Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 11 (25 points) 3 Mr. Desmond Morris has spent his entire working life with his current employer, the Alcorn Manufacturing Company. In his first

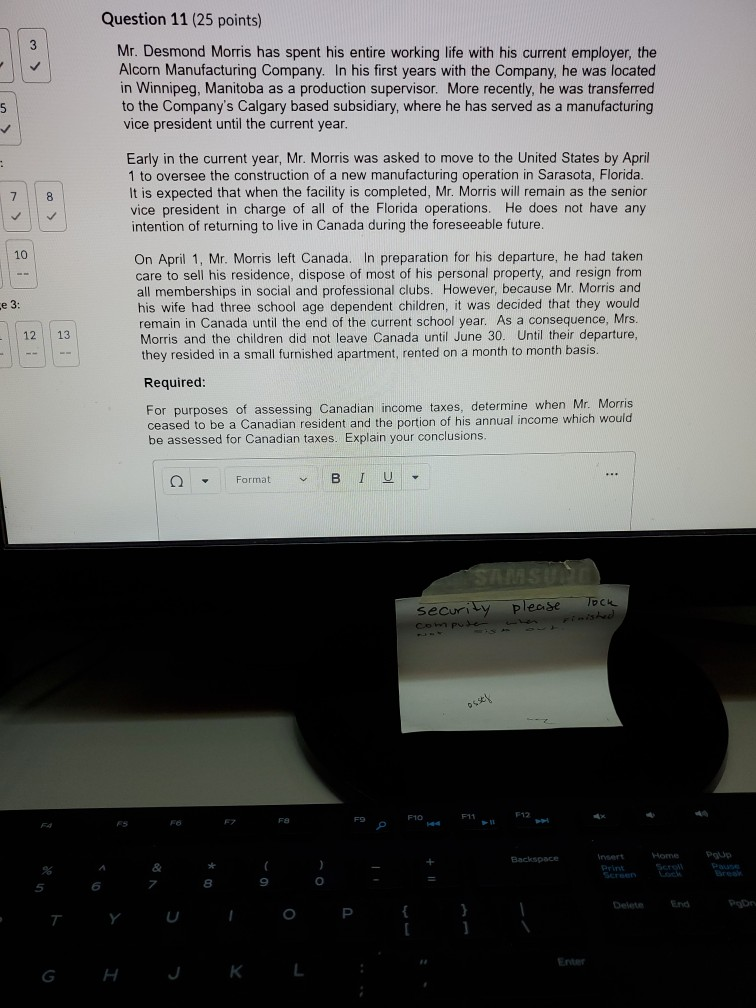

Question 11 (25 points) 3 Mr. Desmond Morris has spent his entire working life with his current employer, the Alcorn Manufacturing Company. In his first years with the Company, he was located in Winnipeg, Manitoba as a production supervisor. More recently, he was transferred to the Company's Calgary based subsidiary, where he has served as a manufacturing vice president until the current year. 5 7 8 Early in the current year, Mr. Morris was asked to move to the United States by April 1 to oversee the construction of a new manufacturing operation in Sarasota, Florida. It is expected that when the facility is completed, Mr. Morris will remain as the senior vice president in charge of all of the Florida operations. He does not have any intention of returning to live in Canada during the foreseeable future. 10 e 3: 12 13 On April 1, Mr. Morris left Canada. In preparation for his departure, he had taken care to sell his residence, dispose of most of his personal property, and resign from all memberships in social and professional clubs. However, because Mr. Morris and his wife had three school age dependent children, it was decided that they would remain in Canada until the end of the current school year. As a consequence, Mrs. Morris and the children did not leave Canada until June 30. Until their departure, they resided in a small furnished apartment, rented on a month to month basis. Required: For purposes of assessing Canadian income taxes, determine when Mr. Morris ceased to be a Canadian resident and the portion of his annual income which would be assessed for Canadian taxes. Explain your conclusions. 1 + Format BI U - SATASUNA security please Tock compuse when Finished F8 F9 F10 F11 F12 Backspace Home Pop ( Print Seraan 8 o Delete PoDn T Enter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started