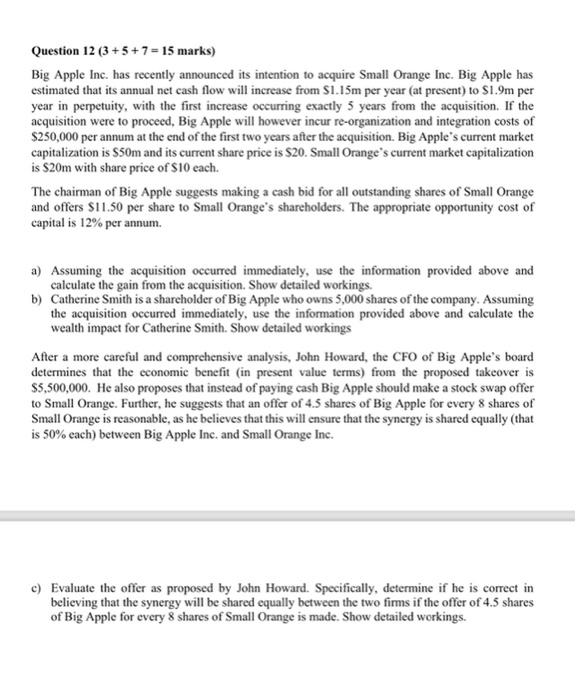

Question 12 (3+5+7= 15 marks) Big Apple Inc. has recently announced its intention to acquire Small Orange Inc. Big Apple has estimated that its annual net cash flow will increase from $1.15m per year (at present) to $1.9m per year in perpetuity, with the first increase occurring exactly 5 years from the acquisition. If the acquisition were to proceed, Big Apple will however incur re-organization and integration costs of $250,000 per annum at the end of the first two years after the acquisition. Big Apple's current market capitalization is $50m and its current share price is $20. Small Orange's current market capitalization is $20m with share price of $10 each. The chairman of Big Apple suggests making a cash bid for all outstanding shares of Small Orange and offers $11.50 per share to Small Orange's shareholders. The appropriate opportunity cost of capital is 12% per annum. a) Assuming the acquisition occurred immediately, use the information provided above and calculate the gain from the acquisition. Show detailed workings. b) Catherine Smith is a shareholder of Big Apple who owns 5,000 shares of the company. Assuming the acquisition occurred immediately, use the information provided above and calculate the wealth impact for Catherine Smith. Show detailed workings After a more careful and comprehensive analysis, John Howard, the CFO of Big Apple's board determines that the economic benefit (in present value terms) from the proposed takeover is $5,500,000. He also proposes that instead of paying cash Big Apple should make a stock swap offer to Small Orange. Further, he suggests that an offer of 4.5 shares of Big Apple for every 8 shares of Small Orange is reasonable, as he believes that this will ensure that the synergy is shared equally (that is 50% each) between Big Apple Inc. and Small Orange Inc. c) Evaluate the offer as proposed by John Howard. Specifically, determine if he is correct in believing that the synergy will be shared equally between the two firms if the offer of 4.5 shares of Big Apple for every 8 shares of Small Orange is made. Show detailed workings. Question 12 (3+5+7= 15 marks) Big Apple Inc. has recently announced its intention to acquire Small Orange Inc. Big Apple has estimated that its annual net cash flow will increase from $1.15m per year (at present) to $1.9m per year in perpetuity, with the first increase occurring exactly 5 years from the acquisition. If the acquisition were to proceed, Big Apple will however incur re-organization and integration costs of $250,000 per annum at the end of the first two years after the acquisition. Big Apple's current market capitalization is $50m and its current share price is $20. Small Orange's current market capitalization is $20m with share price of $10 each. The chairman of Big Apple suggests making a cash bid for all outstanding shares of Small Orange and offers $11.50 per share to Small Orange's shareholders. The appropriate opportunity cost of capital is 12% per annum. a) Assuming the acquisition occurred immediately, use the information provided above and calculate the gain from the acquisition. Show detailed workings. b) Catherine Smith is a shareholder of Big Apple who owns 5,000 shares of the company. Assuming the acquisition occurred immediately, use the information provided above and calculate the wealth impact for Catherine Smith. Show detailed workings After a more careful and comprehensive analysis, John Howard, the CFO of Big Apple's board determines that the economic benefit (in present value terms) from the proposed takeover is $5,500,000. He also proposes that instead of paying cash Big Apple should make a stock swap offer to Small Orange. Further, he suggests that an offer of 4.5 shares of Big Apple for every 8 shares of Small Orange is reasonable, as he believes that this will ensure that the synergy is shared equally (that is 50% each) between Big Apple Inc. and Small Orange Inc. c) Evaluate the offer as proposed by John Howard. Specifically, determine if he is correct in believing that the synergy will be shared equally between the two firms if the offer of 4.5 shares of Big Apple for every 8 shares of Small Orange is made. Show detailed workings