Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 11 please ... Question 10's a & b questions solved using Question 11's information (which answers Question 11) 10. A two-period firm borrows $100

Question 11 please ...

Question 10's a & b questions solved using Question 11's information (which answers Question 11)

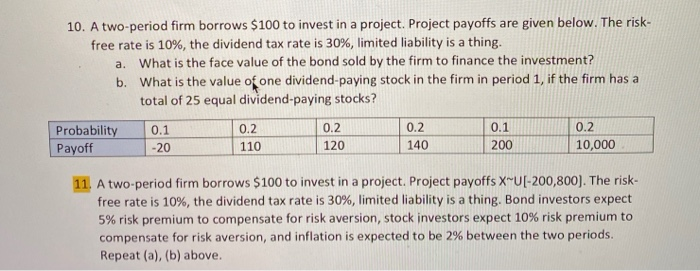

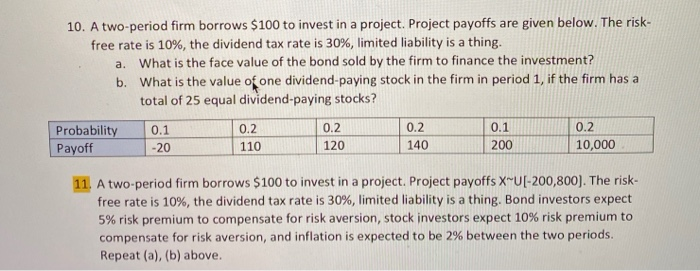

10. A two-period firm borrows $100 to invest in a project. Project payoffs are given below. The risk- free rate is 10%, the dividend tax rate is 30%, limited liability is a thing. a. What is the face value of the bond sold by the firm to finance the investment? b. What is the value of one dividend paying stock in the firm in period 1, if the firm has a total of 25 equal dividend-paying stocks? Probability 0.2 0.2 Payoff -20 110 WARNA 120 L AN 140 200 10,000 0.1 0.2 0.1 0.2 11. A two-period firm borrows $100 to invest in a project. Project payoffs X-U[-200,800). The risk- free rate is 10%, the dividend tax rate is 30%, limited liability is a thing. Bond investors expect 5% risk premium to compensate for risk aversion, stock investors expect 10% risk premium to compensate for risk aversion, and inflation is expected to be 2% between the two periods. Repeat (a), (b) above. 10. A two-period firm borrows $100 to invest in a project. Project payoffs are given below. The risk- free rate is 10%, the dividend tax rate is 30%, limited liability is a thing. a. What is the face value of the bond sold by the firm to finance the investment? b. What is the value of one dividend paying stock in the firm in period 1, if the firm has a total of 25 equal dividend-paying stocks? Probability 0.2 0.2 Payoff -20 110 WARNA 120 L AN 140 200 10,000 0.1 0.2 0.1 0.2 11. A two-period firm borrows $100 to invest in a project. Project payoffs X-U[-200,800). The risk- free rate is 10%, the dividend tax rate is 30%, limited liability is a thing. Bond investors expect 5% risk premium to compensate for risk aversion, stock investors expect 10% risk premium to compensate for risk aversion, and inflation is expected to be 2% between the two periods. Repeat (a), (b) above Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started