Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As the CEO of a western wear manufacturing company called Over Y'alls. Your marketing department has come up with two potential work boots which

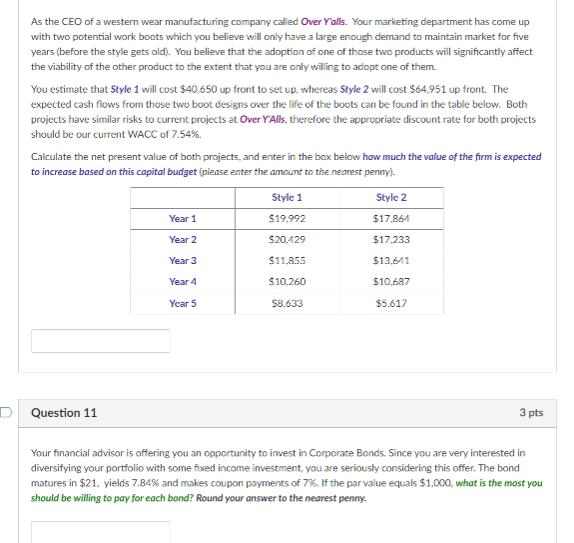

As the CEO of a western wear manufacturing company called Over Y'alls. Your marketing department has come up with two potential work boots which you believe will only have a large enough demand to maintain market for five years (before the style gets old). You believe that the adoption of one of those two products will significantly affect the viability of the other product to the extent that you are only willing to adopt one of them. You estimate that Style 1 will cost $40.650 up front to set up, whereas Style 2 will cost $64.951 up front. The expected cash flows from those two boot designs over the life of the boots can be found in the table below. Both projects have similar risks to current projects at Over Y'Alls, therefore the appropriate discount rate for both projects should be our current WACC of 7.54%. Calculate the net present value of both projects, and enter in the box below how much the value of the firm is expected to increase based on this capital budget (please enter the amount to the nearest penny). D Question 11 Year 1 Year 2 Year 3 Year 4 Year 5 Style 1 $19.992 $20.429 $11.855 $10.260 $8.633 Style 2 $17,864 $17,233 $13,641 $10.687 $5.617 3 pts Your financial advisor is offering you an opportunity to invest in Corporate Bonds. Since you are very interested in diversifying your portfolio with some fixed income investment, you are seriously considering this offer. The bond matures in $21, yields 7.84% and makes coupon payments of 7%. If the par value equals $1,000, what is the most you should be willing to pay for each bond? Round your answer to the nearest penny.

Step by Step Solution

★★★★★

3.55 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Style 1 NPV 40550 1999210754 20429107542 11855107543 10260107544 8633107545 5184...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started