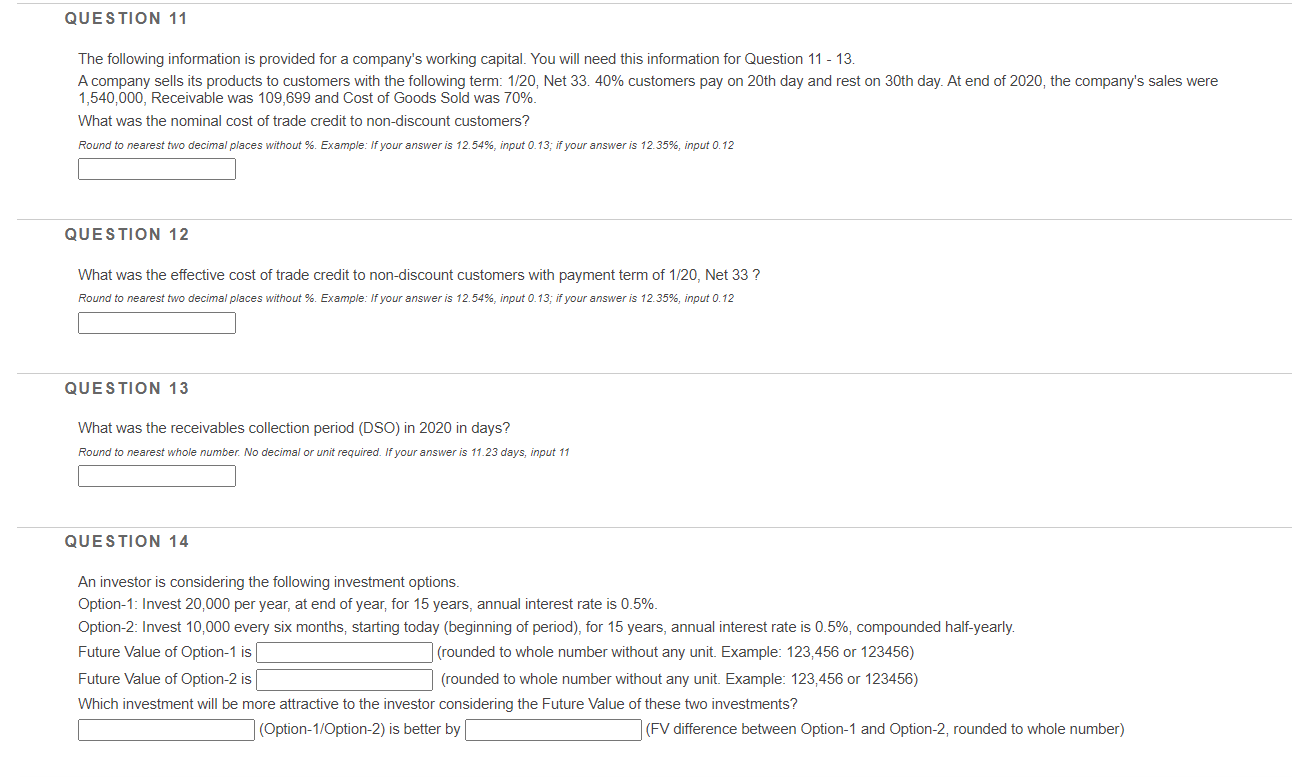

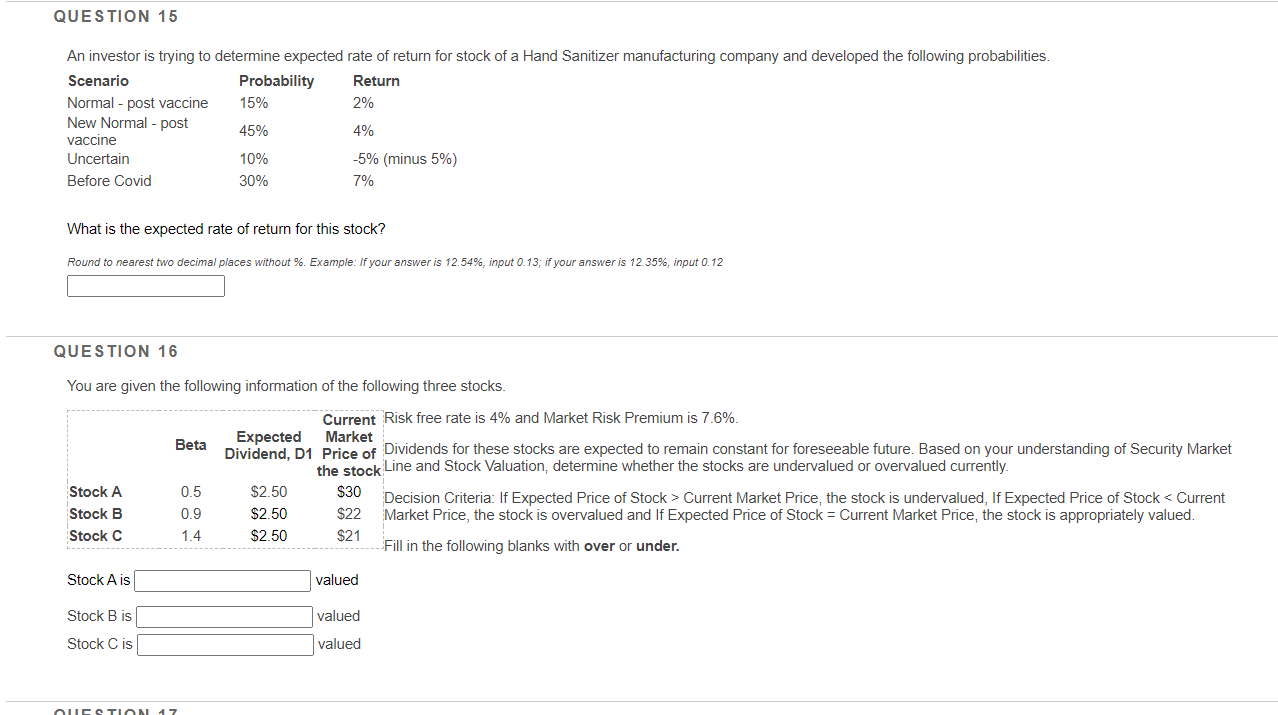

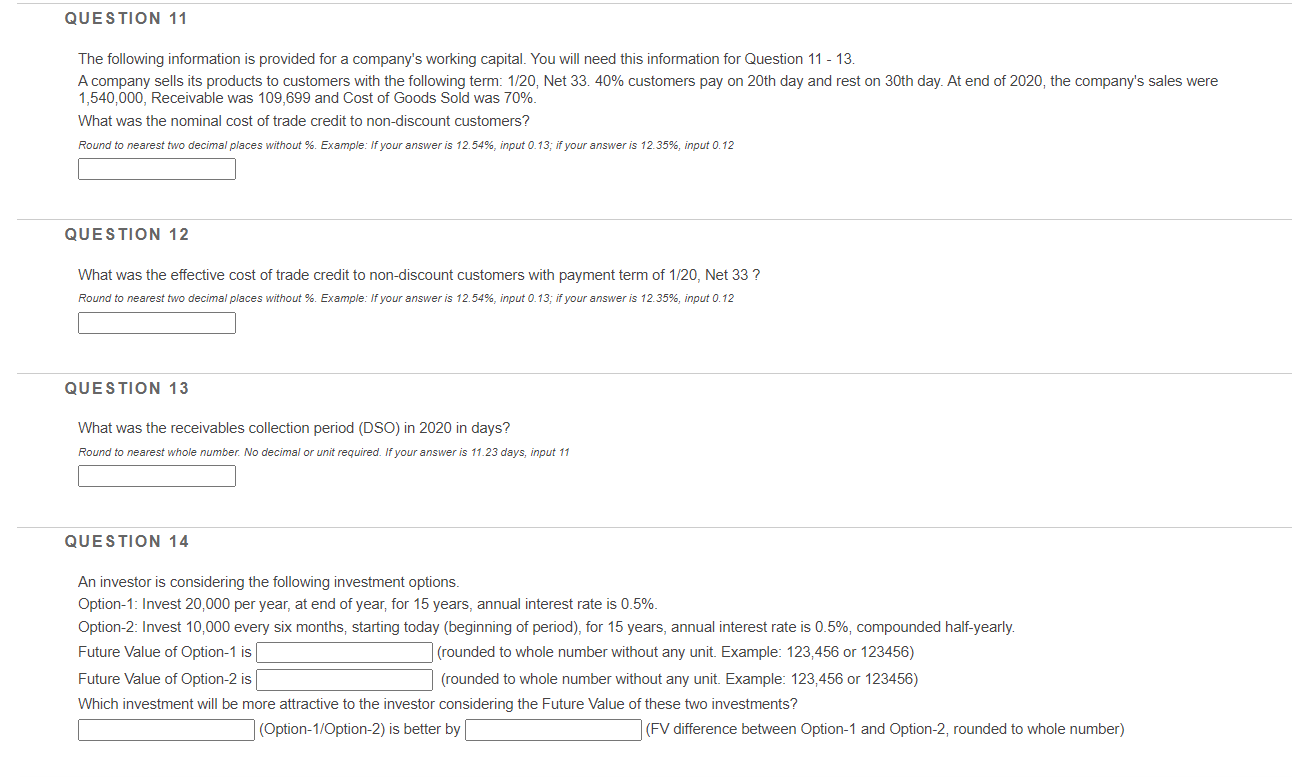

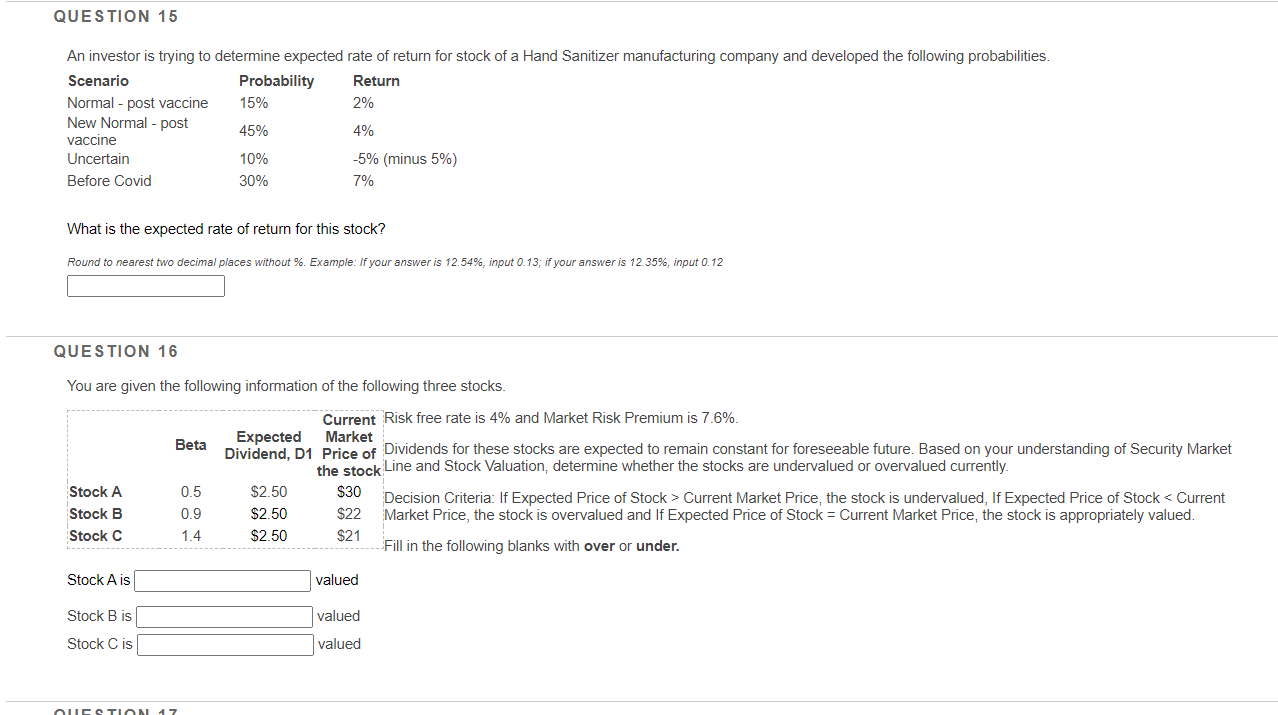

QUESTION 11 The following information is provided for a company's working capital. You will need this information for Question 11 - 13. A company sells its products to customers with the following term: 1/20, Net 33. 40% customers pay on 20th day and rest on 30th day. At end of 2020, the company's sales were 1,540,000, Receivable was 109,699 and Cost of Goods Sold was 70%. What was the nominal cost of trade credit to non-discount customers? Round to nearest two decimal places without %. Example: If your answer is 12.54%, input 0.13, if your answer is 12.35%, input 0.12 QUESTION 12 What was the effective cost of trade credit to non-discount customers with payment term of 1/20, Net 33 ? Round to nearest two decimal places without %. Example: If your answer is 12.54%, input 0.13; if your answer is 12.35%, input 0.12 QUESTION 13 What was the receivables collection period (DSO) in 2020 in days? Round to nearest whole number. No decimal or unit required. If your answer is 11.23 days, input 11 QUESTION 14 An investor is considering the following investment options. Option-1: Invest 20,000 per year, at end of year, for 15 years, annual interest rate is 0.5%. Option-2: Invest 10,000 every six months, starting today (beginning of period), for 15 years, annual interest rate is 0.5%, compounded half-yearly. Future Value of Option-1 is (rounded to whole number without any unit. Example: 123,456 or 123456) Future Value of Option-2 is (rounded to whole number without any unit. Example: 123,456 or 123456) Which investment will be more attractive to the investor considering the Future Value of these two investments? (Option-1/Option-2) is better by (FV difference between Option-1 and Option-2, rounded to whole number) QUESTION 15 An investor is trying to determine expected rate of return for stock of a Hand Sanitizer manufacturing company and developed the following probabilities. Scenario Probability Return Normal - post vaccine 15% 2% New Normal - post 45% 4% vaccine Uncertain 10% -5% (minus 5%) Before Covid 30% 7% What is the expected rate of return for this stock? Round to nearest two decimal places without %. Example: If your answer is 12.54%, input 0.13, if your answer is 12.35%, input 0.12 QUESTION 16 You are given the following information of the following three stocks. Current Risk free rate is 4% and Market Risk Premium is 7.6% Beta Expected Market Dividend, D1 Price of Dividends for these stocks are expected to remain constant for foreseeable future. Based on your understanding of Security Market the stock Line and Stock Valuation, determine whether the stocks are undervalued or overvalued currently. Stock A 0.5 $2.50 $30 Decision Criteria: If Expected Price of Stock > Current Market Price, the stock is undervalued, If Expected Price of Stock