Answered step by step

Verified Expert Solution

Question

1 Approved Answer

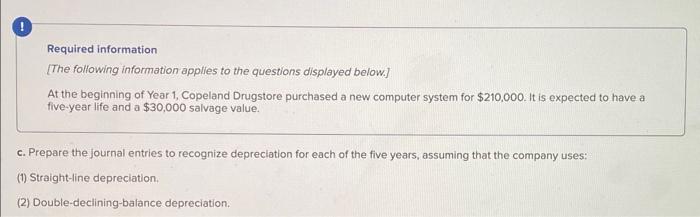

Question #11 Required information [The following information applies to the questions displayed below.] At the beginning of Year 1, Copeland Drugstore purchased a new computer

Question #11

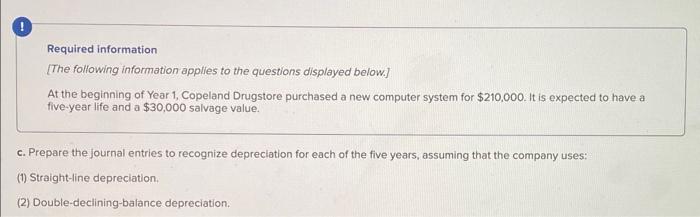

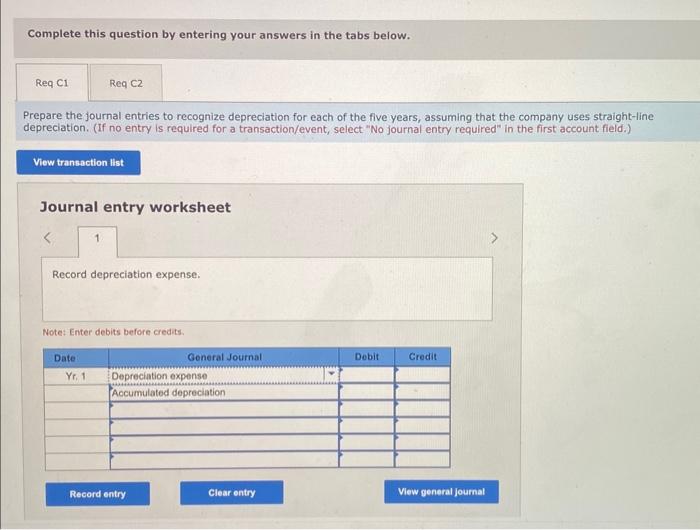

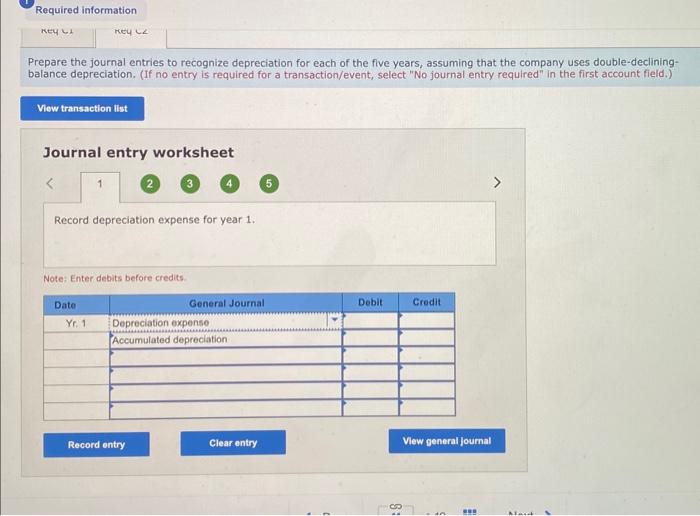

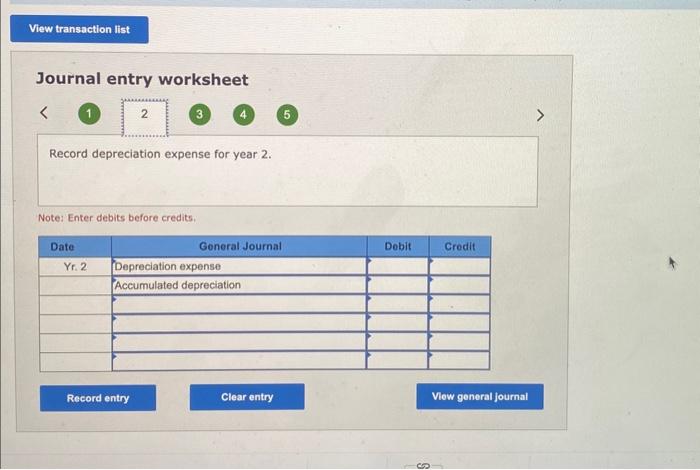

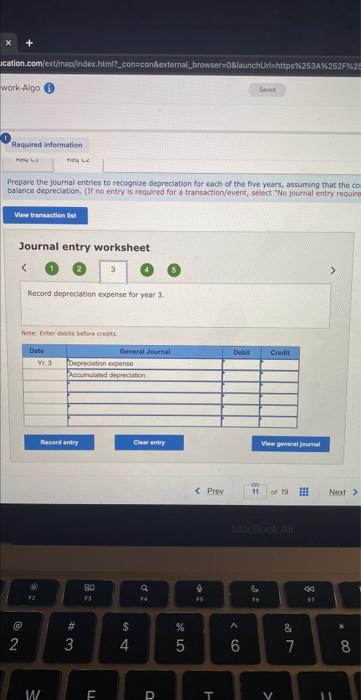

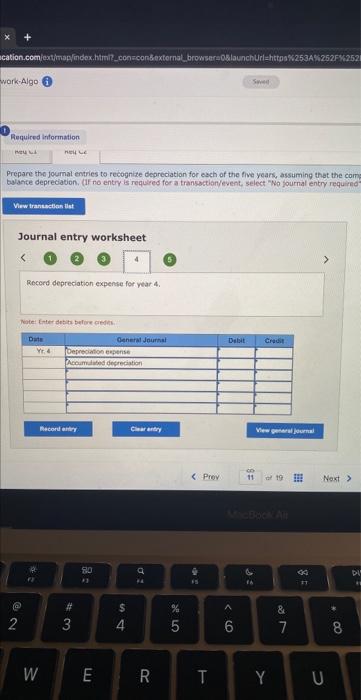

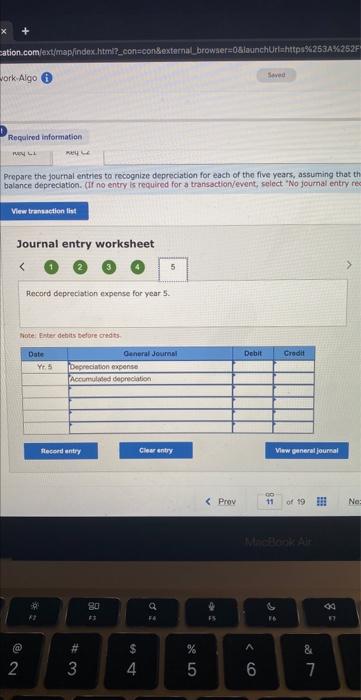

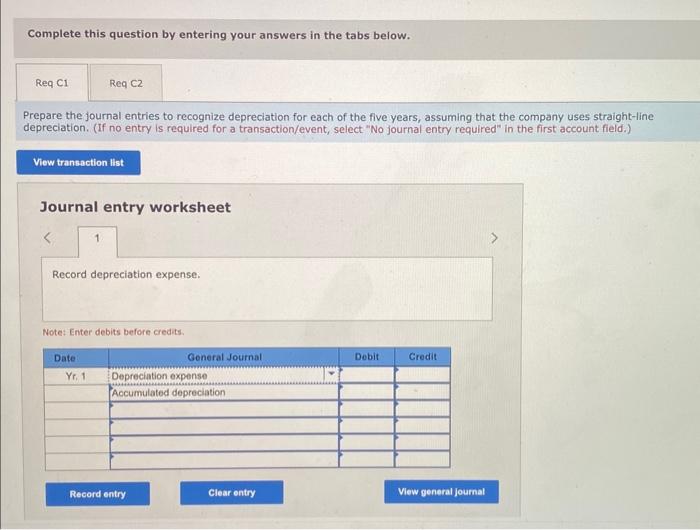

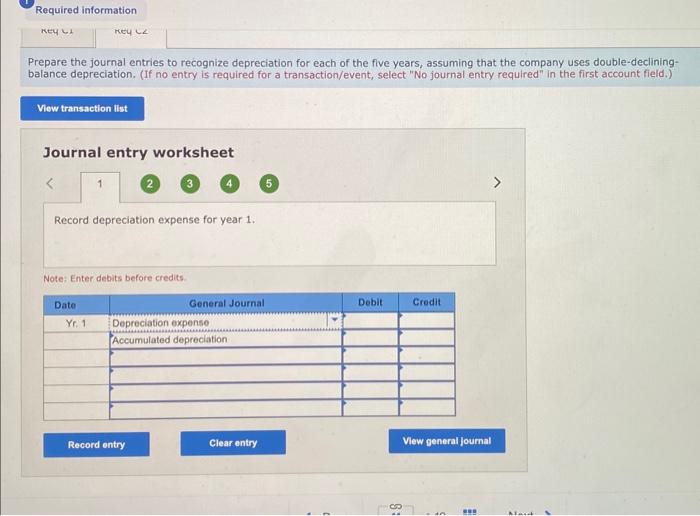

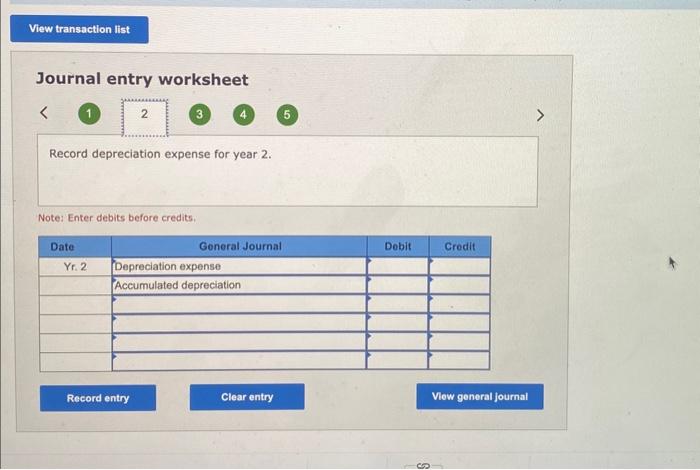

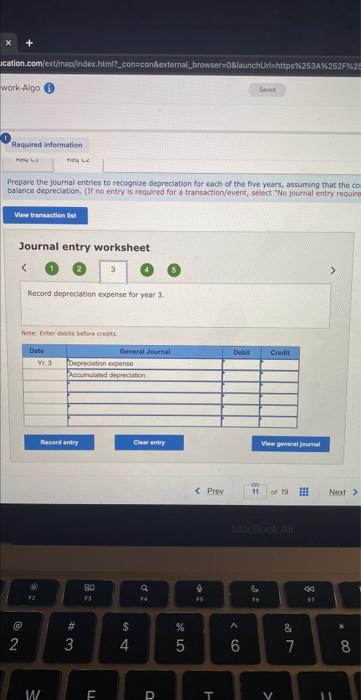

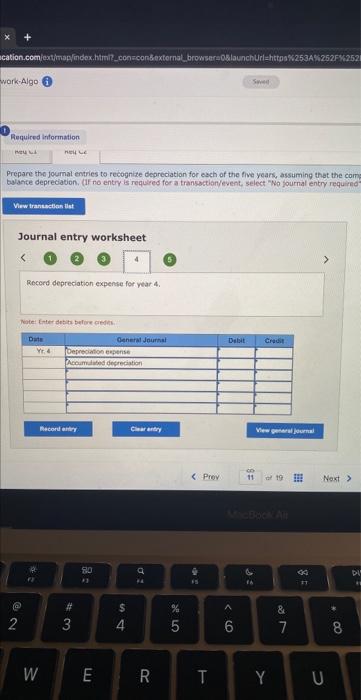

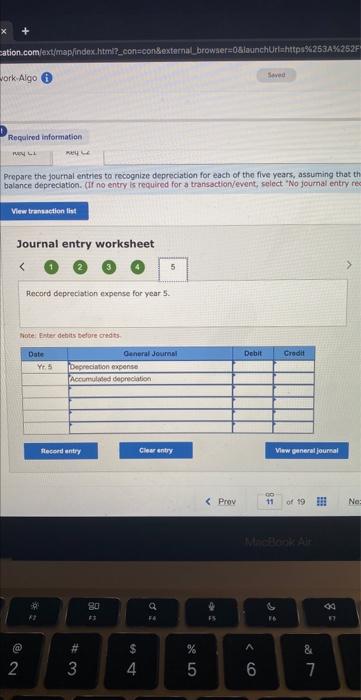

Required information [The following information applies to the questions displayed below.] At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $210,000. It is expected to have a five-year life and a $30,000 salvage value. c. Prepare the journal entries to recognize depreclation for each of the five years, assuming that the company uses: (1) Straight-line depreciation. (2) Double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses straight-line depreciation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note; enter aedits verore credts Prepare the journal entries to recognize depreciation for each of the flve years, assuming that the company uses double-decliningbalance depreciation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet (2) (4) 3 Record depreciation expense for year 1. Note: Enter debits before credits Journal entry worksheet 4 Record depreciation expense for year 2. Note: Enter debits before credits. Prepare the joumal entrics to recognize depreciation for each of the five vears, assuming that the co balance depreciation. (If no entry is requited for a transactionvevent, sclect No jocmal entry requir Journal entry worksheet 11 (4. (5) Record deprecation expense for year 3. huther Eroer deofts befoe eredet. Prepare the joumat entries to recognite depreciation for asch of the five yoars, assuming that the com badsete depredadion. (If no entry is requlred for a transibction/event select "No fournat entry required Journal entry worksheet 1 22 3 (5.) Record depreciation expense for year 4 . Neatei fited detith before eredel. Prepare the jourmal entries to rocognize depreciation for each of the five years, assuming that th bolance depreclation. (If no entry is required for a transactionvevent, select "No joumal entry reo Journal entry worksheet Record deprecistion expense for year 5. Mote. Exter dehits tefare creats. Required information [The following information applies to the questions displayed below.] At the beginning of Year 1, Copeland Drugstore purchased a new computer system for $210,000. It is expected to have a five-year life and a $30,000 salvage value. c. Prepare the journal entries to recognize depreclation for each of the five years, assuming that the company uses: (1) Straight-line depreciation. (2) Double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Prepare the journal entries to recognize depreciation for each of the five years, assuming that the company uses straight-line depreciation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Note; enter aedits verore credts Prepare the journal entries to recognize depreciation for each of the flve years, assuming that the company uses double-decliningbalance depreciation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet (2) (4) 3 Record depreciation expense for year 1. Note: Enter debits before credits Journal entry worksheet 4 Record depreciation expense for year 2. Note: Enter debits before credits. Prepare the joumal entrics to recognize depreciation for each of the five vears, assuming that the co balance depreciation. (If no entry is requited for a transactionvevent, sclect No jocmal entry requir Journal entry worksheet 11 (4. (5) Record deprecation expense for year 3. huther Eroer deofts befoe eredet. Prepare the joumat entries to recognite depreciation for asch of the five yoars, assuming that the com badsete depredadion. (If no entry is requlred for a transibction/event select "No fournat entry required Journal entry worksheet 1 22 3 (5.) Record depreciation expense for year 4 . Neatei fited detith before eredel. Prepare the jourmal entries to rocognize depreciation for each of the five years, assuming that th bolance depreclation. (If no entry is required for a transactionvevent, select "No joumal entry reo Journal entry worksheet Record deprecistion expense for year 5. Mote. Exter dehits tefare creats

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started