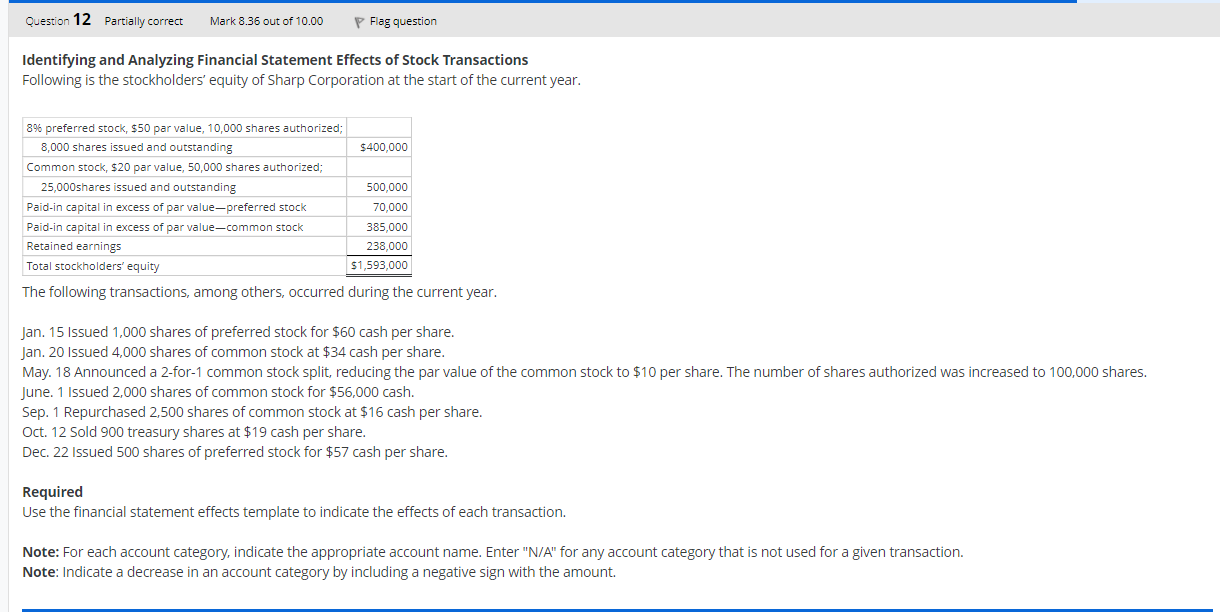

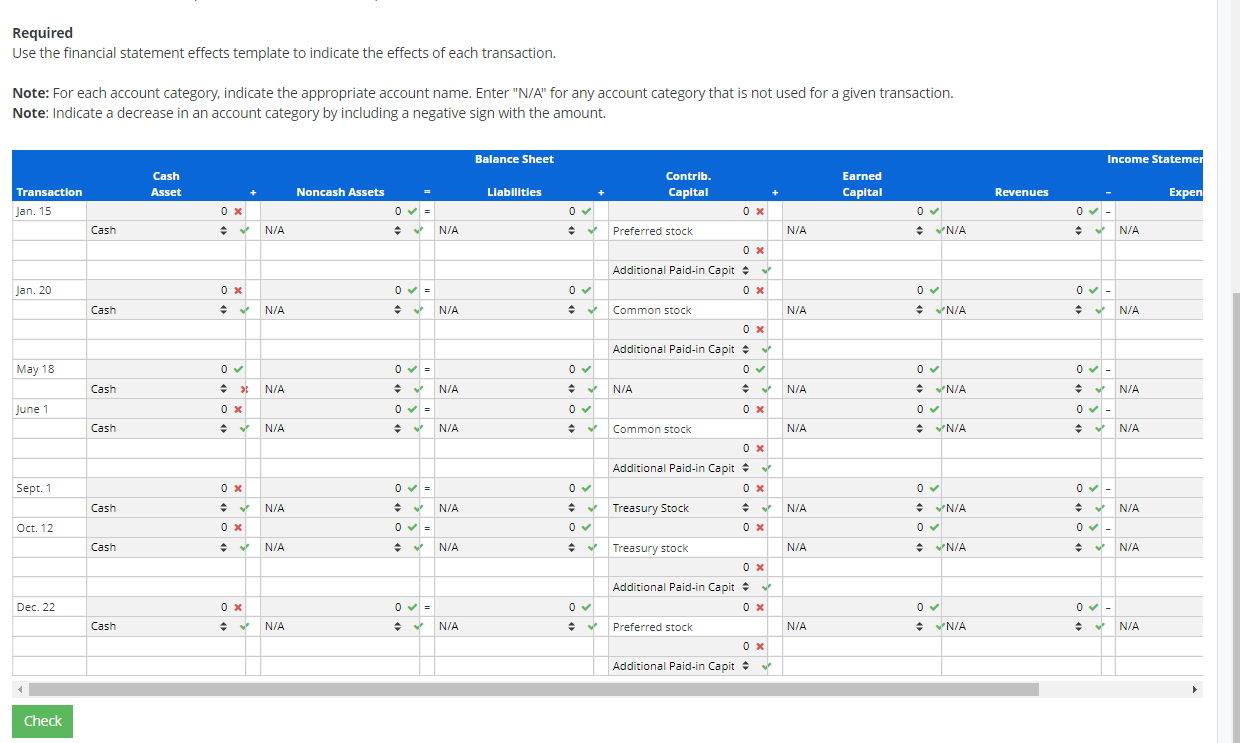

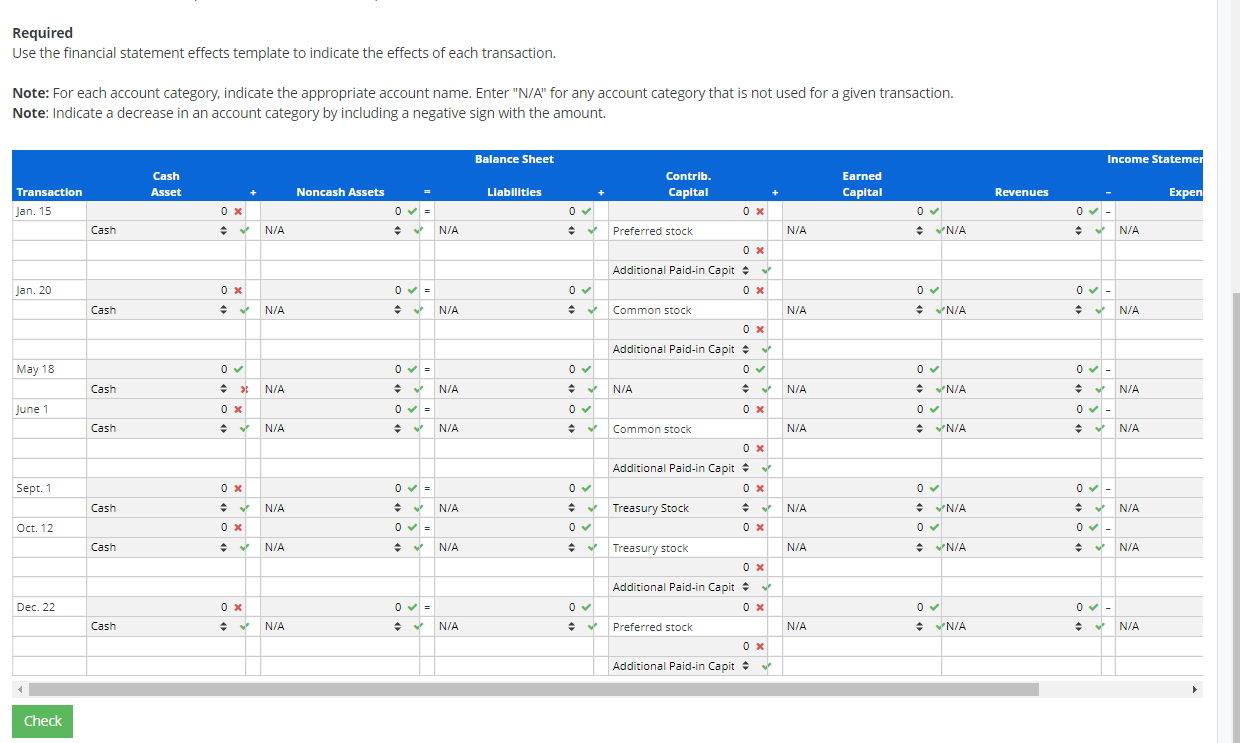

Question 12 Partially correct Mark 8.36 out of 10.00 P Flag question Identifying and Analyzing Financial Statement Effects of Stock Transactions Following is the stockholders' equity of Sharp Corporation at the start of the current year. $400,000 8% preferred stock, $50 par value, 10,000 shares authorized; 8,000 shares issued and outstanding Common stock, $20 par value, 50,000 shares authorized; 25,000shares issued and outstanding Paid-in capital in excess of par value-preferred stock Paid-in capital in excess of par value-common stock Retained earnings Total stockholders' equity 500,000 70,000 385,000 238,000 $1,593,000 The following transactions, among others, occurred during the current year. Jan. 15 Issued 1,000 shares of preferred stock for $60 cash per share. Jan. 20 Issued 4,000 shares of common stock at $34 cash per share. May. 18 Announced a 2-for-1 common stock split, reducing the par value of the common stock to $10 per share. The number of shares authorized was increased to 100,000 shares. June. 1 Issued 2,000 shares of common stock for $56,000 cash. Sep. 1 Repurchased 2,500 shares of common stock at $16 cash per share. Oct. 12 Sold 900 treasury shares at $19 cash per share. Dec. 22 Issued 500 shares of preferred stock for $57 cash per share. Required Use the financial statement effects template to indicate the effects of each transaction. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. Required Use the financial statement effects template to indicate the effects of each transaction. Note: For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction. Note: Indicate a decrease in an account category by including a negative sign with the amount. Balance Sheet Income Statemer Cash Contrib. Capital Asset Noncash Assets Liabilities Earned Capital Revenues - Transaction Jan. 15 Expen 0 X 0 = 0 X 0 - 0 N/A Cash N N/A N/A Preferred stock N/A N/A 0 x Additional Paid-in Capit Jan. 20 Ox 0 = OX 0 - Cash N/A N/A Common stock N/A N N/A N/A 0 X Additional Paid-in Capit May 18 0 0 = 0- Cash > N/A N/A N/A N/A N/A N/A June 1 0 X 0 = 0 0 X 0 0 - Cash N/A N/A N Common stock N/A N N/A e N/A 0 X Additional Paid-in Capit Sept. 1 0 0 = 0 Ox 0 0 - Cash N/A N/A Treasury Stock N/A N/A N/A Oct. 12 0 X 05 0 0 x 0 0 - Cash N/A N/A Treasury stock N/A N/A N/A 0 x Additional Paid-in Capit Dec. 22 0 x 0 0 OX 0 0 - Cash N/A N/A Preferred stock N/A N/A N/A 0 x Additional Paid-in Capit Check