Answered step by step

Verified Expert Solution

Question

1 Approved Answer

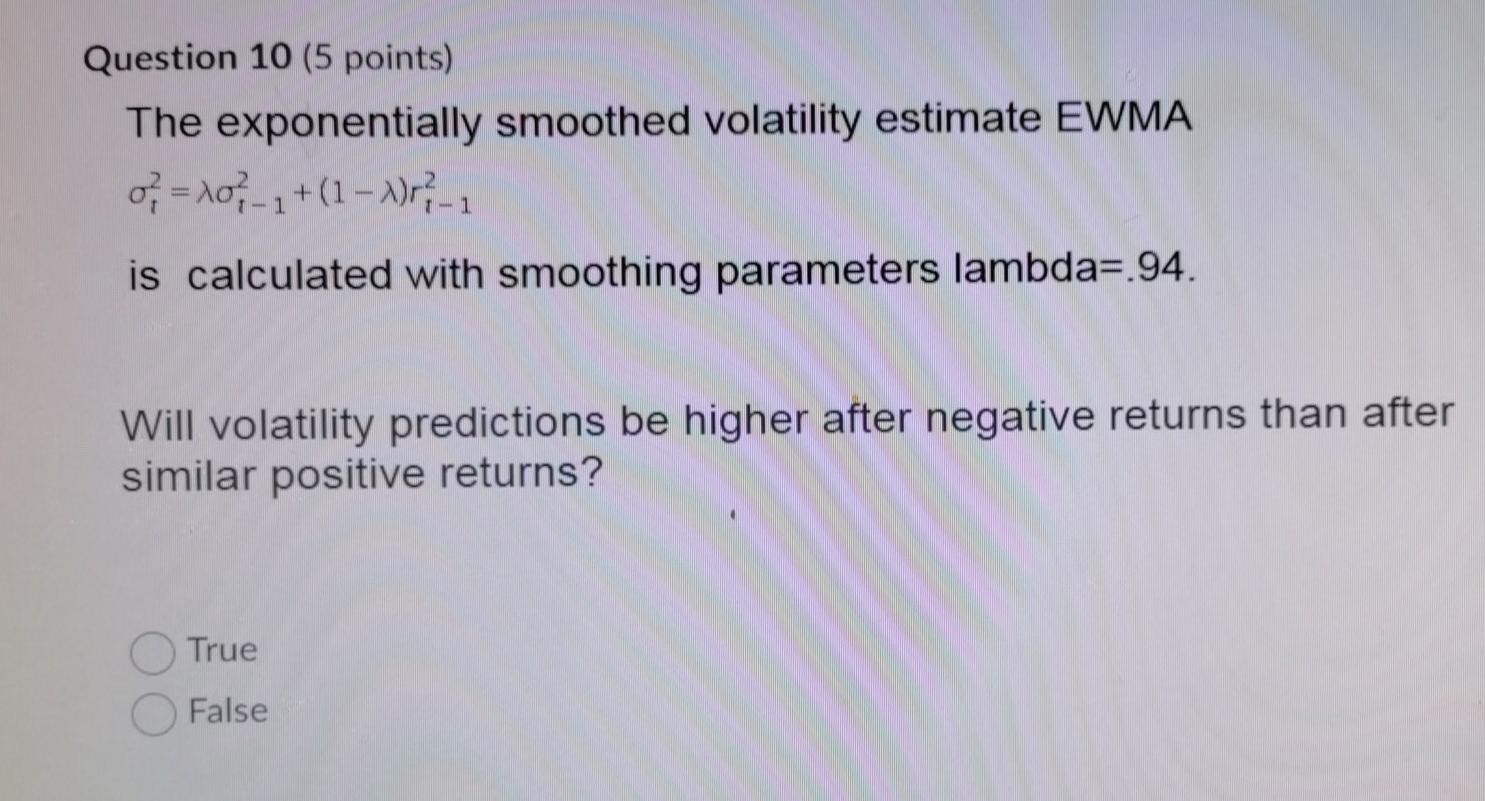

Question 10 (5 points) The exponentially smoothed volatility estimate EWMA o; = 10;-1 + (1 - Nr-1 is calculated with smoothing parameters lambda=.94. Will volatility

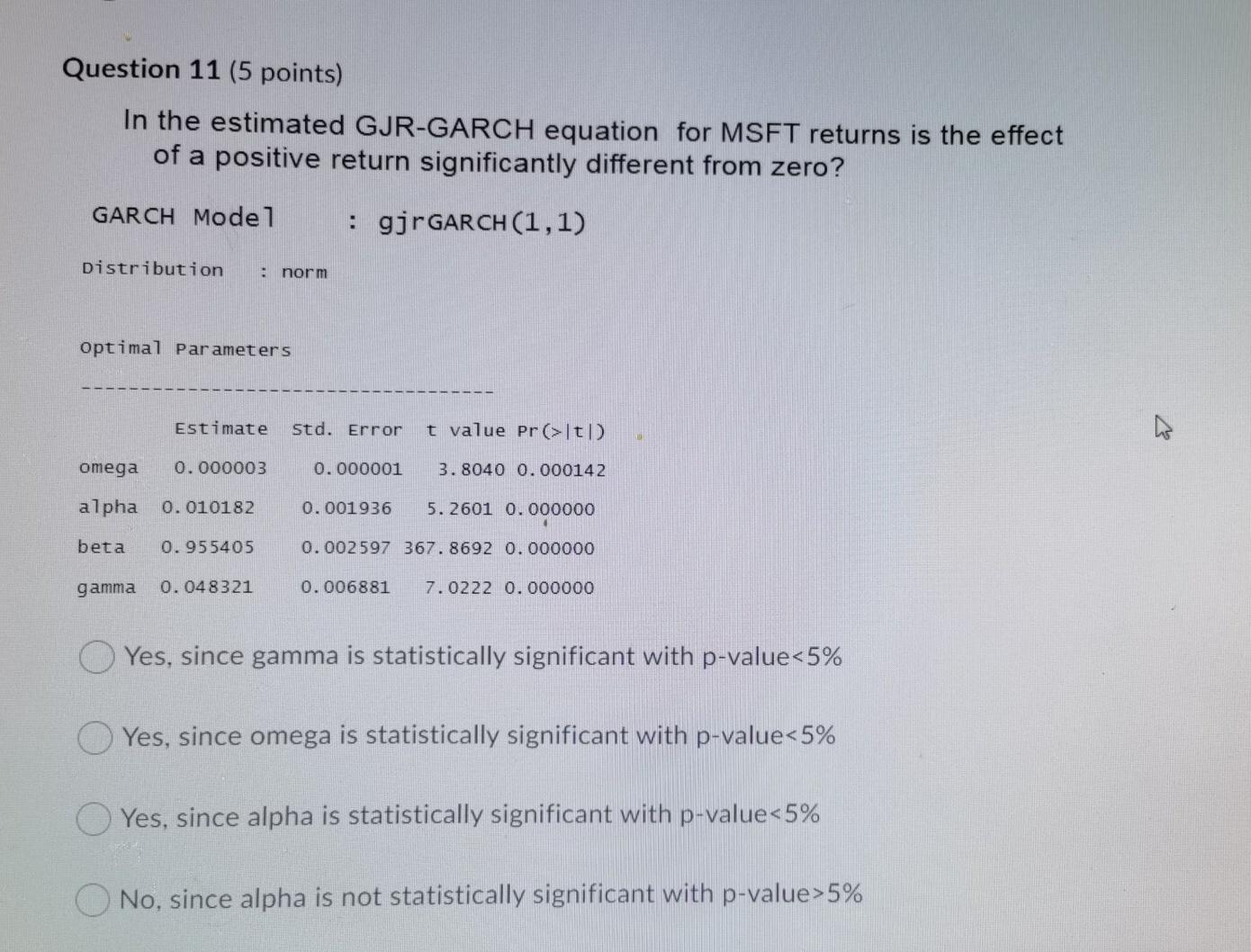

Question 10 (5 points) The exponentially smoothed volatility estimate EWMA o; = 10;-1 + (1 - Nr-1 is calculated with smoothing parameters lambda=.94. Will volatility predictions be higher after negative returns than after similar positive returns? True False Question 11 (5 points) In the estimated GJR-GARCH equation for MSFT returns is the effect of a positive return significantly different from zero? GARCH Model : gjrGARCH (1,1) distribution norm optimal parameters Estimate Std. Error t value pr(>1t| omega 0.000003 0.000001 3.8040 0.000142 alpha 0.010182 0.001936 5. 2601 0.000000 beta 0.955405 0.002597 367.8692 0.000000 gamma 0.048321 0.006881 7.0222 0.000000 Yes, since gamma is statistically significant with p-value5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started