Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 12 Please! Question 12 Please! Ihe net investment in operating assets (capital expenditures less depreciation plus in- vestment in working capital) will be S

Question 12 Please!

Question 12 Please!

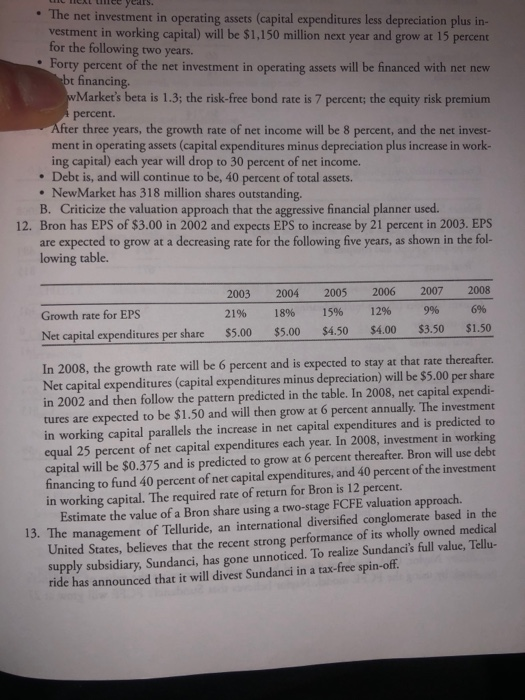

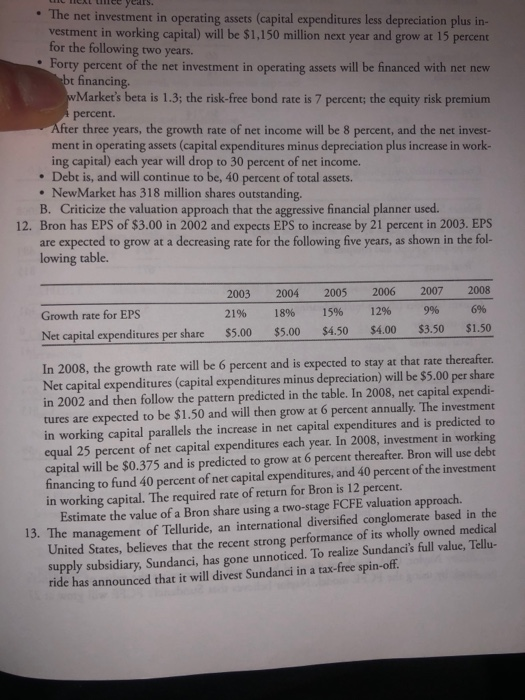

Ihe net investment in operating assets (capital expenditures less depreciation plus in- vestment in working capital) will be S 1,150 million next year and grow at 15 percent for the following two years. Forty percent of the net investment in operating assets will financed with net new financing. Marketi is 1.3; the risk-fr tnd rate is 7 irrcent; equity risk premium three years. the growth rate of net income will be 8 percent, and the net invot- ment in (Fating assets (capital exFnditures minus depreciation plus in work- ing capital) each year Will drop to 30 percent of net income. Debt is. and will continue to be, 40 VErcent Of total asrts. NewMarket has 318 million shares outstanding. B. Criticize the valuation approach that the financial planner used. 12. Bron has EPS Of in and expects EPS to increase by 21 percent in 2003- EPS are expected to grow at a decreasing ratc for the following five years, as shown in the fol- lowing table. Growth rate for EPS 2007 Net apical expenditu-es share S5.OO SS") S450 $3.50 SI In 2008. the growth rate will be 6 percent and is exFctcd to stay at that rate thereafter. Net capital expenditures (capital expenditures minus depreciation) will be $5.00 share in 2002 and then follow the pattern predicted in the table. In 2008, net capital expendi- tureS are expected to be S I SO and will then grow at 6 FrCent annually. The investment in working capital parallels the increase in net capital expenditures and is predicted to equal 25 percent of net capital expenditures each year. In 2008, investment in working capital will bc SO. 375 and is predicted to grow at 6 percent thereafter. Bron will use debt financing to fund 40 percent Of net capital expenditures, and 40 percent of the investment in working capital. required rate of return for Bron is 12 Frcent. Estimate the value Of a Bron share using a two-stage FC,FE valuation approach. 13. The management Of Telluride, an international diversified conglomerate based in the United States, believes that thc recent Strong performance of its wholly owned medical supply subsidiary. Sundanci, has gone unnoticed. realize Sundanci's full value, Tellu ride has announced that it Will divest Sundanci in a tax-fr spin-off.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started