Answered step by step

Verified Expert Solution

Question

1 Approved Answer

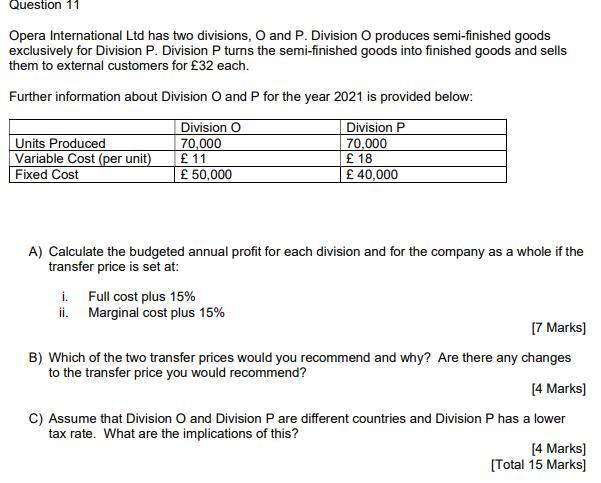

Question 11 Opera International Ltd has two divisions, O and P. Division O produces semi-finished goods exclusively for Division P. Division P turns the

Question 11 Opera International Ltd has two divisions, O and P. Division O produces semi-finished goods exclusively for Division P. Division P turns the semi-finished goods into finished goods and sells them to external customers for 32 each. Further information about Division O and P for the year 2021 is provided below: Division O Division P 70,000 70,000 11 18 50,000 40,000 Units Produced Variable Cost (per unit) Fixed Cost A) Calculate the budgeted annual profit for each division and for the company as a whole if the transfer price is set at: i. ii. Full cost plus 15% Marginal cost plus 15% [7 Marks] B) Which of the two transfer prices would you recommend and why? Are there any changes to the transfer price you would recommend? [4 Marks] C) Assume that Division O and Division P are different countries and Division P has a lower tax rate. What are the implications of this? [4 Marks] [Total 15 Marks]

Step by Step Solution

★★★★★

3.30 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A i Full cost plus 15 Div ision 0 70 000 units x 11 15 910 000 Div ision P 70 000 units x 18 15 1 53...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started