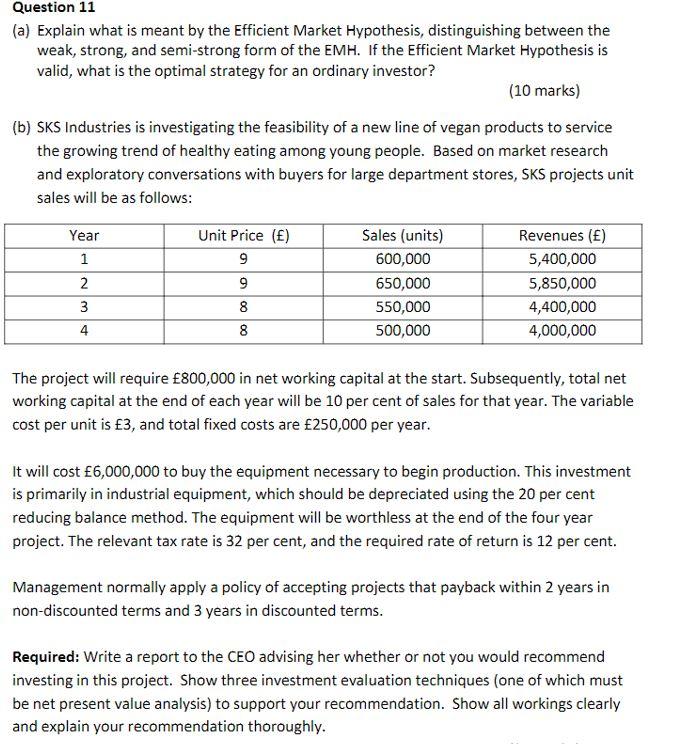

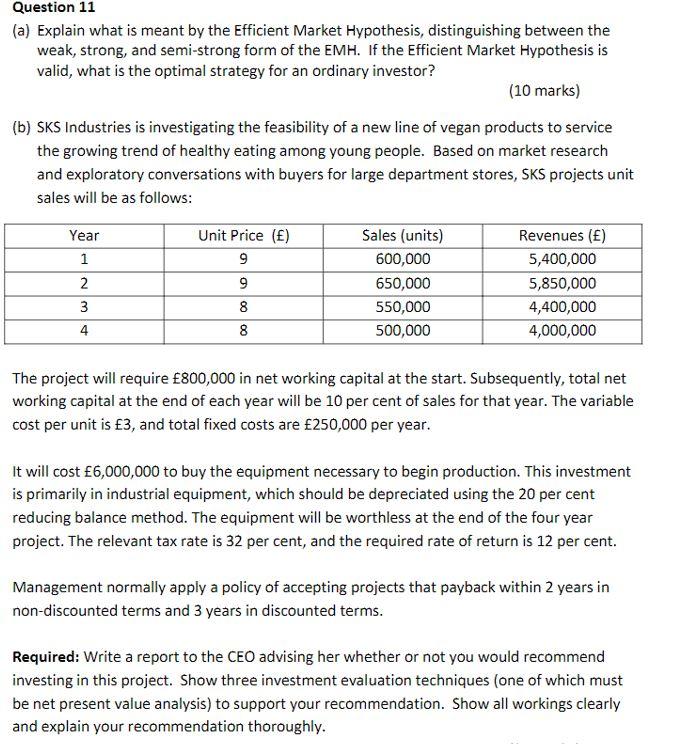

Question 11 (a) Explain what is meant by the Efficient Market Hypothesis, distinguishing between the weak, strong, and semi-strong form of the EMH. If the Efficient Market Hypothesis is valid, what is the optimal strategy for an ordinary investor? (10 marks) (b) SKS Industries is investigating the feasibility of a new line of vegan products to service the growing trend of healthy eating among young people. Based on market research and exploratory conversations with buyers for large department stores, SKS projects unit sales will be as follows: The project will require 800,000 in net working capital at the start. Subsequently, total net working capital at the end of each year will be 10 per cent of sales for that year. The variable cost per unit is 3, and total fixed costs are 250,000 per year. It will cost 6,000,000 to buy the equipment necessary to begin production. This investment is primarily in industrial equipment, which should be depreciated using the 20 per cent reducing balance method. The equipment will be worthless at the end of the four year project. The relevant tax rate is 32 per cent, and the required rate of return is 12 per cent. Management normally apply a policy of accepting projects that payback within 2 years in non-discounted terms and 3 years in discounted terms. Required; Write a report to the CEO advising her whether or not you would recommend investing in this project. Show three investment evaluation techniques (one of which must be net present value analysis) to support your recommendation. Show all workings clearly and explain your recommendation thoroughly. Question 11 (a) Explain what is meant by the Efficient Market Hypothesis, distinguishing between the weak, strong, and semi-strong form of the EMH. If the Efficient Market Hypothesis is valid, what is the optimal strategy for an ordinary investor? (10 marks) (b) SKS Industries is investigating the feasibility of a new line of vegan products to service the growing trend of healthy eating among young people. Based on market research and exploratory conversations with buyers for large department stores, SKS projects unit sales will be as follows: The project will require 800,000 in net working capital at the start. Subsequently, total net working capital at the end of each year will be 10 per cent of sales for that year. The variable cost per unit is 3, and total fixed costs are 250,000 per year. It will cost 6,000,000 to buy the equipment necessary to begin production. This investment is primarily in industrial equipment, which should be depreciated using the 20 per cent reducing balance method. The equipment will be worthless at the end of the four year project. The relevant tax rate is 32 per cent, and the required rate of return is 12 per cent. Management normally apply a policy of accepting projects that payback within 2 years in non-discounted terms and 3 years in discounted terms. Required; Write a report to the CEO advising her whether or not you would recommend investing in this project. Show three investment evaluation techniques (one of which must be net present value analysis) to support your recommendation. Show all workings clearly and explain your recommendation thoroughly