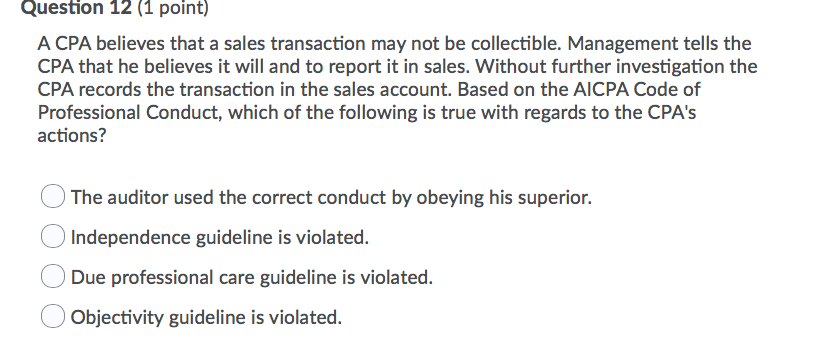

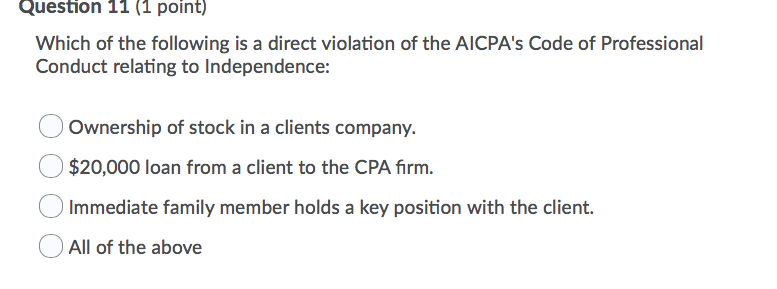

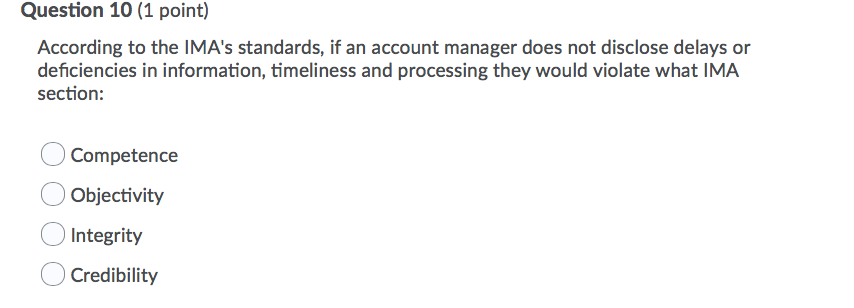

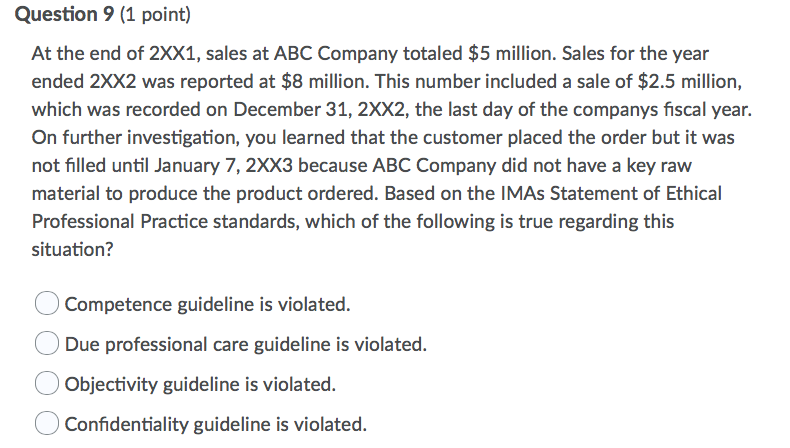

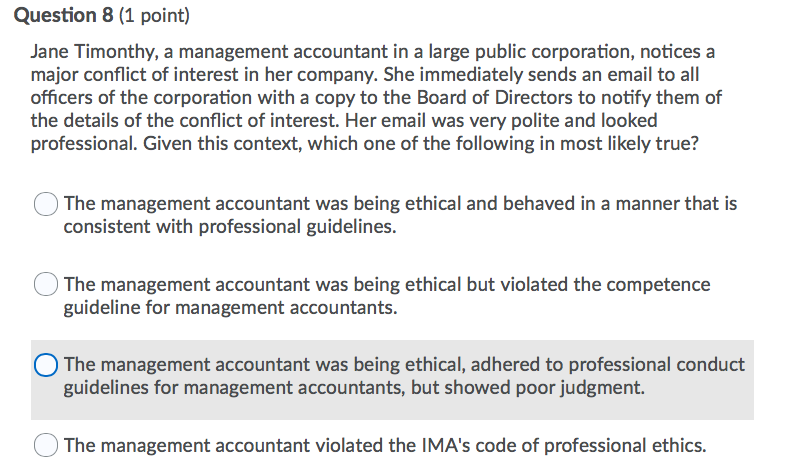

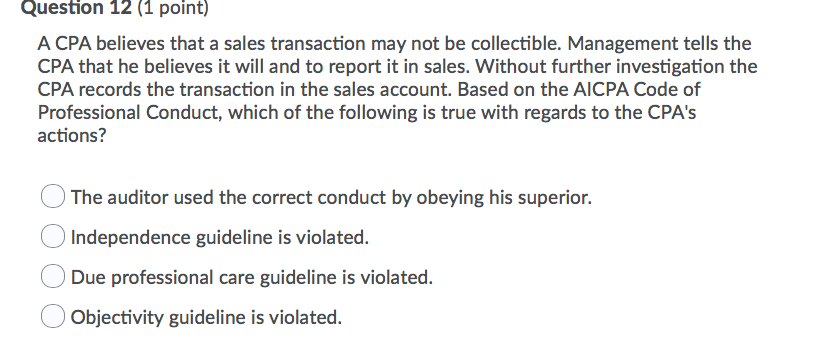

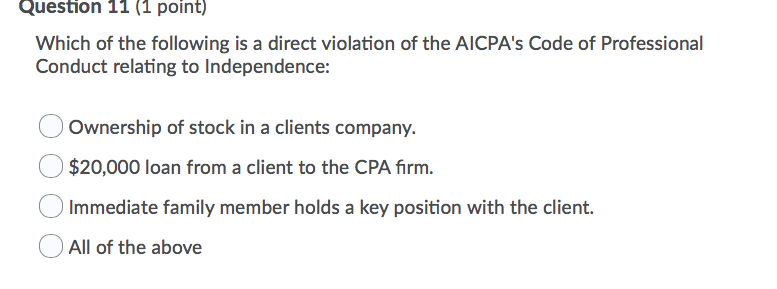

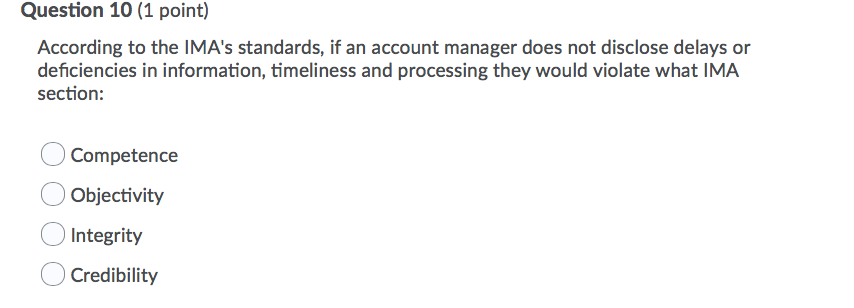

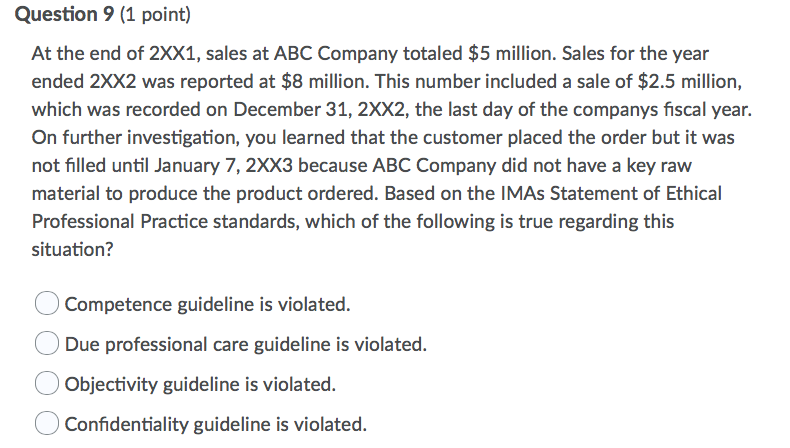

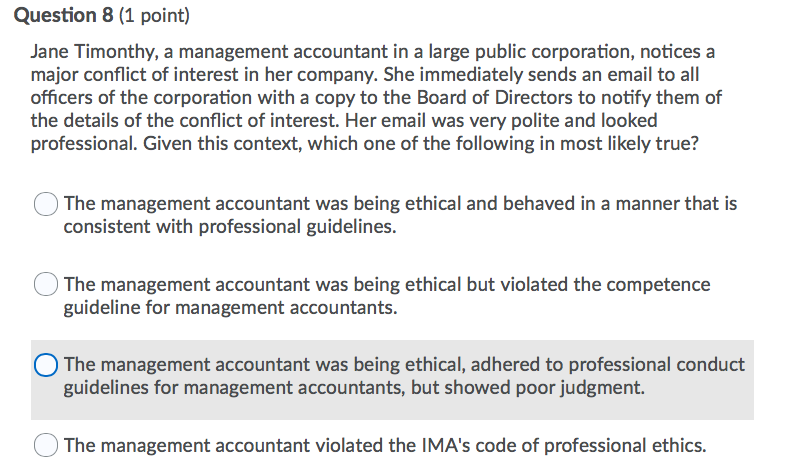

Question 12 (1 point) A CPA believes that a sales transaction may not be collectible. Management tells the CPA that he believes it will and to report it in sales. Without further investigation the CPA records the transaction in the sales account. Based on the AICPA Code of Professional Conduct, which of the following is true with regards to the CPA's actions? The auditor used the correct conduct by obeying his superior. Independence guideline is violated. Due professional care guideline is violated. Objectivity guideline is violated. Question 11 (1 point) Which of the following is a direct violation of the AICPA's Code of Professional Conduct relating to Independence: Ownership of stock in a clients company. $20,000 loan from a client to the CPA firm. Immediate family member holds a key position with the client. O All of the above Question 10 (1 point) According to the IMA's standards, if an account manager does not disclose delays or deficiencies in information, timeliness and processing they would violate what IMA section: Competence Objectivity Integrity Credibility Question 9 (1 point) At the end of 2XX1, sales at ABC Company totaled $5 million. Sales for the year ended 2XX2 was reported at $8 million. This number included a sale of $2.5 million, which was recorded on December 31, 2XX2, the last day of the companys fiscal year. On further investigation, you learned that the customer placed the order but it was not filled until January 7, 2XX3 because ABC Company did not have a key raw material to produce the product ordered. Based on the IMAs Statement of Ethical Professional Practice standards, which of the following is true regarding this situation? Competence guideline is violated. Due professional care guideline is violated. Objectivity guideline is violated. Confidentiality guideline is violated. Question 8 (1 point) Jane Timonthy, a management accountant in a large public corporation, notices a major conflict of interest in her company. She immediately sends an email to all officers of the corporation with a copy to the Board of Directors to notify them of the details of the conflict of interest. Her email was very polite and looked professional. Given this context, which one of the following in most likely true? The management accountant was being ethical and behaved in a manner that is consistent with professional guidelines. The management accountant was being ethical but violated the competence guideline for management accountants. The management accountant was being ethical, adhered to professional conduct guidelines for management accountants, but showed poor judgment. The management accountant violated the IMA's code of professional ethics