Answered step by step

Verified Expert Solution

Question

1 Approved Answer

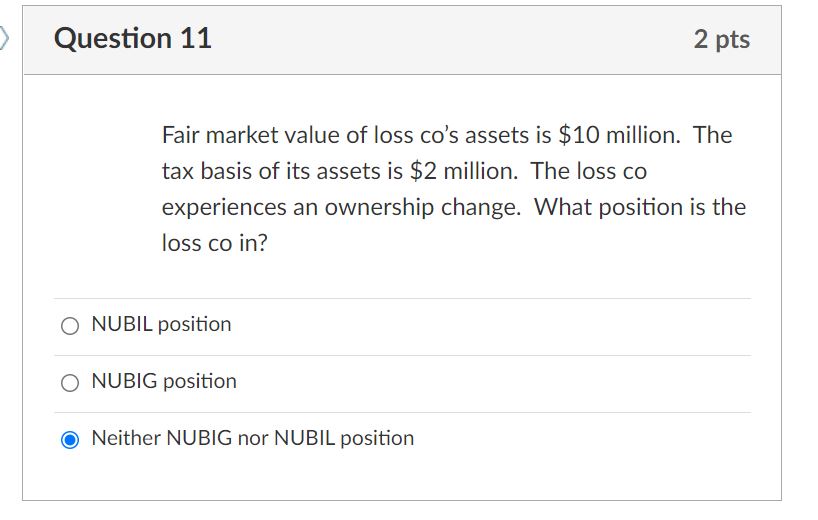

Question 11 2 pts Fair market value of loss co's assets is $10 million. The tax basis of its assets is $2 million. The

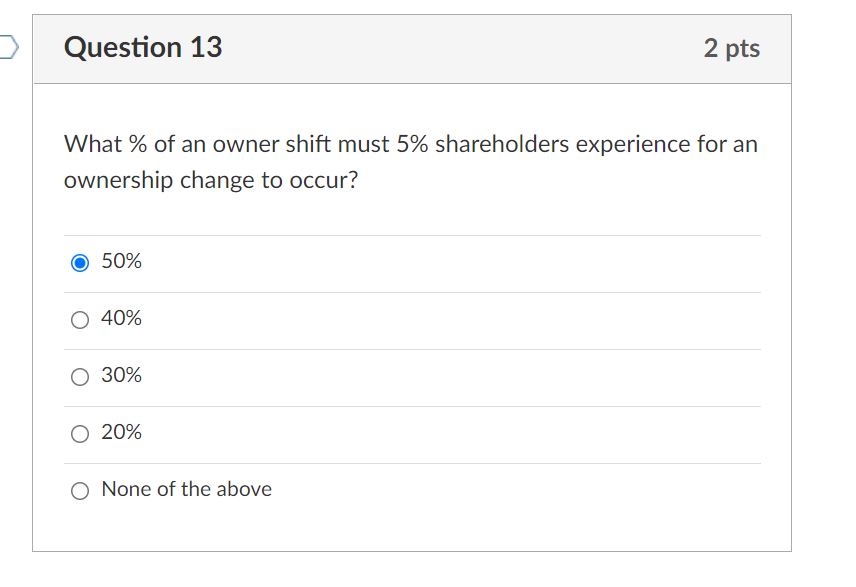

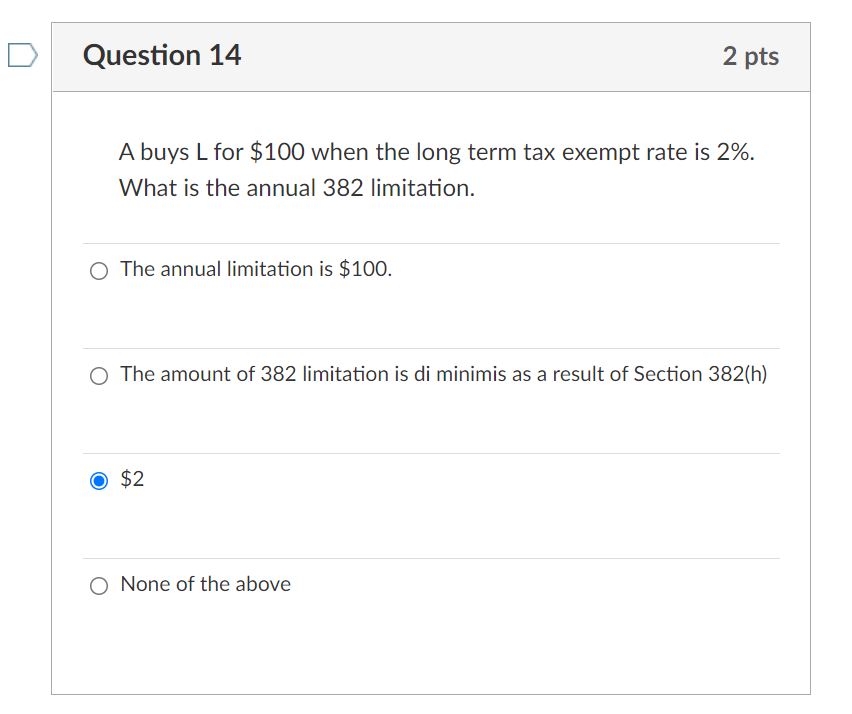

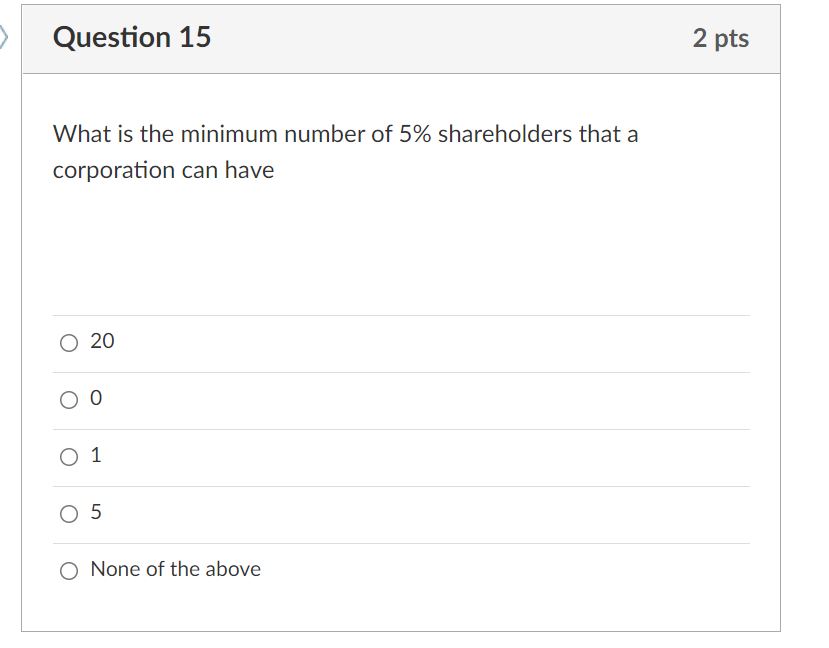

Question 11 2 pts Fair market value of loss co's assets is $10 million. The tax basis of its assets is $2 million. The loss co experiences an ownership change. What position is the loss co in? O NUBIL position O NUBIG position ONeither NUBIG nor NUBIL position Question 13 What % of an owner shift must 5% shareholders experience for an ownership change to occur? 50% 40% 30% 20% 2 pts None of the above Question 14 A buys L for $100 when the long term tax exempt rate is 2%. What is the annual 382 limitation. O The annual limitation is $100. 2 pts O The amount of 382 limitation is di minimis as a result of Section 382(h) $2 O None of the above Question 15 What is the minimum number of 5% shareholders that a corporation can have 20 00 O 1 05 O None of the above 2 pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Answers to Your Tax Law Questions Quest...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started