Answered step by step

Verified Expert Solution

Question

1 Approved Answer

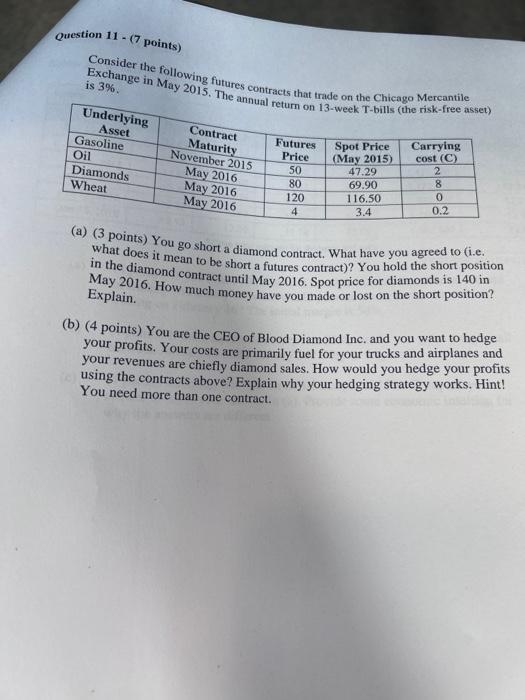

Question 11 - (7 points) Consider the following futures contracts that trade on the Chicago Mercantile Exchange in May 2015. The annual return on 13-week

Question 11 - (7 points) Consider the following futures contracts that trade on the Chicago Mercantile Exchange in May 2015. The annual return on 13-week T-bills (the risk-free asset) is 3%. Underlying Asset Gasoline Oil Diamonds Wheat Contract Maturity November 2015 May 2016 May 2016 May 2016 Futures Price 50 80 120 4 Spot Price (May 2015) 47.29 69.90 116.50 3.4 Carrying cost (C) 2 8 0 0.2 (a) (3 points) You go short a diamond contract. What have you agreed to (i.e. what does it mean to be short a futures contract)? You hold the short position in the diamond contract until May 2016. Spot price for diamonds is 140 in May 2016. How much money have you made or lost on the short position? Explain. (b) (4 points) You are the CEO of Blood Diamond Inc. and you want to hedge your profits. Your costs are primarily fuel for your trucks and airplanes and your revenues are chiefly diamond sales. How would you hedge your profits using the contracts above? Explain why your hedging strategy works. Hint! You need more than one contract.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started