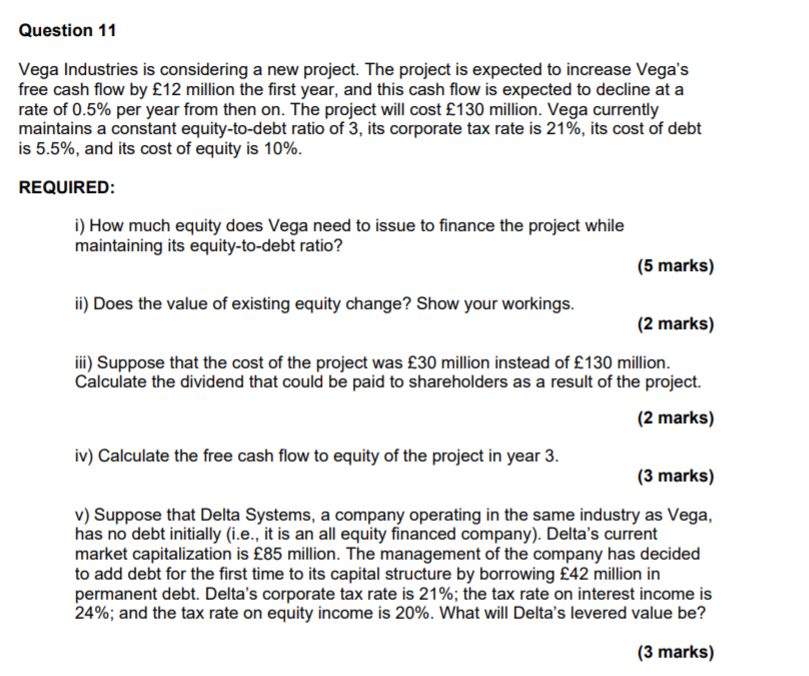

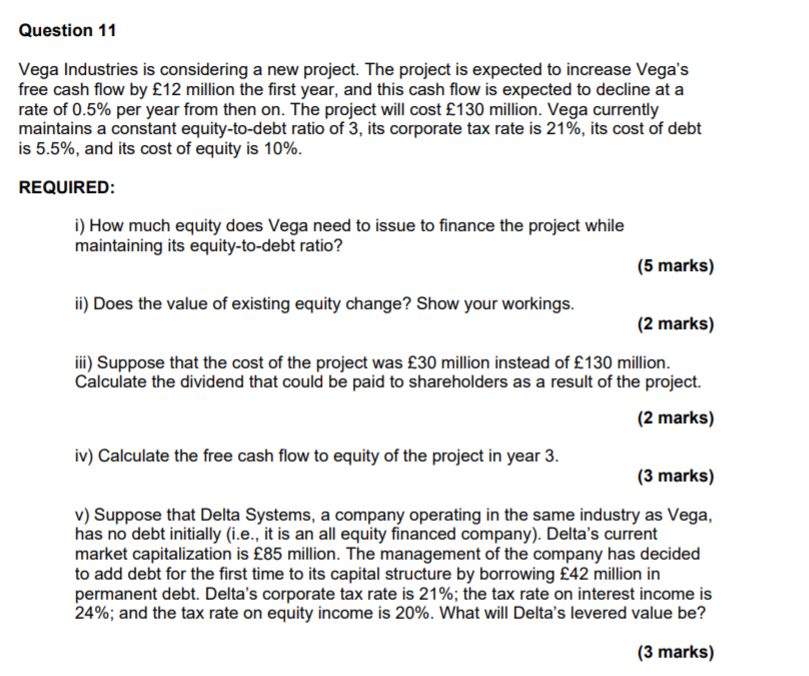

Question 11 Vega Industries is considering a new project. The project is expected to increase Vega's free cash flow by 12 million the first year, and this cash flow is expected to decline at a rate of 0.5% per year from then on. The project will cost 130 million. Vega currently maintains a constant equity-to-debt ratio of 3, its corporate tax rate is 21%, its cost of debt is 5.5%, and its cost of equity is 10%. REQUIRED: i) How much equity does Vega need to issue to finance the project while maintaining its equity-to-debt ratio? (5 marks) ii) Does the value of existing equity change? Show your workings. (2 marks) iii) Suppose that the cost of the project was 30 million instead of 130 million. Calculate the dividend that could be paid to shareholders as a result of the project. (2 marks) iv) Calculate the free cash flow to equity of the project in year 3. (3 marks) v) Suppose that Delta Systems, a company operating in the same industry as Vega, has no debt initially (i.e., it is an all equity financed company). Delta's current market capitalization is 85 million. The management of the company has decided to add debt for the first time to its capital structure by borrowing 42 million in permanent debt. Delta's corporate tax rate is 21%; the tax rate on interest income is 24%; and the tax rate on equity income is 20%. What will Delta's levered value be? (3 marks) Question 11 Vega Industries is considering a new project. The project is expected to increase Vega's free cash flow by 12 million the first year, and this cash flow is expected to decline at a rate of 0.5% per year from then on. The project will cost 130 million. Vega currently maintains a constant equity-to-debt ratio of 3, its corporate tax rate is 21%, its cost of debt is 5.5%, and its cost of equity is 10%. REQUIRED: i) How much equity does Vega need to issue to finance the project while maintaining its equity-to-debt ratio? (5 marks) ii) Does the value of existing equity change? Show your workings. (2 marks) iii) Suppose that the cost of the project was 30 million instead of 130 million. Calculate the dividend that could be paid to shareholders as a result of the project. (2 marks) iv) Calculate the free cash flow to equity of the project in year 3. (3 marks) v) Suppose that Delta Systems, a company operating in the same industry as Vega, has no debt initially (i.e., it is an all equity financed company). Delta's current market capitalization is 85 million. The management of the company has decided to add debt for the first time to its capital structure by borrowing 42 million in permanent debt. Delta's corporate tax rate is 21%; the tax rate on interest income is 24%; and the tax rate on equity income is 20%. What will Delta's levered value be