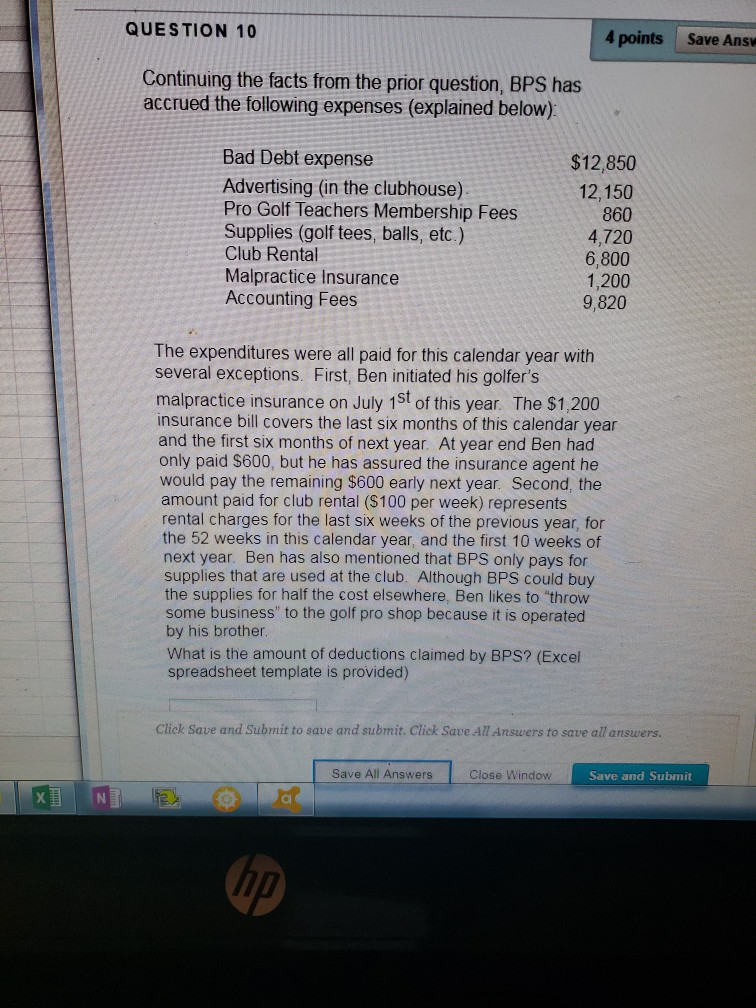

QUESTION 10 4 points Save Answ Continuing the facts from the prior question, BPS has accrued the following expenses (explained below Bad Debt expense Advertising

QUESTION 10 4 points Save Answ Continuing the facts from the prior question, BPS has accrued the following expenses (explained below Bad Debt expense Advertising (in the clubhouse) Pro Golf Teachers Membership Fees Supplies (golf tees, balls, etc.) Club Rental Malpractice Insurance Accounting Fees $12,850 12,150 860 4,720 6,800 1,200 9,820 The expenditures were all paid for this calendar year with several exceptions. First, Ben initiated his golfers malpractice insurance on July 1St of this year. The $1,200 insurance bill covers the last six months of this calendar year and the first six months of next year. At year end Ben had only paid S600, but he has assured the insurance agent he would pay the remaining $600 early next year. Second, the amount paid for club rental ($100 per week) represents rental charges for the last six weeks of the previous year, for the 52 weeks in this calendar year, and the first 10 weeks of next year. Ben has also mentioned that BPS only pays for supplies that are used at the club. Although BPS could buy the supplies for half the cost elsewhere, Ben likes to "throw some business" to the golf pro shop because it is operated by his brother What is the amount of deductions claimed by BPS? (Excel spreadsheet template is provided) Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Close Window Save and Submit al QUESTION 10 4 points Save Answ Continuing the facts from the prior question, BPS has accrued the following expenses (explained below Bad Debt expense Advertising (in the clubhouse) Pro Golf Teachers Membership Fees Supplies (golf tees, balls, etc.) Club Rental Malpractice Insurance Accounting Fees $12,850 12,150 860 4,720 6,800 1,200 9,820 The expenditures were all paid for this calendar year with several exceptions. First, Ben initiated his golfers malpractice insurance on July 1St of this year. The $1,200 insurance bill covers the last six months of this calendar year and the first six months of next year. At year end Ben had only paid S600, but he has assured the insurance agent he would pay the remaining $600 early next year. Second, the amount paid for club rental ($100 per week) represents rental charges for the last six weeks of the previous year, for the 52 weeks in this calendar year, and the first 10 weeks of next year. Ben has also mentioned that BPS only pays for supplies that are used at the club. Although BPS could buy the supplies for half the cost elsewhere, Ben likes to "throw some business" to the golf pro shop because it is operated by his brother What is the amount of deductions claimed by BPS? (Excel spreadsheet template is provided) Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Close Window Save and Submit al

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started