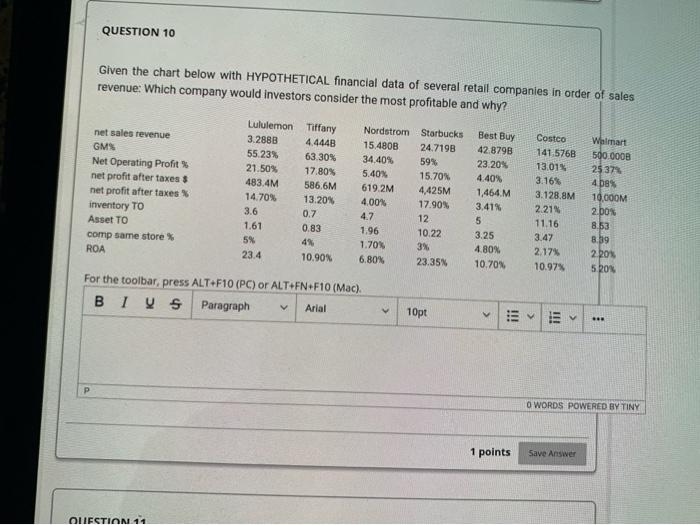

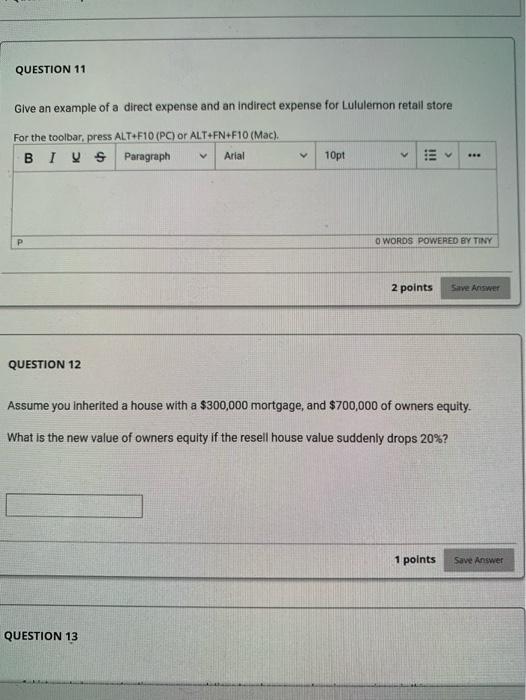

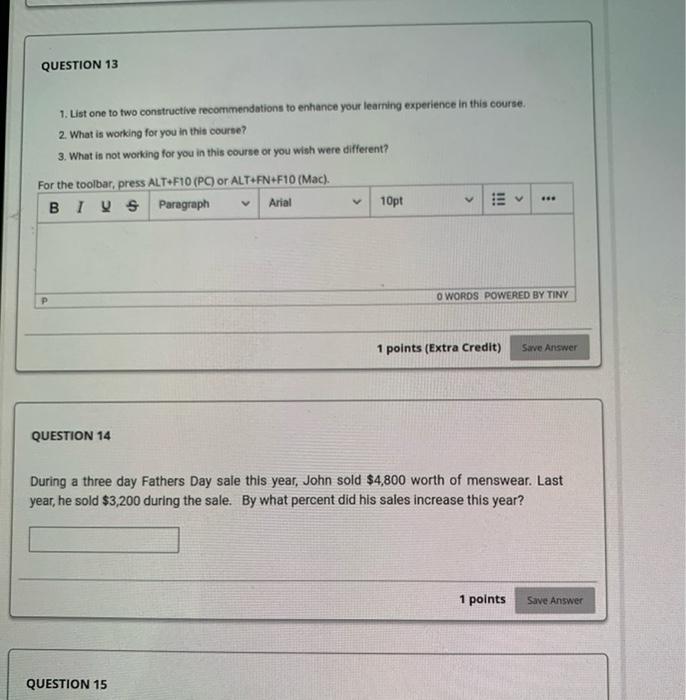

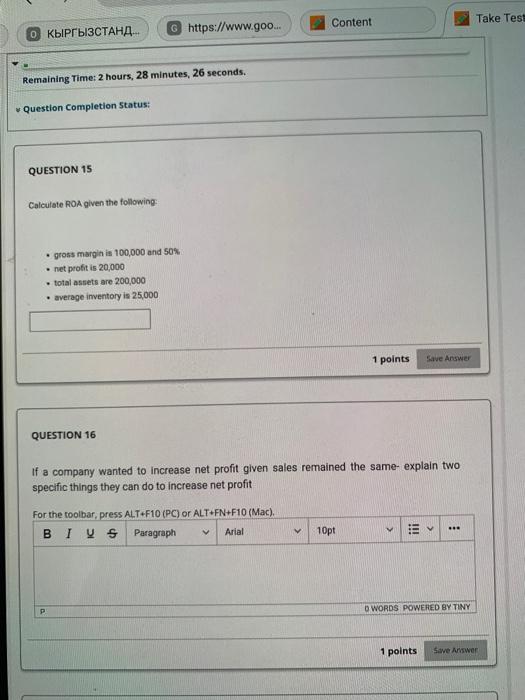

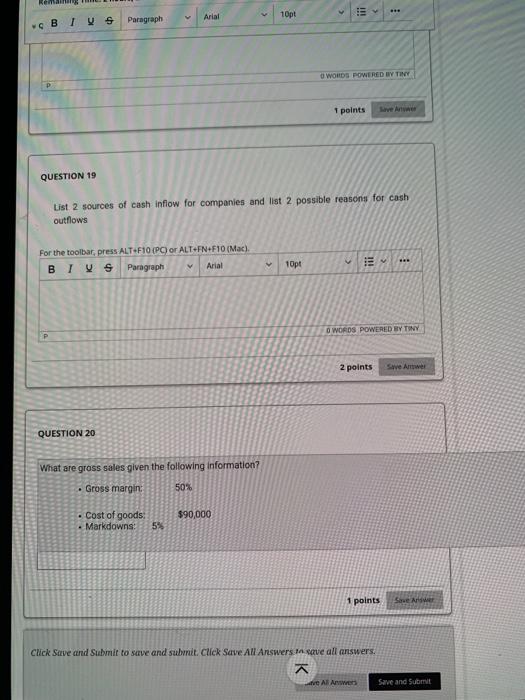

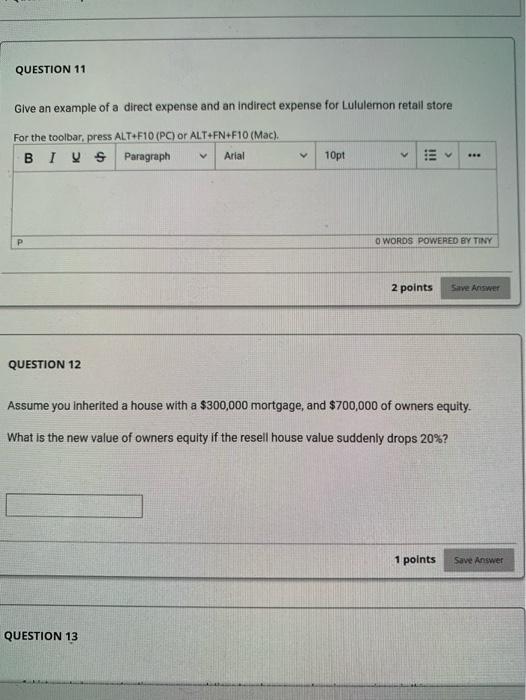

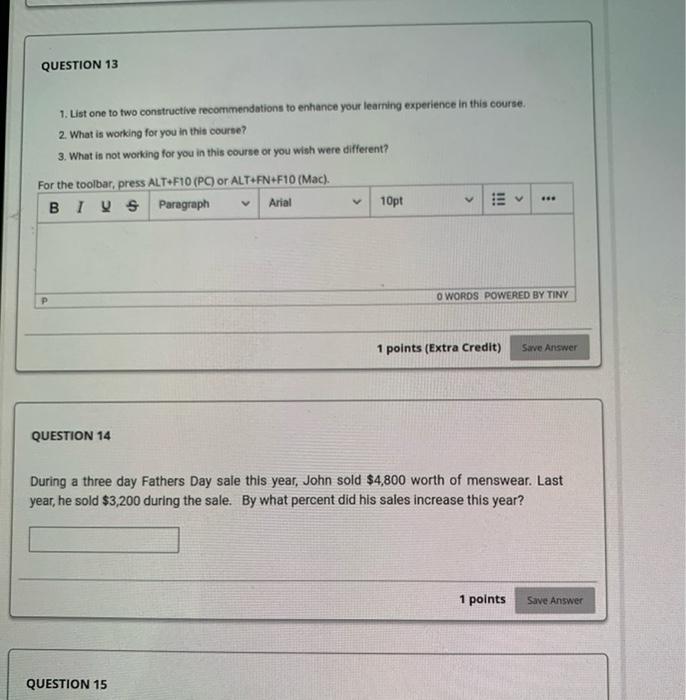

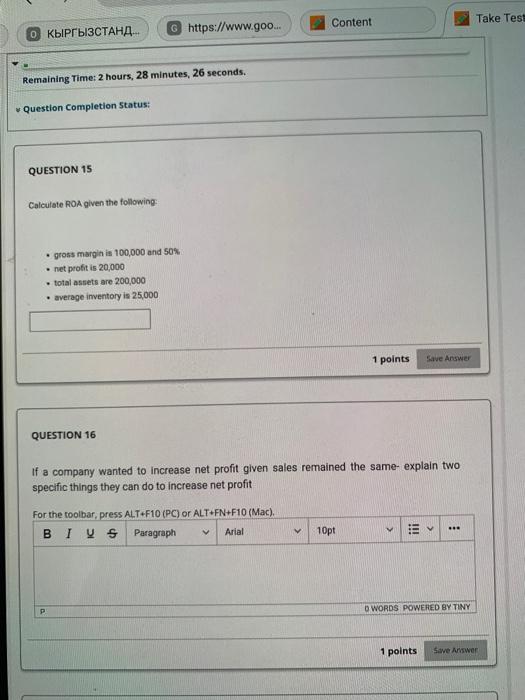

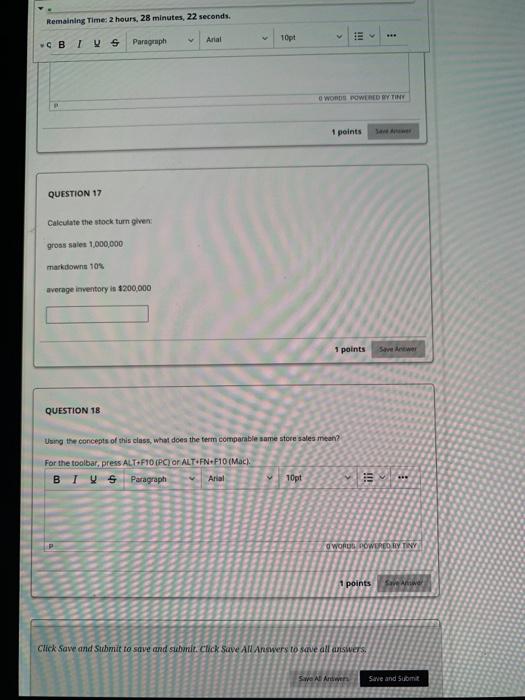

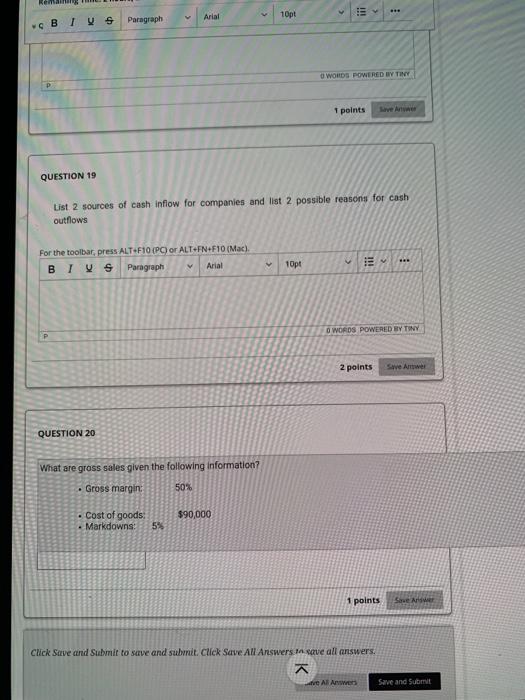

QUESTION 10 Given the chart below with HYPOTHETICAL financial data of several retail companies in order of sales revenue: Which company would investors consider the most profitable and why? net sales revenue GM Net Operating Profit net profit after taxes $ net profit after taxes inventory TO Asset TO comp same store % ROA Lululemon Tiffany 3.2888 4.4448 55.23% 63 30% 21.50% 17.80% 483.4M 586.6M 14.70% 13.20 3.6 0.7 1.61 0.83 5% 4% 23.4 10.90 Nordstrom Starbucks 15.480B 24.719B 34.40% 59% 5.40% 15.70% 619.2M 4,425M 4.00% 17.90% 4.7 12 1.96 10.22 1.70% 6.80 23.35 Best Buy 42.8798 23 20% 4.40% 1.464.M 3.41% 5 3.25 4.80% 10,70 Costco 141.5768 13.01% 3.16% 3.128.8M 2.21 11.16 3.47 2.17% 10.97% Walmart 500.0008 2$ 37% 4 b 10.000M 2.box 8.53 8.39 220$ 5 20 3% For the toolbar, press ALT+F10 (PC) or ALT+FN.F10 (Mac). B 1 y s Paragraph Arial V 10pt !!! M O WORDS POWERED BY TINY 1 points Save Answer QUESTION 11 QUESTION 11 Give an example of a direct expense and an indirect expense for Lululemon retail store For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI VS Paragraph Arial 10pt ! v - P O WORDS POWERED BY TINY 2 points Save Answer QUESTION 12 Assume you inherited a house with a $300,000 mortgage, and $700,000 of owners equity. What is the new value owners equity if the resell alue suddenly drops 20%? 1 points Save Answer QUESTION 13 QUESTION 13 1. List one to two constructive recommendations to enhance your learning experience in this course. 2. What is working for you in this course? 3. What is not working for you in this course or you wish were different? For the toolbar, press ALT F10 (PC) or ALT+FN+F10 (Mac). BI US Paragraph Arial 10pt O WORDS POWERED BY TINY P 1 points (Extra Credit) Save Answer QUESTION 14 During a three day Fathers Day sale this year, John sold $4,800 worth of menswear. Last year, he sold $3,200 during the sale. By what percent did his sales increase this year? 1 points Save Answer QUESTION 15 Content Take Test o ... https://www.goo... Remaining Time: 2 hours, 28 minutes, 26 seconds. Question Completion Status: QUESTION 15 Calculate ROA given the following: gross margin is 100,000 and 50% net profit is 20,000 total assets are 200,000 average inventory is 25,000 1 points Save Answer QUESTION 16 If a company wanted to increase net profit given sales remained the same explain two specific things they can do to increase net profit For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI VS Paragraph 10pt Arial . V !!!! O WORDS POWERED BY TINY 2 points QUESTION 20 What are gross sales given the following information? Gross margin: 50% $90,000 Cost of goods Markdowns 5% 1 points Save Answer Click Save and Submit to save and submit. Click Save All Answers to save all answers, ve ARAW Save and Submit QUESTION 10 Given the chart below with HYPOTHETICAL financial data of several retail companies in order of sales revenue: Which company would investors consider the most profitable and why? net sales revenue GM Net Operating Profit net profit after taxes $ net profit after taxes inventory TO Asset TO comp same store % ROA Lululemon Tiffany 3.2888 4.4448 55.23% 63 30% 21.50% 17.80% 483.4M 586.6M 14.70% 13.20 3.6 0.7 1.61 0.83 5% 4% 23.4 10.90 Nordstrom Starbucks 15.480B 24.719B 34.40% 59% 5.40% 15.70% 619.2M 4,425M 4.00% 17.90% 4.7 12 1.96 10.22 1.70% 6.80 23.35 Best Buy 42.8798 23 20% 4.40% 1.464.M 3.41% 5 3.25 4.80% 10,70 Costco 141.5768 13.01% 3.16% 3.128.8M 2.21 11.16 3.47 2.17% 10.97% Walmart 500.0008 2$ 37% 4 b 10.000M 2.box 8.53 8.39 220$ 5 20 3% For the toolbar, press ALT+F10 (PC) or ALT+FN.F10 (Mac). B 1 y s Paragraph Arial V 10pt !!! M O WORDS POWERED BY TINY 1 points Save Answer QUESTION 11 QUESTION 11 Give an example of a direct expense and an indirect expense for Lululemon retail store For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI VS Paragraph Arial 10pt ! v - P O WORDS POWERED BY TINY 2 points Save Answer QUESTION 12 Assume you inherited a house with a $300,000 mortgage, and $700,000 of owners equity. What is the new value owners equity if the resell alue suddenly drops 20%? 1 points Save Answer QUESTION 13 QUESTION 13 1. List one to two constructive recommendations to enhance your learning experience in this course. 2. What is working for you in this course? 3. What is not working for you in this course or you wish were different? For the toolbar, press ALT F10 (PC) or ALT+FN+F10 (Mac). BI US Paragraph Arial 10pt O WORDS POWERED BY TINY P 1 points (Extra Credit) Save Answer QUESTION 14 During a three day Fathers Day sale this year, John sold $4,800 worth of menswear. Last year, he sold $3,200 during the sale. By what percent did his sales increase this year? 1 points Save Answer QUESTION 15 Content Take Test o ... https://www.goo... Remaining Time: 2 hours, 28 minutes, 26 seconds. Question Completion Status: QUESTION 15 Calculate ROA given the following: gross margin is 100,000 and 50% net profit is 20,000 total assets are 200,000 average inventory is 25,000 1 points Save Answer QUESTION 16 If a company wanted to increase net profit given sales remained the same explain two specific things they can do to increase net profit For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). BI VS Paragraph 10pt Arial . V !!!! O WORDS POWERED BY TINY 2 points QUESTION 20 What are gross sales given the following information? Gross margin: 50% $90,000 Cost of goods Markdowns 5% 1 points Save Answer Click Save and Submit to save and submit. Click Save All Answers to save all answers, ve ARAW Save and Submit