Answered step by step

Verified Expert Solution

Question

1 Approved Answer

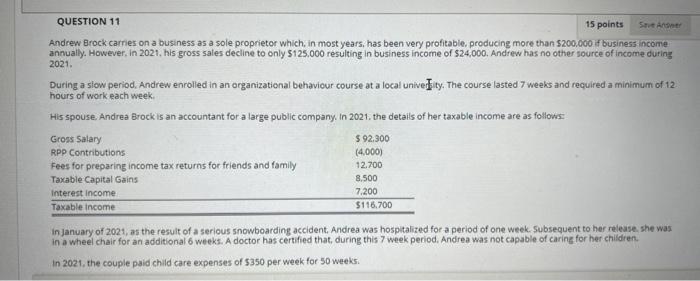

QUESTION 11 15 points Save Answer Andrew Brock carries on a business as a sole proprietor which, in most years, has been very profitable,

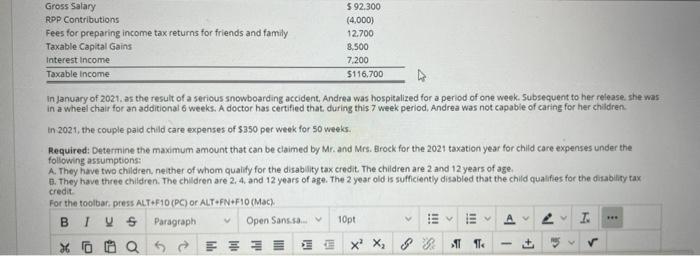

QUESTION 11 15 points Save Answer Andrew Brock carries on a business as a sole proprietor which, in most years, has been very profitable, producing more than $200,000 if business income annually. However, in 2021, his gross sales decline to only $125.000 resulting in business income of $24,000. Andrew has no other source of income during 2021. During a slow period. Andrew enrolled in an organizational behaviour course at a local univerity. The course lasted 7 weeks and required a minimum of 12 hours of work each week. His spouse, Andrea Brock is an accountant for a large public company. In 2021. the details of her taxable income are as follows: Gross Salary RPP Contributions Fees for preparing income tax returns for friends and family Taxable Capital Gains Interest income Taxable income $92.300 (4,000) 12.700 8.500 7,200 $116.700 In January of 2021, as the result of a serious snowboarding accident. Andrea was hospitalized for a period of one week. Subsequent to her release, she was in a wheel chair for an additional 6 weeks. A doctor has certified that, during this 7 week period. Andrea was not capable of caring for her children. In 2021, the couple paid child care expenses of $350 per week for 50 weeks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started