Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 11 The following figures have been extracted from the financial statements of KND Ltd: Book Value of Current Assets $45 million and Current

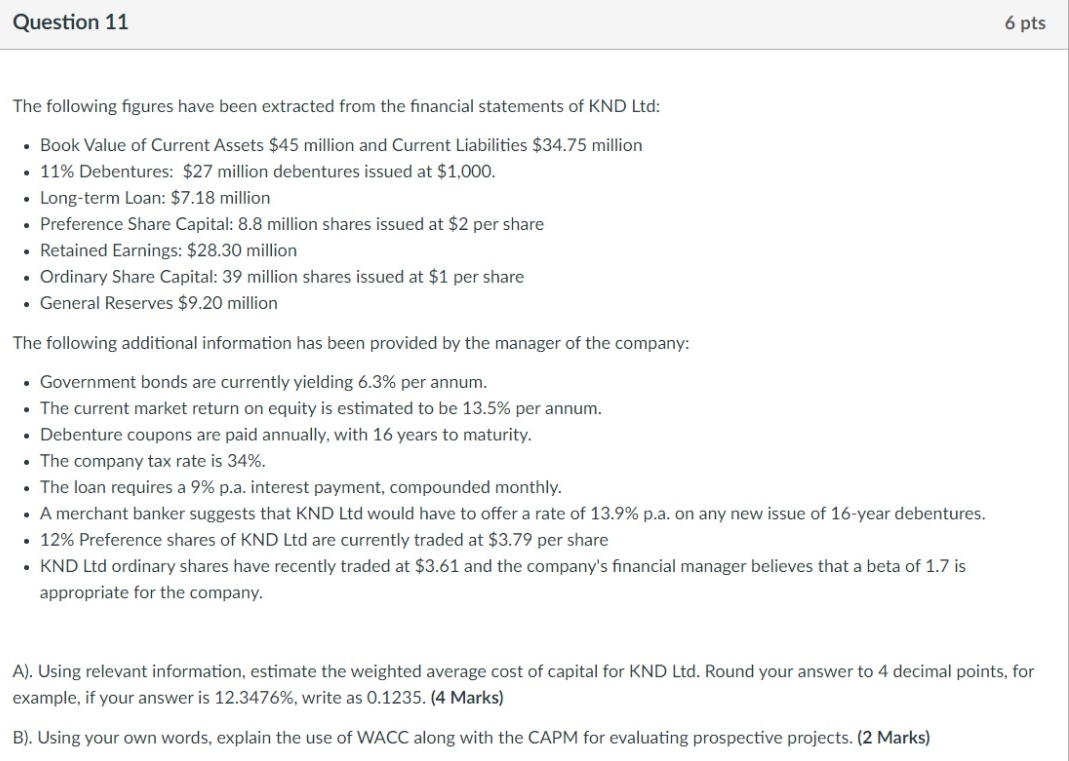

Question 11 The following figures have been extracted from the financial statements of KND Ltd: Book Value of Current Assets $45 million and Current Liabilities $34.75 million 11% Debentures: $27 million debentures issued at $1,000. Long-term Loan: $7.18 million Preference Share Capital: 8.8 million shares issued at $2 per share Retained Earnings: $28.30 million Ordinary Share Capital: 39 million shares issued at $1 per share General Reserves $9.20 million The following additional information has been provided by the manager of the company: Government bonds are currently yielding 6.3% per annum. The current market return on equity is estimated to be 13.5% per annum. Debenture coupons are paid annually, with 16 years to maturity. The company tax rate is 34%. The loan requires a 9% p.a. interest payment, compounded monthly. A merchant banker suggests that KND Ltd would have to offer a rate of 13.9% p.a. on any new issue of 16-year debentures. 12% Preference shares of KND Ltd are currently traded at $3.79 per share KND Ltd ordinary shares have recently traded at $3.61 and the company's financial manager believes that a beta of 1.7 is appropriate for the company. 6 pts A). Using relevant information, estimate the weighted average cost of capital for KND Ltd. Round your answer to 4 decimal points, for example, if your answer is 12.3476%, write as 0.1235. (4 Marks) B). Using your own words, explain the use of WACC along with the CAPM for evaluating prospective projects. (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Calculating the Weighted Average Cost of Capital WACC for KND Ltd 1 Cost of Debt after tax Debenture coupon rate 11 Debenture yield to maturity 139 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started