Answered step by step

Verified Expert Solution

Question

1 Approved Answer

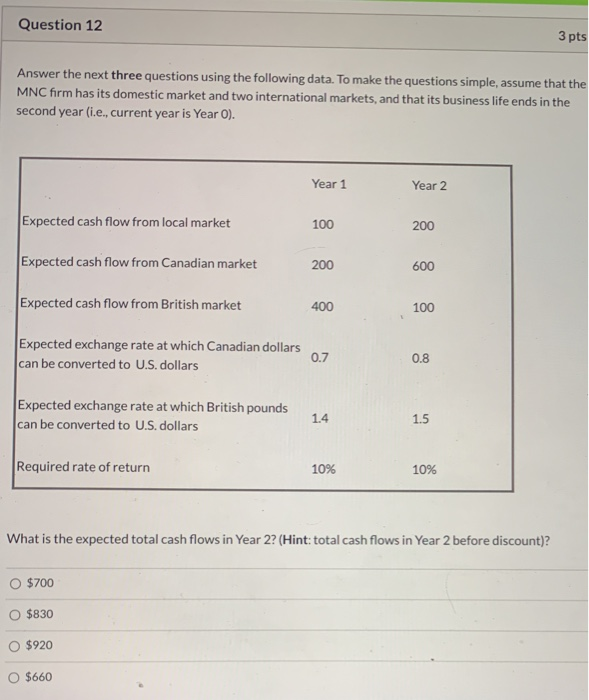

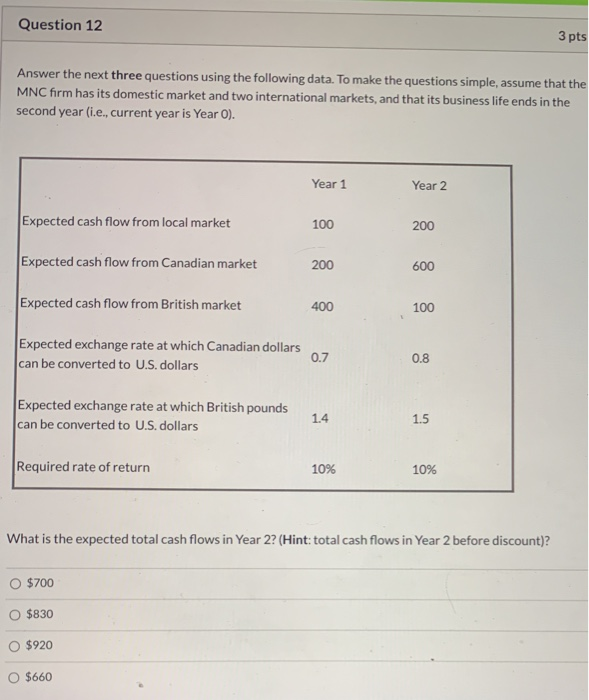

Question 12 3 pts Answer the next three questions using the following data. To make the questions simple, assume that the MNC firm has its

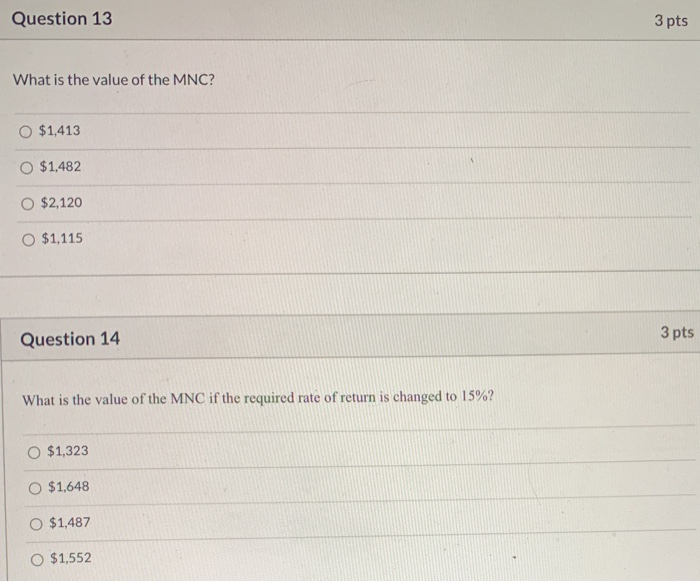

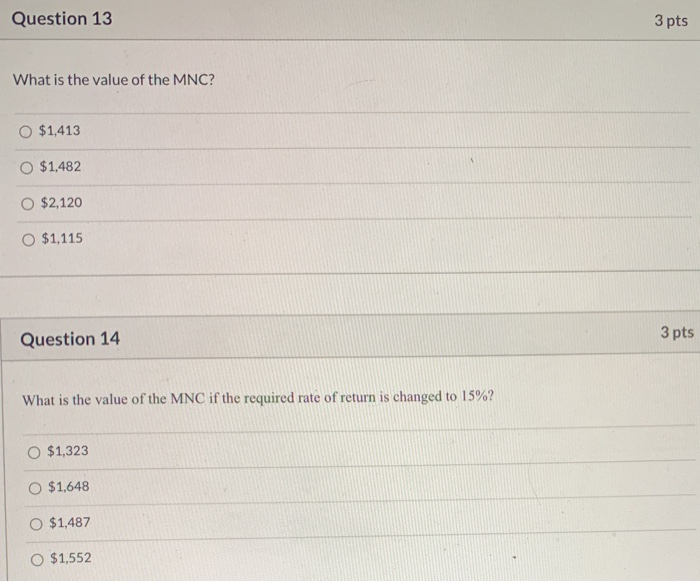

Question 12 3 pts Answer the next three questions using the following data. To make the questions simple, assume that the MNC firm has its domestic market and two international markets, and that its business life ends in the second year (i.e., current year is Year 0). Year 1 Year 2 Expected cash flow from local market 100 200 Expected cash flow from Canadian market 200 600 Expected cash flow from British market 400 100 Expected exchange rate at which Canadian dollars can be converted to U.S. dollars 0.7 0.8 Expected exchange rate at which British pounds can be converted to U.S. dollars 1.4 1.5 Required rate of return 10% 10% What is the expected total cash flows in Year 2? (Hint:total cash flows in Year 2 before discount)? O $700 O $830 $920 $660 Question 13 3 pts What is the value of the MNC? O $1,413 O $1,482 $2,120 O $1,115 Question 14 3 pts What is the value of the MNC if the required rate of return is changed to 15%? O $1,323 O $1,648 O $1,487 O $1,552

Question 12 3 pts Answer the next three questions using the following data. To make the questions simple, assume that the MNC firm has its domestic market and two international markets, and that its business life ends in the second year (i.e., current year is Year 0). Year 1 Year 2 Expected cash flow from local market 100 200 Expected cash flow from Canadian market 200 600 Expected cash flow from British market 400 100 Expected exchange rate at which Canadian dollars can be converted to U.S. dollars 0.7 0.8 Expected exchange rate at which British pounds can be converted to U.S. dollars 1.4 1.5 Required rate of return 10% 10% What is the expected total cash flows in Year 2? (Hint:total cash flows in Year 2 before discount)? O $700 O $830 $920 $660 Question 13 3 pts What is the value of the MNC? O $1,413 O $1,482 $2,120 O $1,115 Question 14 3 pts What is the value of the MNC if the required rate of return is changed to 15%? O $1,323 O $1,648 O $1,487 O $1,552

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started