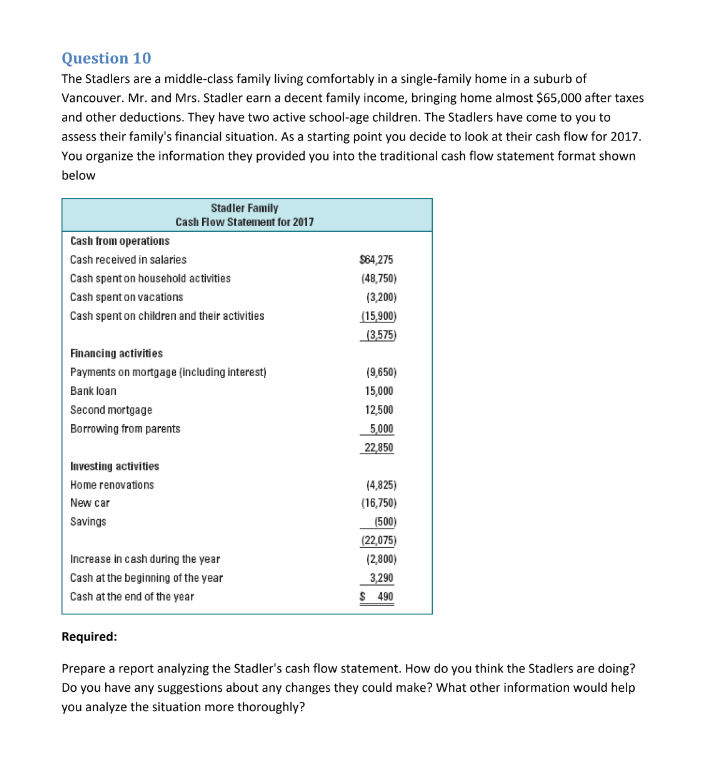

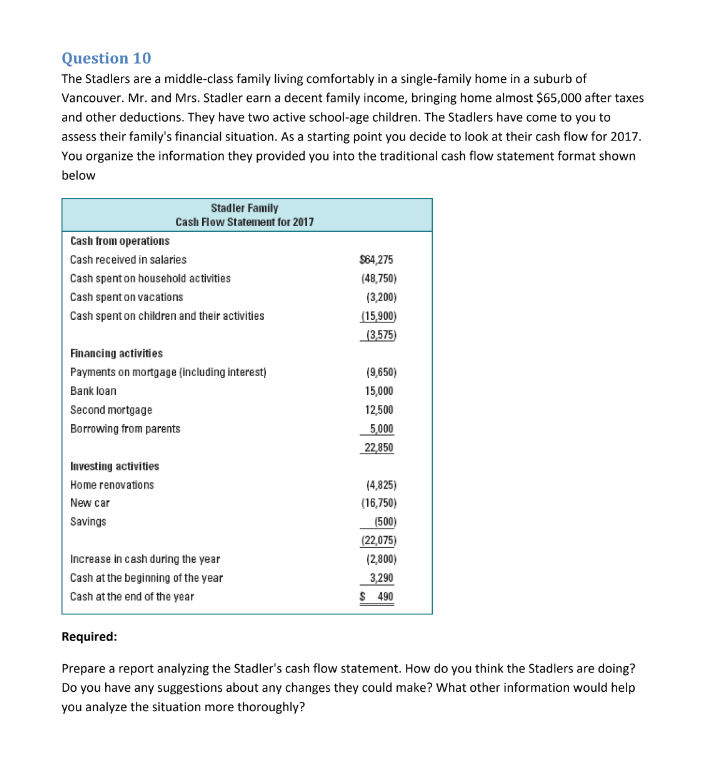

Question 10 The Stadlers are a middle-class family living comfortably in a single-family home in a suburb of Vancouver. Mr. and Mrs. Stadler earn a decent family income, bringing home almost $65,000 after taxes and other deductions. They have two active school-age children. The Stadlers have come to you to assess their family's financial situation. As a starting point you decide to look at their cash flow for 2017. You organize the information they provided you into the traditional cash flow statement format shown below Stadler Family Cash Flow Statement for 2017 Cash from operations Cash received in salaries Cash spent on household activities Cash spent on vacations Cash spent on children and their activities S64,275 (48,750) (3,200) (15,900) (3,575) Financing activities Payments on mortgage (including interest) Bank loan Second mortgage Borrowing from parents (9,650) 15,000 12,500 5,000 22,850 Investing activities Home renovations New car Savings (4,825) (16,750) (500) (22,075) (2,800) 3,290 $ 490 Increase in cash during the year Cash at the beginning of the year Cash at the end of the year Required: Prepare a report analyzing the Stadler's cash flow statement. How do you think the Stadlers are doing? Do you have any suggestions about any changes they could make? What other information would help you analyze the situation more thoroughly? Question 10 The Stadlers are a middle-class family living comfortably in a single-family home in a suburb of Vancouver. Mr. and Mrs. Stadler earn a decent family income, bringing home almost $65,000 after taxes and other deductions. They have two active school-age children. The Stadlers have come to you to assess their family's financial situation. As a starting point you decide to look at their cash flow for 2017. You organize the information they provided you into the traditional cash flow statement format shown below Stadler Family Cash Flow Statement for 2017 Cash from operations Cash received in salaries Cash spent on household activities Cash spent on vacations Cash spent on children and their activities S64,275 (48,750) (3,200) (15,900) (3,575) Financing activities Payments on mortgage (including interest) Bank loan Second mortgage Borrowing from parents (9,650) 15,000 12,500 5,000 22,850 Investing activities Home renovations New car Savings (4,825) (16,750) (500) (22,075) (2,800) 3,290 $ 490 Increase in cash during the year Cash at the beginning of the year Cash at the end of the year Required: Prepare a report analyzing the Stadler's cash flow statement. How do you think the Stadlers are doing? Do you have any suggestions about any changes they could make? What other information would help you analyze the situation more thoroughly