Answered step by step

Verified Expert Solution

Question

1 Approved Answer

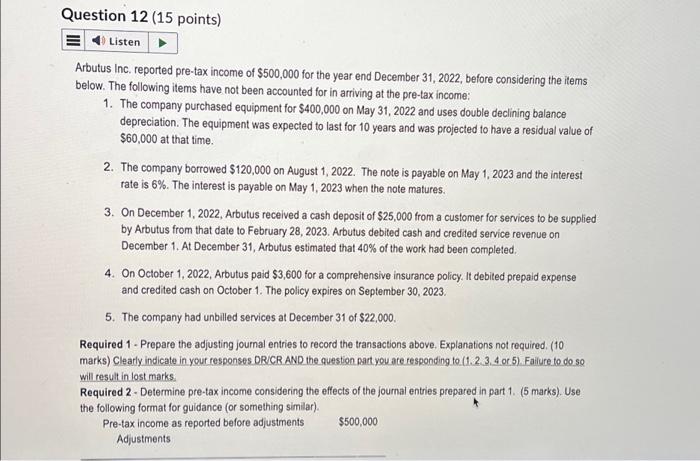

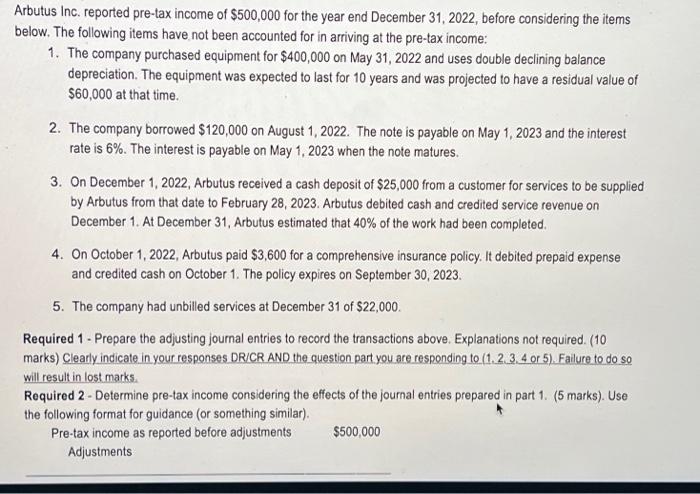

Question 12 (15 points) = Listen Arbutus Inc. reported pre-tax income of $500,000 for the year end December 31, 2022, before considering the items below.

Question 12 (15 points) = Listen Arbutus Inc. reported pre-tax income of $500,000 for the year end December 31, 2022, before considering the items below. The following items have not been accounted for in arriving at the pre-tax income: 1. The company purchased equipment for $400,000 on May 31, 2022 and uses double declining balance depreciation. The equipment was expected to last for 10 years and was projected to have a residual value of $60,000 at that time. 2. The company borrowed $120,000 on August 1, 2022. The note is payable on May 1, 2023 and the interest rate is 6%. The interest is payable on May 1, 2023 when the note matures. 3. On December 1, 2022, Arbutus received a cash deposit of $25,000 from a customer for services to be supplied by Arbutus from that date to February 28, 2023. Arbutus debited cash and credited service revenue on December 1. At December 31, Arbutus estimated that 40% of the work had been completed. 4. On October 1, 2022, Arbutus paid $3,600 for a comprehensive insurance policy. It debited prepaid expense and credited cash on October 1. The policy expires on September 30, 2023. 5. The company had unbilled services at December 31 of $22,000. Required 1 - Prepare the adjusting journal entries to record the transactions above. Explanations not required. (10 marks) Clearly indicate in your responses DR/CR AND the question part you are responding to (1, 2, 3, 4 or 5). Failure to do so will result in lost marks. Required 2 - Determine pre-tax income considering the effects of the journal entries prepared in part 1. (5 marks). Use the following format for guidance (or something similar). Pre-tax income as reported before adjustments Adjustments $500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started