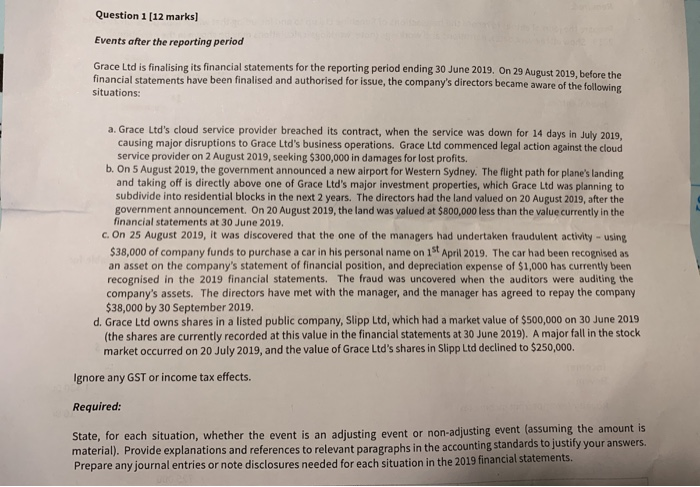

Question 1[12 marks] Events after the reporting period Grace Ltd is finalising its financial statements for the reporting period ending 30 June 2019. On 29 August 2019, before the financial statements have been finalised and authorised for issue, the company's directors became aware of the following situations: a. Grace Ltd's cloud service provider breached its contract, when the service was down for 14 days in July 2019. causing major disruptions to Grace Ltd's business operations. Grace Ltd commenced legal action against the cloud service provider on 2 August 2019, seeking $300,000 in damages for lost profits. b. On 5 August 2019, the government announced a new airport for Western Sydney. The flight path for plane's landing and taking off is directly above one of Grace Ltd's major investment properties, which Grace Ltd was planning to subdivide into residential blocks in the next 2 years. The directors had the land valued on 20 August 2019, after the government announcement. On 20 August 2019, the land was valued at $800,000 less than the value currently in the financial statements at 30 June 2019. c. On 25 August 2019, it was discovered that the one of the managers had undertaken fraudulent activity - using $38,000 of company funds to purchase a car in his personal name on 19 April 2019. The car had been recognised as an asset on the company's statement of financial position, and depreciation expense of $1,000 has currently been recognised in the 2019 financial statements. The fraud was uncovered when the auditors were auditing the company's assets. The directors have met with the manager, and the manager has agreed to repay the company $38,000 by 30 September 2019. d. Grace Ltd owns shares in a listed public company, Slipp Ltd, which had a market value of $500,000 on 30 June 2019 (the shares are currently recorded at this value in the financial statements at 30 June 2019). A major fall in the stock market occurred on 20 July 2019, and the value of Grace Ltd's shares in Slipp Ltd declined to $250,000. Ignore any GST or income tax effects. Required: State, for each situation, whether the event is an adjusting event or non-adjusting event (assuming the amount is material). Provide explanations and references to relevant paragraphs in the accounting Standards to justify your answers. Prepare any journal entries or note disclosures needed for each situation in the 2019 financial statements