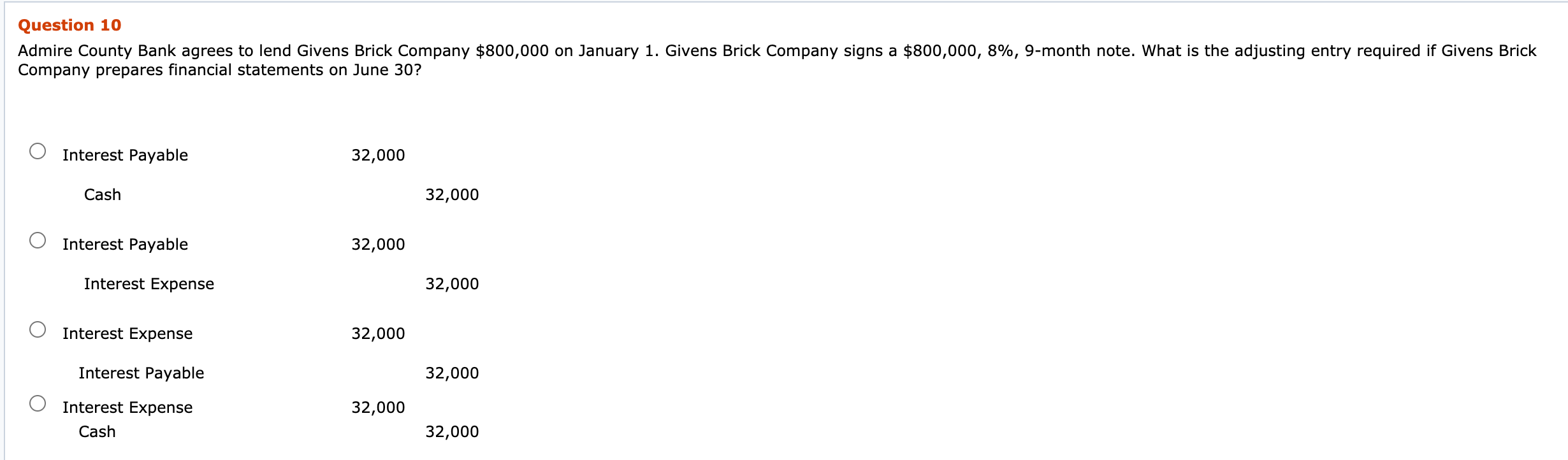

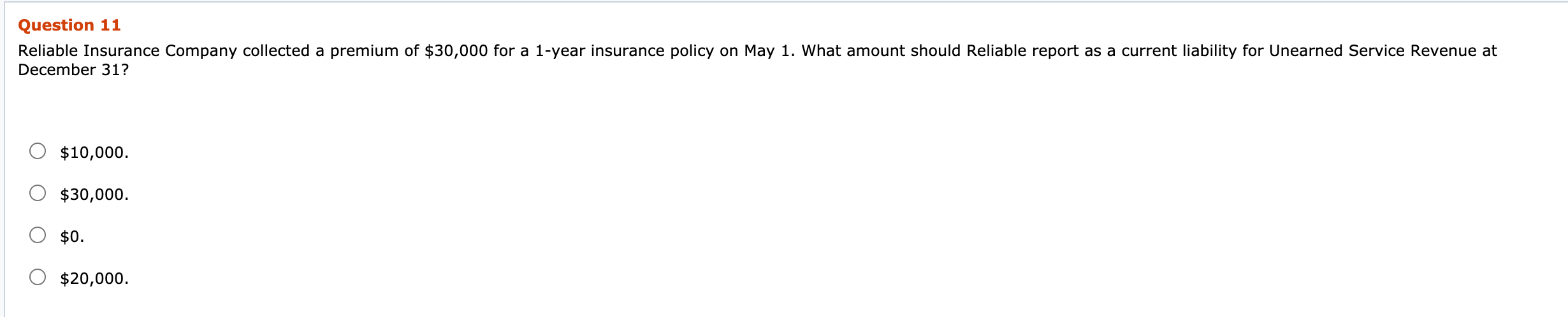

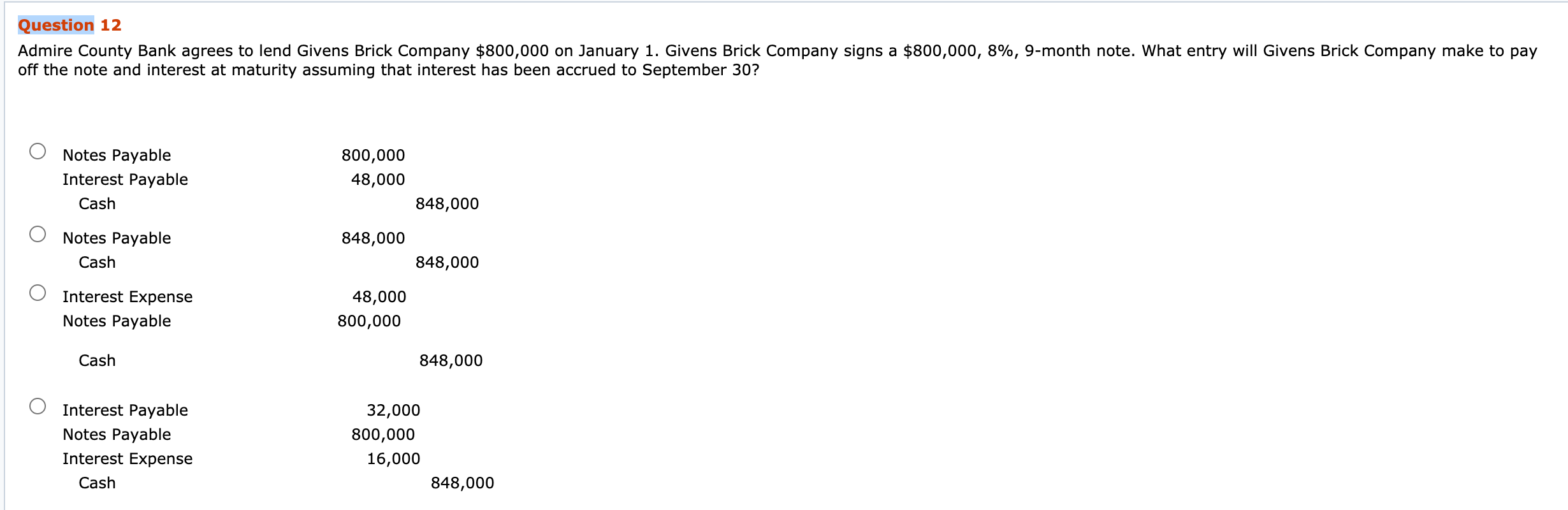

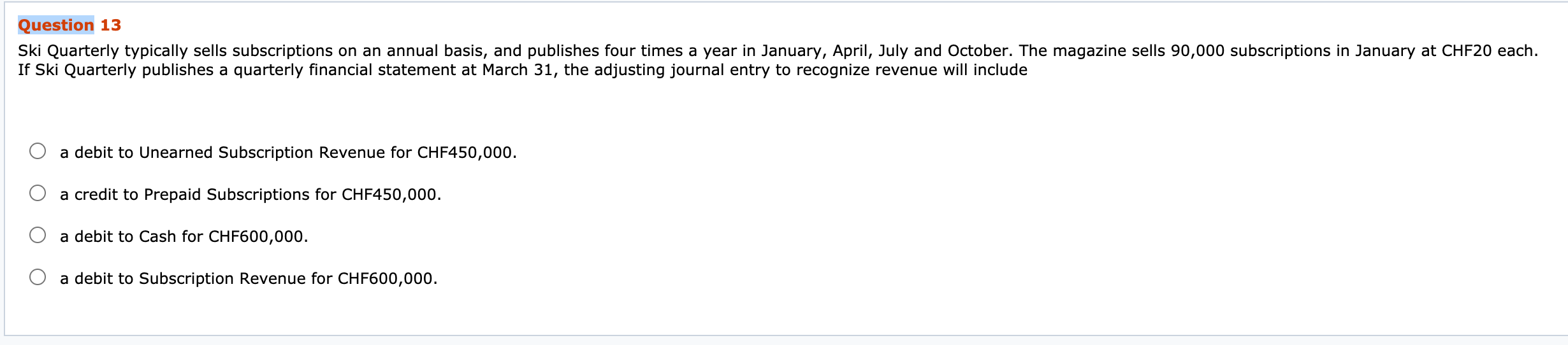

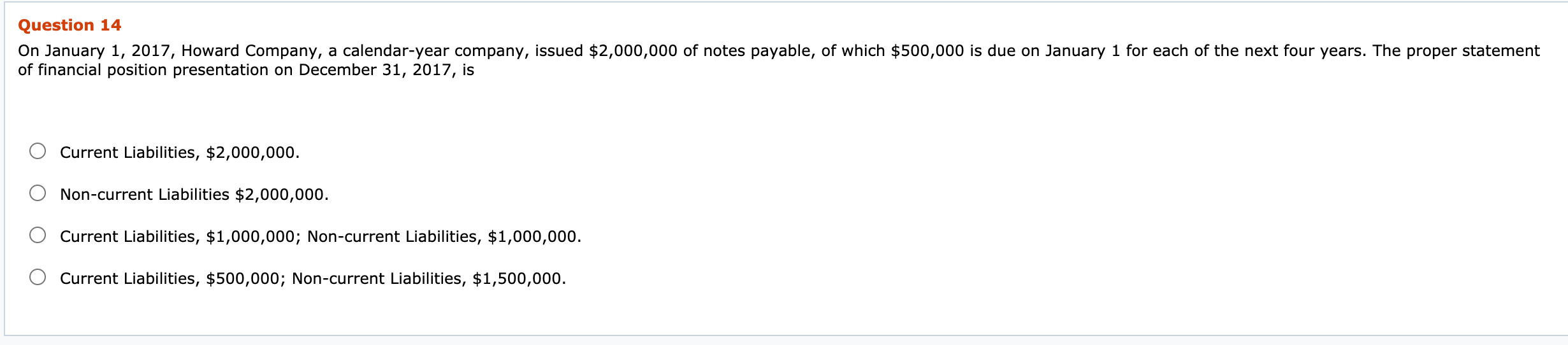

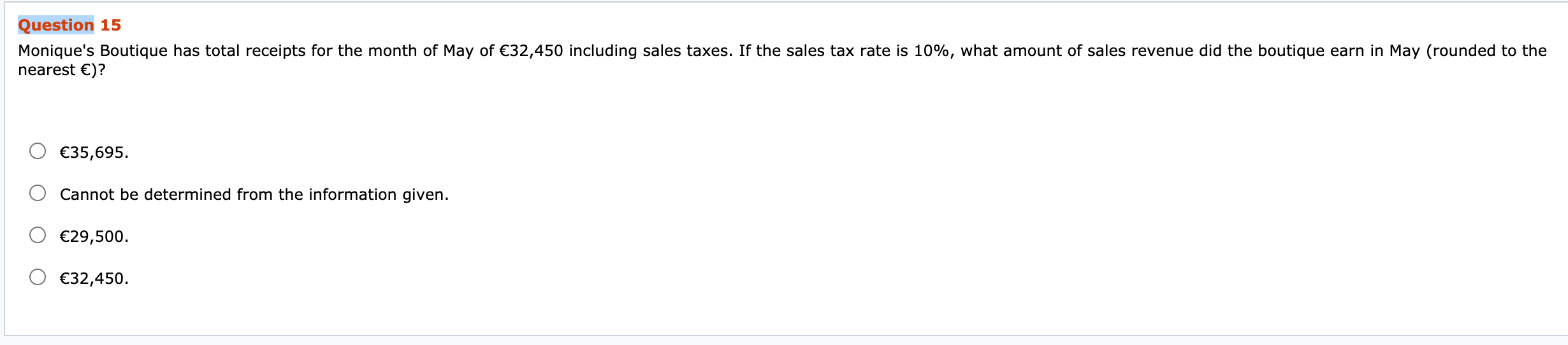

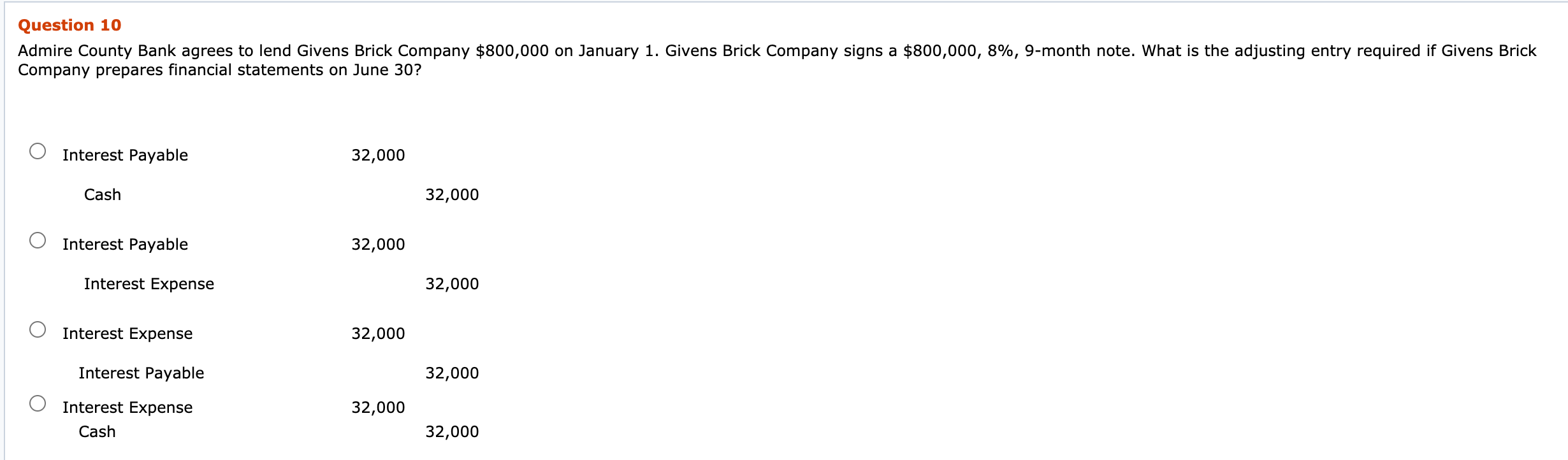

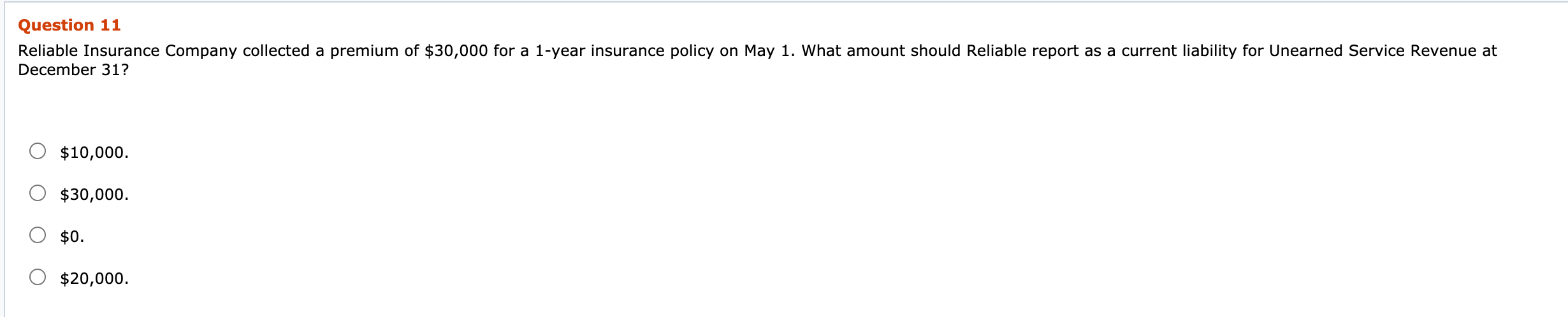

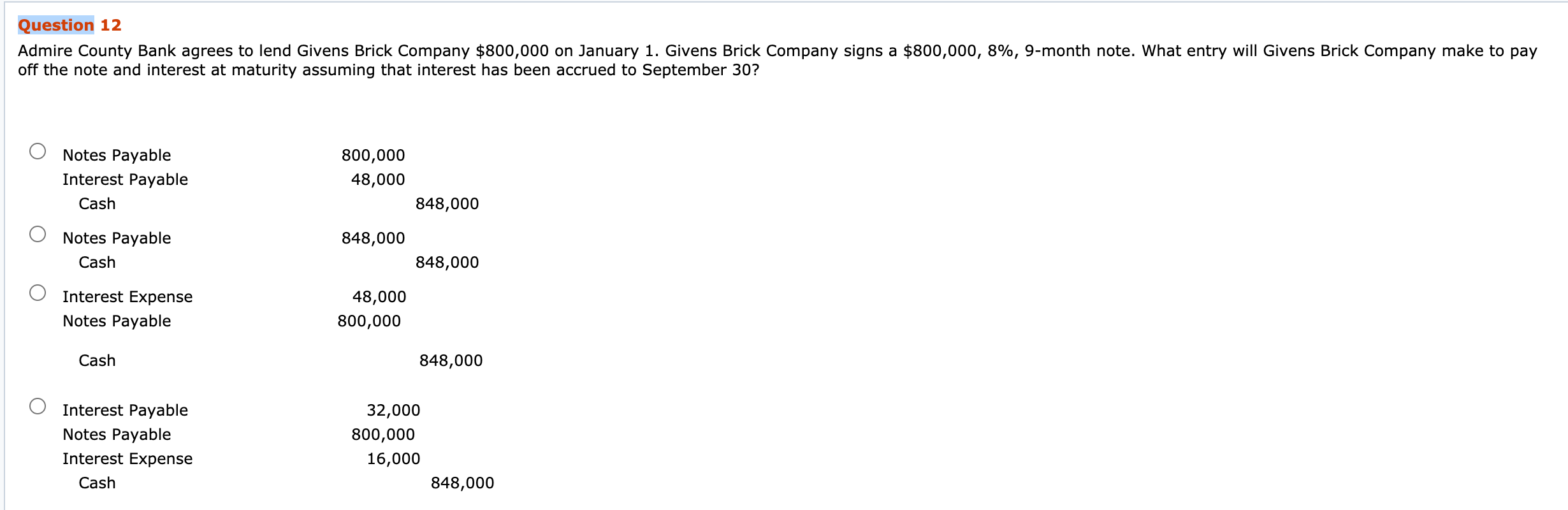

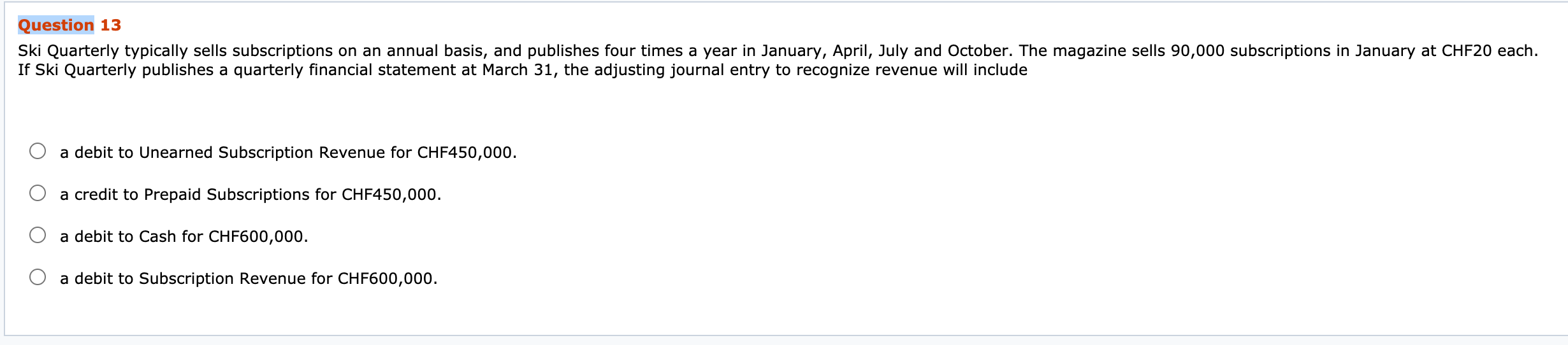

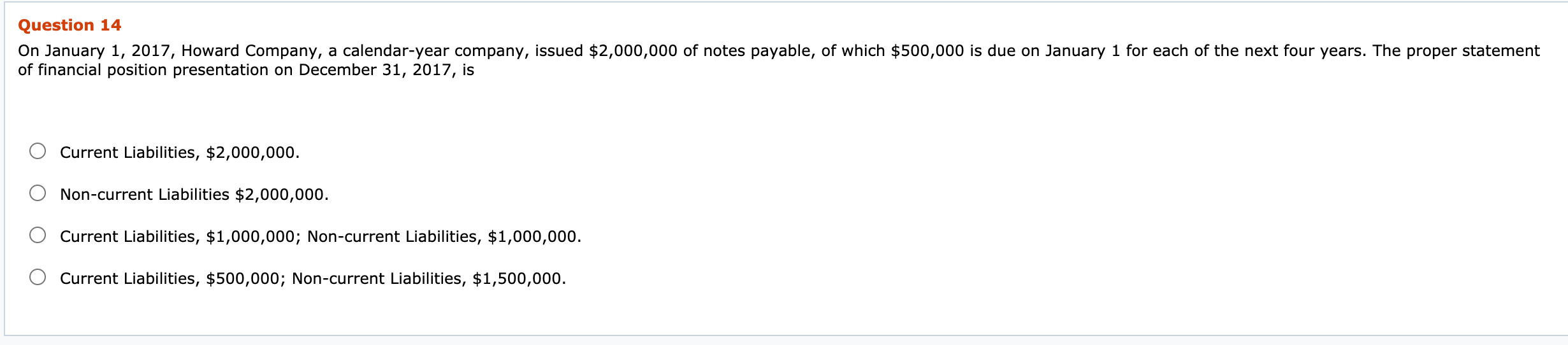

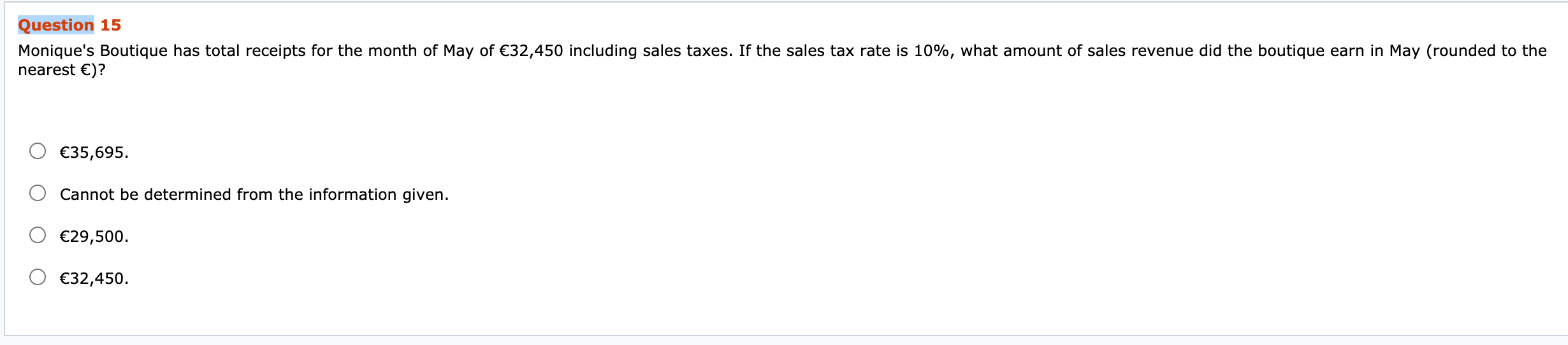

Question 10 Admire County Bank agrees to lend Givens Brick Company $800,000 on January 1. Givens Brick Company signs a $800,000, 8%, 9-month note. What is the adjusting entry required if Givens Brick Company prepares financial statements on June 30? Interest Payable 32,000 Cash 32,000 Interest Payable 32,000 Interest Expense 32,000 Interest Expense 32,000 Interest Payable 32,000 32,000 Interest Expense Cash 32,000 Question 11 Reliable Insurance Company collected a premium of $30,000 for a 1-year insurance policy on May 1. What amount should Reliable report as a current liability for Unearned Service Revenue at December 31? $10,000. $30,000. $0. $20,000. Question 12 Admire County Bank agrees to lend Givens Brick Company $800,000 on January 1. Givens Brick Company signs a $800,000, 8%, 9-month note. What entry will Givens Brick Company make to pay off the note and interest at maturity assuming that interest has been accrued to September 30? Notes Payable Interest Payable Cash 800,000 48,000 848,000 848,000 Notes Payable Cash 848,000 Interest Expense Notes Payable 48,000 800,000 Cash 848,000 Interest Payable Notes Payable Interest Expense Cash 32,000 800,000 16,000 848,000 Question 13 Ski Quarterly typically sells subscriptions on an annual basis, and publishes four times a year in January, April, July and October. The magazine sells 90,000 subscriptions in January at CHF20 each. If Ski Quarterly publishes a quarterly financial statement at March 31, the adjusting journal entry to recognize revenue will include a debit to Unearned Subscription Revenue for CHF450,000. a credit to Prepaid Subscriptions for CHF450,000. a debit to Cash for CHF600,000. a debit to Subscription Revenue for CHF600,000. Question 14 On January 1, 2017, Howard Company, a calendar-year company, issued $2,000,000 of notes payable, of which $500,000 is due on January 1 for each of the next four years. The proper statement of financial position presentation on December 31, 2017, is Current Liabilities, $2,000,000. Non-current Liabilities $2,000,000. Current Liabilities, $1,000,000; Non-current Liabilities, $1,000,000. Current Liabilities, $500,000; Non-current Liabilities, $1,500,000. Question 15 Monique's Boutique has total receipts for the month of May of 32,450 including sales taxes. If the sales tax rate is 10%, what amount of sales revenue did the boutique earn in May (rounded to the nearest )? 35,695. Cannot be determined from the information given. 29,500. 32,450