Answered step by step

Verified Expert Solution

Question

1 Approved Answer

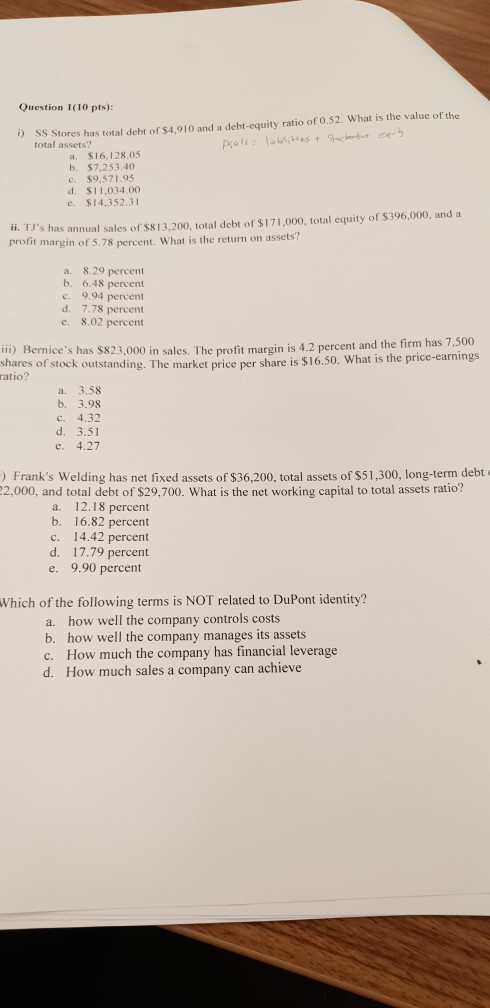

Question 1(10 pts): D SS Stores has total debt of $4,910 and a debt-equity ratio of 0.52. What is the value of the total assets?

Question 1(10 pts): D SS Stores has total debt of $4,910 and a debt-equity ratio of 0.52. What is the value of the total assets? a. $16,128.05 b. $7,253,40 c. $9,571.95 d. $11,034.00 e. $14,352.31 i. TJ's has annual sales of $813,200, total debt of $171,000, total equity of $396,000, and a profit margin of 5.78 percent. What is the return on assets? a. 8.29 percent b. 6.48 percent c. 9.94 percent d. 7.78 percent e. 8.02 percent ii) Bernice's has $823,000 in sales. The profit margin is 4.2 percent and the firm h hares ofe $16.50. What is he price-earnings shares of stock outstanding. The market price per s atio? a. 3.58 b. 3.98 c. 4.32 d. 3.51 e. 4.27 ) Frank's Welding has net fixed assets of $36,200, total assets of s51,300, long-term debt 2,000, and total debt of $29,700. What is the net working capital to total assets ratio? a. 12.18 percent b. 16.82 percent c. 14.42 percent d. 17.79 percent e. 9.90 percent Which of the following terms is NOT related to DuPont identity? a. how well the company controls costs b. how well the company manages its assets c. How much the company has financial leverage d. How much sales a company can achieve

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started