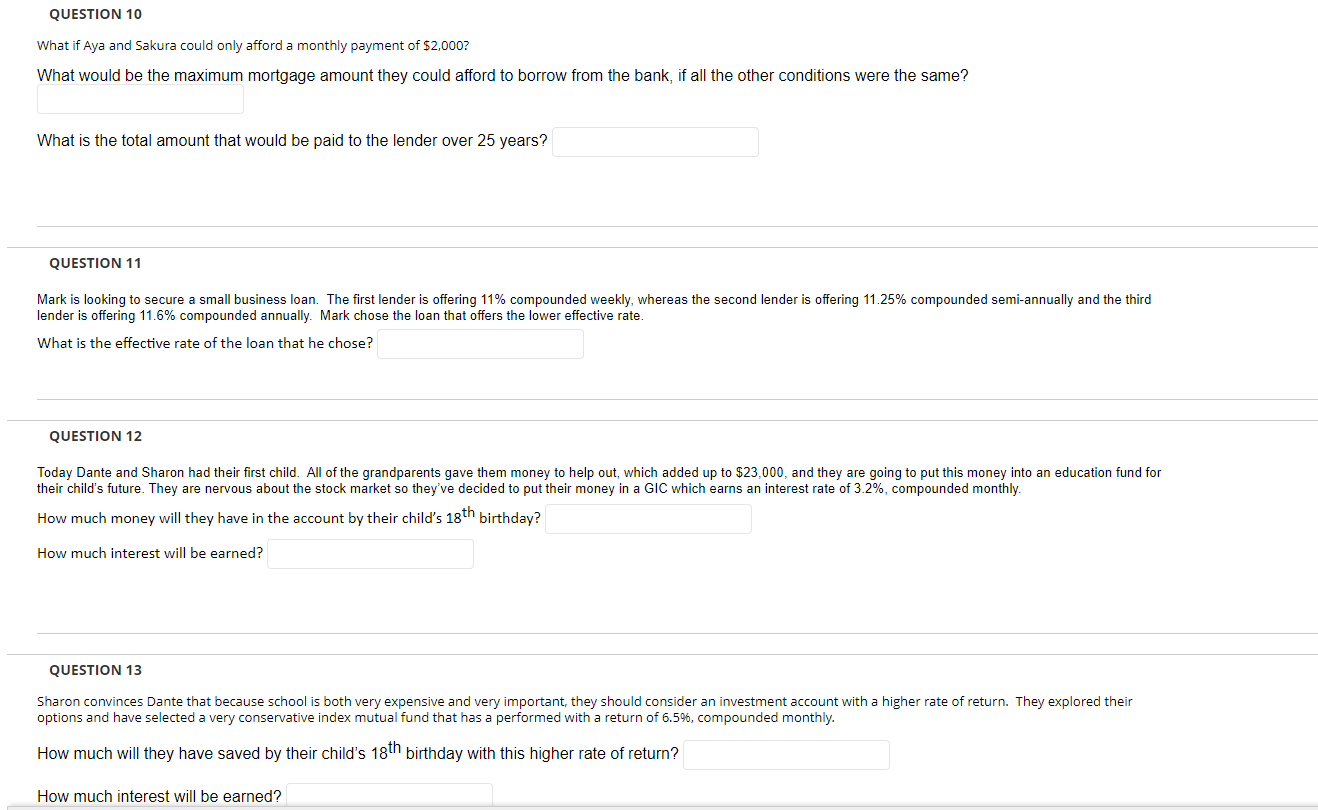

QUESTION 10 What if Aya and Sakura could only afford a monthly payment of $2,000 ? What would be the maximum mortgage amount they could afford to borrow from the bank, if all the other conditions were the same? What is the total amount that would be paid to the lender over 25 years? QUESTION 11 Mark is looking to secure a small business loan. The first lender is offering 11% compounded weekly, whereas the second lender is offering 11.25% compounded semi-annually and the third lender is offering 11.6% compounded annually. Mark chose the loan that offers the lower effective rate. What is the effective rate of the loan that he chose? QUESTION 12 Today Dante and Sharon had their first child. All of the grandparents gave them money to help out, which added up to $23,000, and they are going to put this money into an education fund for their child's future. They are nervous about the stock market so they've decided to put their money in a GIC which earns an interest rate of 3.2%, compounded monthly. How much money will they have in the account by their child's 18th birthday? How much interest will be earned? QUESTION 13 Sharon convinces Dante that because school is both very expensive and very important, they should consider an investment account with a higher rate of return. They explored their options and have selected a very conservative index mutual fund that has a performed with a return of 6.5%, compounded monthly. How much will they have saved by their child's 18th birthday with this higher rate of return? How much interest will be earned? QUESTION 10 What if Aya and Sakura could only afford a monthly payment of $2,000 ? What would be the maximum mortgage amount they could afford to borrow from the bank, if all the other conditions were the same? What is the total amount that would be paid to the lender over 25 years? QUESTION 11 Mark is looking to secure a small business loan. The first lender is offering 11% compounded weekly, whereas the second lender is offering 11.25% compounded semi-annually and the third lender is offering 11.6% compounded annually. Mark chose the loan that offers the lower effective rate. What is the effective rate of the loan that he chose? QUESTION 12 Today Dante and Sharon had their first child. All of the grandparents gave them money to help out, which added up to $23,000, and they are going to put this money into an education fund for their child's future. They are nervous about the stock market so they've decided to put their money in a GIC which earns an interest rate of 3.2%, compounded monthly. How much money will they have in the account by their child's 18th birthday? How much interest will be earned? QUESTION 13 Sharon convinces Dante that because school is both very expensive and very important, they should consider an investment account with a higher rate of return. They explored their options and have selected a very conservative index mutual fund that has a performed with a return of 6.5%, compounded monthly. How much will they have saved by their child's 18th birthday with this higher rate of return? How much interest will be earned